Platts AGS Aims To Bring Clarity Amid Crisis To U.S. Crude Values

By Matthew Eversman

HOUSTON–With the anniversary of the April 20 collapse of the WTI crude futures contract approaching, the market continues to consider U.S. Gulf Coast-based benchmark alternatives, with Platts American GulfCoast Select (AGS) gaining traction. It is all the more important, given the focus on U.S. oil exports and the role U.S. shale is playing in the global arena.

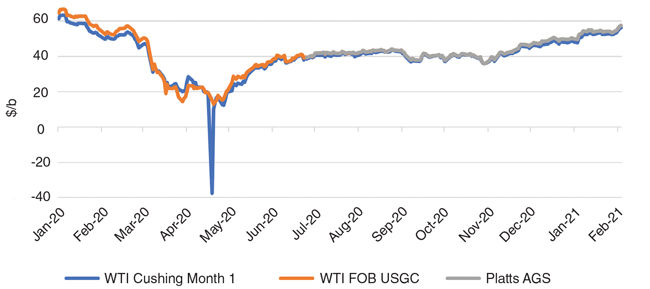

Although the crude industry is yet to coalesce around a new pricing mechanism, market participants have reached consensus that a new pricing reference is crucial to mitigating the divergence between pricing linked to the Cushing, Ok., futures contract and Gulf Coast pricing that was–in an extreme example–displayed on April 20, 2020 (Figure 1).

As evidenced in the April 20 plummet and 2020 volatility more broadly, Platts’ waterborne U.S. export price assessments provide a clear assessment of value at the intersection of the domestic and global market, free of any distortion from land-locked pipeline logistics. Drawing on the principles that have led the Dated Brent and Dubai/Oman benchmarks to success, AGS serves as a pricing reference for the export market and inland market alike.

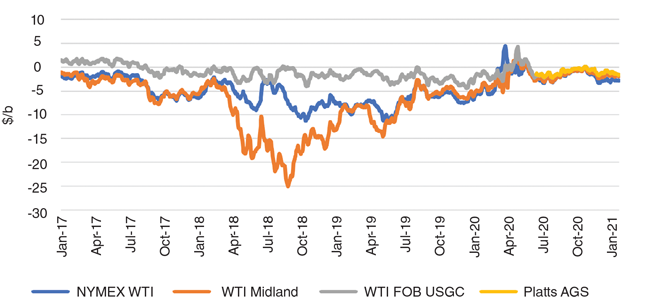

While AGS provides a waterborne free-on-board (FOB) value, its potential use extends all the way back to the wellhead. AGS is not exposed to the pricing volatility common with pipeline and terminal values that may be impacted by severe swings in short-term supply or demand. This waterborne assessment needs only to be combined with the appropriate fixed differential to provide an inland value (Figure 2).

As part of its methodology, S&P Global Platts stipulates clearly-defined quality and trade parameters, while reflecting a wide geographic area that includes the United States’ key export centers of Houston and Corpus Christi, Tx.

Export fundamentals

While the U.S. crude export outlook took a step back with the impact of the coronavirus pandemic, the resilience of U.S. producers means shipments abroad from the Gulf Coast will trough at levels that will continue to support a robust assessment.

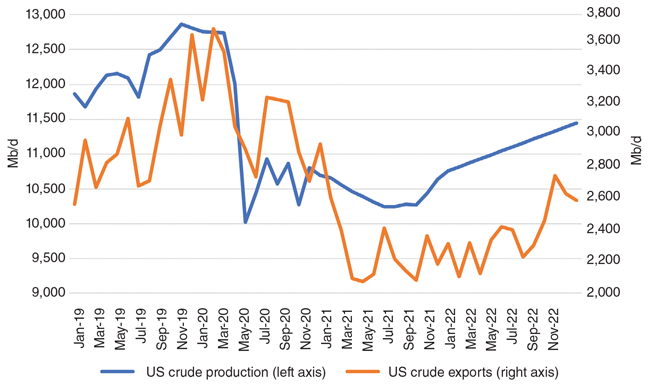

U.S. production is still feeling the impact of capital expenditure decisions made during the peak of global crude oil demand destruction. After reaching an all-time high of 12.9 million barrels a day in November 2019, U.S. crude production plummeted to 10 MMbbl/d by May 2020 as many producers shuttered wells operating at a loss.

Many of those wells came back on line, but with the pace of new drilling screeching to a halt, production remains well below pre-pandemic levels. Production will not climb above 11 MMbbl/d until 2022, according to S&P Global Platts Analytics (Figure 3).

Even amid depressed production levels, U.S. crude exports should remain above 2 MMbbl/d through this cyclical trough, reaching a low point 2.1 MMbbl/d in April 2021. With about 1.7 MMbbl/d of mostly light, sweet crude shipping from the U.S. Gulf Coast, export volumes should be more than adequate to support a robust assessment. This volume represents more than two Aframax cargoes each day.

