Frac Fleet Update

Rebounding Frac Activity Starting To Hit Constraints, Growing Cost Pressures

By Matt Johnson and Mark Rossano

HOUSTON–The U.S. oil and gas industry has survived some huge market shocks during the past year, but even through adversity, the industry has persisted and remains on a path of growth for 2021.

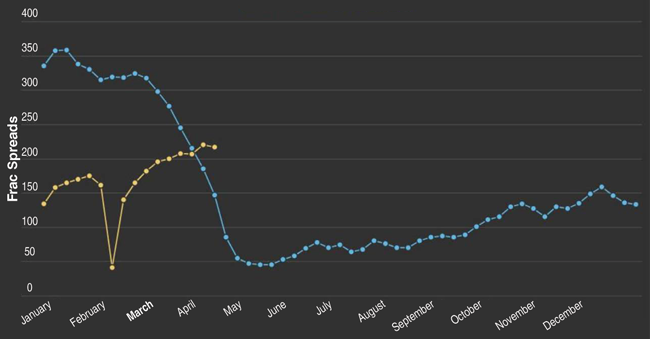

The pace of hydraulic fracturing activity has rebounded rather spectacularly since last May 15–when the number of active spreads was 45 (an historic low point that was briefly touched again in February, but only after the extraordinary “deep freeze” weather anomaly sent frac activity to zero across most of Texas and surrounding areas). As the industry entered the fourth quarter of 2020, completion activity accelerated to reach its normal seasonal peak by mid-December.

The beginning of 2021 started off like any other year, with a steady rise throughout January, as work commenced following the holiday season. Activity ground to a halt in February with the frigid weather in Texas, but within three weeks, the frac spread count did not merely close the gap, but exploded through the other side.Our initial assumptions were for a gradual recovery throughout the first and second quarters, climbing to about 200 spreads by the middle of May as companies prepared for the typical summer push that typically peaks in July. Instead, there was a surge of demand coming out of the February freeze.

The rally back to 200 was rapid. After closing out February at 140, 60 spreads were brought back within four weeks, pushing to a near-term top of 220 crews by mid-April. This outpaced our expectations and has caused us to increase our confidence range for the rest of the year. We now expect to close out 2021 at 275 active spreads, with U.S. oil production exiting the year at 11.5 million-11.7 million barrels a day. We believe the number will be closer to 11.5 MMbbl/d, but the speed of the recovery will provide uplift on total production.

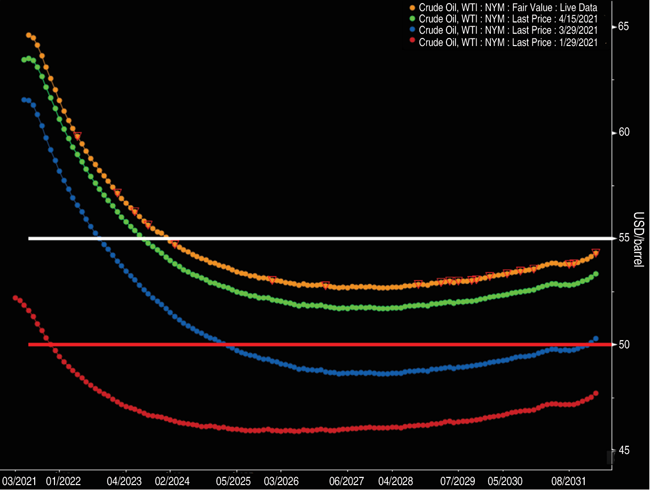

At the beginning of 2021, we had expected to close the year at 250 spreads, producing about 11.3 MMbbl/d-11.5 MMbbl/d. The view was that we were going to see a slowdown of activations as we approached 200, as companies began looking to manage their drilled but uncompleted well inventories and cash flows. Instead, crude pricing has been supportive with the ability to effectively hedge down the curve, which benefits private companies the most. A private company does not have the same hurdles as a public one, allowing it to be nimble in bringing back activity. They only have a handful of shareholders and smaller production profiles, making it easier to hedge, thereby limiting downside risk.

The smaller basins–including the Ardmore, San Joaquin and Cherokee–will see a seasonal bump in completions in April and May, which we also factored in, but at a lower rate. Instead, we saw a wave of activations at the end of April, bringing us to the current level. The crude futures price curve holding well above $55 through December 2023 offers an opportunity to protect downside at favorable pricing (Figure 1).

The strength in the natural gas liquids market also provides an uplift to the basket of prices operators receive, and given the demand in the global market, the elevated prices will remain at least through 2021. The rise of liquified petroleum gas in the global market, driven by tight feedstock markets, rising consumption and shortages throughout the petrochemical complex, will keep prices robust.

