Industry Perspectives: Capital Markets And The Wild Ride

By Dennis Kissler and Jason Reimbold

So far, this year has been a wild ride for the oil and natural gas sector.

In January, West Texas Intermediate crude was selling for $82 a barrel and natural gas prices were near $5 an Mcf. By early May, WTI crude was down to $64 a barrel, and by late April, natural gas prices were down to $2 an Mcf. Economic uncertainty about inflation, interest rates and continued Covid-19 lockdowns in Asia, combined with geopolitical upheaval and a myriad of other factors, all have contributed to volatility and are adding challenges to the sector’s already sluggish transactions market.

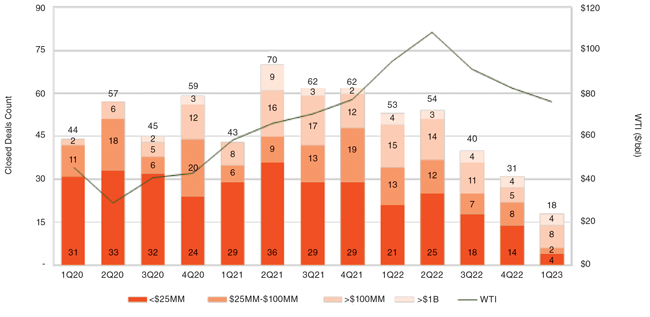

The acquisitions and divestitures market started slow with closed transactions reaching four-year lows and the number of closed deals in the first quarter of 2023 dropping 42%, quarter-over-quarter, while continuing the downward trend that started in the second half of 2022 (Figure 1).

With fewer deals transacting, would-be sellers remained sidelined and the flow of new asset offerings going up for bid represented a 52% year-over-year decline in the first quarter, as pricing volatility and economic uncertainty continued to hinder the market.

Crude Calculations

As we reach the year’s midpoint, experts are projecting what is to come for the remainder of 2023—both for the larger global economy and, more specifically, the oil and gas sector.

If the U.S. and Asian economies can hold together, crude oil economies can move back to a deficit structure by more than 1 million barrels a day before year’s end. If that happens, WTI prices may return to the territory of $90 a barrel. If capital expenditures for new drilling stay stagnant while regional banks consolidate their lending practices—it is easy to foresee a price increase.

However, demand is something of a wild card.

The midyear mark again finds us in “driving season” and travel demands seem to be hitting on all cylinders. Nevertheless, that does not necessarily mean we are in the clear. Consumers already unsure about the economy may become increasingly nervous if interest rates climb further in the United States and the strain on the financial system continues to make headlines. If that happens, crude prices may retreat to about $50 a barrel.

Meanwhile, seeing India and others turn discounted Russian oil into fuel is one short-term factor that may stress refinery profitability. That, in turn, may contribute to misconceptions about refined product oversupply, which seem likely to slow crude demand. Essentially, it is a safe bet that crude price volatility will endure for at least as long as the Russia-Ukraine war.

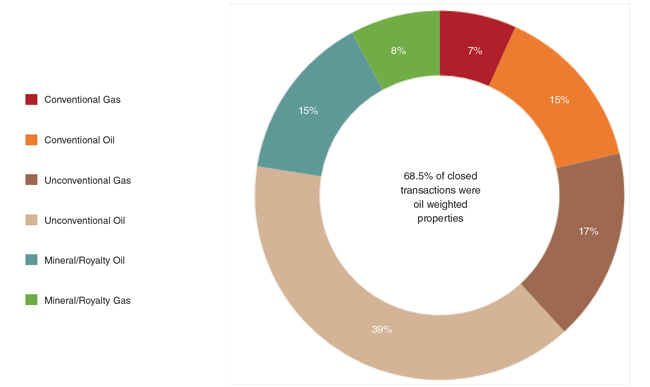

The overall market sentiment of buyers and sellers of properties remains more bullish for oil, with the commodity dominating the transactions market. Oil weighted properties represented slightly more than two-thirds of deals closed in the trailing 12 months ending 1Q23 (Figure 2). Despite the volatility, perceptions of a range bound oil price between $60 and $70 a barrel have helped get deals across the finish line.

LNG Wildcard

The near-term outlook for natural gas appears slightly less sunny—especially if record U.S. production persists and Europe continues to receive natural gas from Russia. In the first half of the year, natural gas prices endured a perfect storm: The United States saw one of the warmest January and February temperature patterns on record. On top of that, Russia defied many analyst predictions and continued to flow natural gas into Europe. Looking forward, the only bright spot seems to be elevated power demand. With natural gas prices around $2 an Mcf, many power generators have switched over from coal.

Meanwhile, much of the new landlocked production from Appalachia and the Permian appears likely to neither raise nor depress prices. Inadequate regional gas infrastructure may inflict suffering on local basis areas, but not so much at the Henry Hub Nymex price level.

All signs suggest liquefied natural gas will continue to grow, and European storage will need to be monitored closely. If needed, LNG certainly can have a dramatic draw on storage, especially during adverse weather. In fact, LNG will be the natural gas price wildcard for the next several years.

So will crude oil and natural gas prices rebound this year? Maybe. But the greater probability seems suggest more instability: As geopolitical uncertainty continues—particularly with regard to the Russia-Ukraine war—and economic uncertainty persists in the United States and abroad, price volatility will continue to characterize the oil and gas markets.

What will this mean for the A&D market? The answer is twofold: Big swings in commodity prices in either direction will be a challenge for both buyers and sellers. However, limited deal-flow is resulting in greater competition for assets, and more buyers looking at fewer assets should help drive valuations to a level that could attract more sellers to the market.

DENNIS KISSLER is senior vice president of trading for BOK Financial, where he has spent the last decade and half specializing in analytical research and trading oil and gas futures and derivatives. He spent 12 years on the CME trading floor as an independent trader, owned a major commodities brokerage firm with offices in six states and spent his college summers working on an oil and gas drilling rig in western Oklahoma.

JASON REIMBOLD is managing director of energy investment banking for BOK Financial Securities, where he is responsible for leading the energy investment banking group while originating and executing client mandates including acquisitions, divestments, raising capital and facilitating joint ventures. He has worked in energy finance since 2005 and currently offices in Dallas. He earned a BSBA in finance from the University of Tulsa and served in the U.S. Army and U.S. Army Cavalry.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.