Methodology

Crude quality was an important issue as Platts developed the AGS methodology. Unlike, for instance, the North Sea, where a certain grade will be fed by a relatively small geographic area, the Permian Basin covers a huge swath of the southwestern United States with big gathering systems feeding a number of long-haul pipelines.

With more than 4 MMbbl/d of production spread across two distinct basins, a crude buyer for a refinery might argue that the Permian should be carved up into different grades such Brent, Forties, Oseberg, Ekofisk, and more recently Troll, a few thousand miles to the northeast.

Platts decided it would be most useful to draw up the specifications for one grade that captured most of the unblended, direct-from-Permian supply while meeting the technical needs of refiners across the Americas, Europe and Asia. The specifications of the WTI Midland grade crude that underpins the Platts AGS assessment are:

- Sulfur–0.2% or less by weight as determined by ASTM Standard D-4294;

- Gravity–not less than 40 degrees American Petroleum Institute, nor more than 44 degrees API as determined by ASTM Standard D5002;

- Vanadium–2 ppm or lower as determined by ASTM Standard D5708 Method B;

- Nickel–2 ppm or lower as determined by ASTM Standard D5708 Method B;

- Reid vapor pressure–below 9.5 pounds per square inch at 100 degrees Fahrenheit as determined by ASTM Standard D6377; and

- Basic sediment, water and other impurities–less than 1% as determined by ASTM Standard D4007.

AGS reflects the typical cargo size for FOB U.S. Gulf Coast trading of 700,000 barrels as dictated by the draft restrictions for Aframax-size vessels at a majority of docks used for crude exports. Draft restrictions vary from dock to dock, so cargo sizes between 550,000 and 800,000 barrels may be used in the assessment.

Normalization of cargo sizes that deviate from the typical is critical for this broadly representative benchmark. S&P Global Platts understands that FOB value is sensitive to cargo size as buyers look to optimize their per barrel freight cost. Bids, offers and trades that deviate from the 700,000 barrel typical would be normalized to reflect the freight economics of the typical cargo size using that day’s U.S. Gulf Coast to UK Aframax assessment.

AGS reflects U.S. Gulf Coast ports including Houston, Texas City, Nederland, Beaumont, Port Arthur and Corpus Christi. The most competitive port on a cargo-size adjusted basis defines the overall assessment.

The assessment reflects cargoes loading 15-45 calendar days forward of the publication date, meaning a continuous loading program freed from monthly pipeline cycles.

Real-Time Communication

S&P Global Platts assesses global crude markets under the premise that price is a function of time. Assessments are based on determining outright tradable value throughout the trading day, culminating in an end-of-day value at typical market closing time, which is 1:30 p.m. Central Standard Time in the United States.

Platts eWindow® is a real-time communication tool developed in collaboration with ICE that allows reviewed market participants to publish bids, offers and expressions of interest used in Platts Market-On-Close (MOC) price assessment process. For U.S. waterborne crude, the eWindow instrument–the mechanism by which bids and offers are input–offers flexibility to accommodate the varied structure of deals in this market.

The MOC process provides a mechanism for market participants to transparently demonstrate value to Platts using firm market information. A firm bid, open to the market, demonstrates that value is above the bid level, precisely as an offer demonstrates that value is below the offer level as long as the bid or offer remains standing. This market information would be used in determining the assessment.

Participation and Physical Performance

Market participants can submit bids and offers through the FOB U.S. Gulf Coast eWindow tool with a laycan window as narrow as five days and as wide as 10 days. If a trade occurs in the MOC assessment process, once a terminal has been nominated, counterparties would communicate bilaterally to narrow the laycan to two days within the established window, as per current industry practices.

S&P Global Platts expects any counterparties that report a trade in the MOC assessment process to employ previously established credit and operational terms. A market maker can specify general terms and conditions (GTCs) in the terms, quality and conditions box in the tool, but existing bilateral GTC arrangements take precedence.

Any trades concluded during the MOC price assessment process would follow the established market standard of operational tolerance +/-5% at the buyer’s option subject to physical limitations of the vessel and dock.

Bids or offers that cannot be logistically performed upon are not published. Any data not reflective of the market or market standards will not be included in the final Platts price assessment. For instance, a bid for an 800,000 barrel cargo loading FOB Nederland may be removed from the publishing process given the 600,000-barrel draft restriction for cargoes loading from that location. Participants who submit a bid or offer in the MOC process must be contactable for as long as the bid or offer remains live.

Editor’s note: For more about AGS, visit http://plts.co/d9vR50Dx928.

Matt Eversman manages the Americas crude and fuel oil pricing team at S&P Global Platts, providing operational and strategic direction for a group of two managing editors and seven front-line reporters. He worked closely with Platts’ Price Group, Structured Market Engagement, and other teams in the development and rollout of Platts AGS. Prior to joining the price reporting agency space in 2013, Eversman worked in finance as an investment analyst. He holds a B.A. in economics from Bucknell University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.