Pause Point

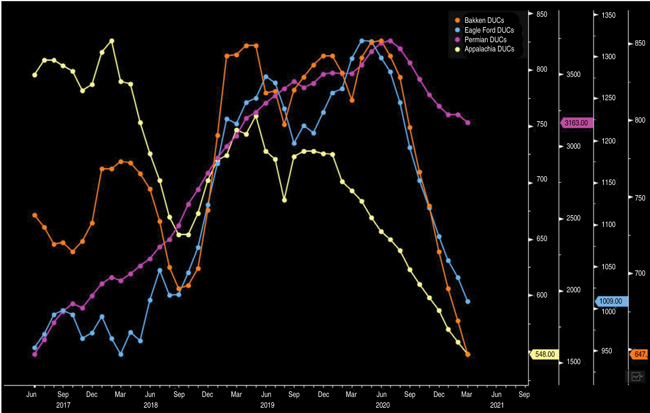

There likely will be a pause point at 220 as the market digests the activation while also increasing rig activity to replenish the DUC inventory. The first four months of the year were focused on arresting decline curves and building a production cushion, but the United States has been working through DUC inventory for more than a year now. Rig count additions will begin to outpace crews, which will slow or stop (depending on the basin) inventory drawdowns.

The speed of activity also is causing oil field service companies to reassess their costs to adjust pricing going forward, focusing on available horsepower and labor to ensure seamless additions. Cold-stacked spreads need to be examined because some equipment may need to be repaired, rebuilt or replaced depending on degradation and stripping of parts to keep other spreads operational during the COVID-19 downturn. This also provides an opportunity for companies to evaluate the next wave of pricing needed to keep the party going. We have seen limited pricing pressure in the market, but with the next round of additional crews requiring more extensive maintenance (or replacements) and hiring, we expect to see more pricing power.

The biggest growth area has been the Permian Basin (shocking, we know), where we have seen the lion’s share of activity. The Permian is starting to level off on DUC drawdowns (Figure 2), but the inventory has been depleted in key areas, such as the Eagle Ford and Bakken. At the current rate of activity, the Bakken will see steady production declines. There is typically an increase in completion crews as winter ends and the “spring thaw” sets in, but the uncertainty around the Dakota Access Pipeline will limit the amount of activity in the region. Until that is cleared, Bakken operators will look to steady declines but not grow in the region or invest in replenishing DUCs in any meaningful capacity.

The Eagle Ford and Permian are where we expect to see rigs accelerate, and based on the rate of change in DUC drawdowns in the Permian, we are reaching a steady state of spreads-to-rig ratio.

Another factor is the advance of efficiencies, with the most important one being “dual fracs” or “simul-fracs.” This just means that a crew with 33% more horsepower can fracture two wells at the same time instead of doing one at a time. At the beginning of last year, we had minimal adoption, but as COVID-19 set in and operators did everything possible to slow decline curves while maximizing every dollar, simul-fracs gained favor.

As completion crews were furloughed, the strongest members of teams were retained and merged, leaving strong “A” crews capable of working at the fastest rates with top results. As crews are added back, there is some dilution of talent, but the use of computers, artificial intelligence, and other technological advancements help maintain some of the efficiency gains as the algorithms learn. We also have seen the adoption of simul-fracs accelerated (especially in the Permian), which will help production growth throughout 2021.

Tipping Point

Since 2016, the standard in the fracturing patch has been to produce, and ultimately utilize, Tier 4 emission standards. To meet the standards, most engines will leverage advanced emission controls, resulting in a massive reduction in sulfur. From what we have seen in our research, this is what major operators are commanding, at a minimum, and soon they will be asking for an even higher level of carbon dioxide management through the use of fully electric powered spreads (and other equipment on the well pad being powered by electricity).

Over the past five years, we have seen the worst of it as E-fleets continued to roll out. A host of issues, including continuity problems on the well pad (uptime), talent exiting stage left, logistics growing pains and two difficult cycles (which paralyzed pressure pumpers) have prohibited the adoption of this exciting cost-saving technology.

Evolution Well Services and U.S. Well Services have led the charge in the electric fleet world. Early adopter Eco-Stim has been out of business since May 2020. These are the only two pumpers that have more than one e-fleet spread working in U.S. basins. We are tracking seven fully utilized spreads by Evolution, with competitor U.S. Well Services accounting for five additional e-fleet spreads.

There is theory and then there is practice. Halliburton, NexTier and ProPetro have all been testing their own electric equipment with mixed success without officially disclosing their long-term goals. All of them have been touting field-level success, but no party has pushed their chips in the middle. Halliburton seems to be pretty confident with its grid-frac approach. ProPetro has been testing multiple strategies, and we look for this to be a combined effort with ProPetro’s friends over at ProFrac. NexTier has decided to move forward with National Oilwell Varco as a technology partner for its e-fleets, but we have been able to track down only one spread out in the field “practicing.”

Liberty Oilfield Services announced a recent dive into electric fracturing with a company called ST9 Gas & Oil. ST9 started in 2017, providing a line of products to service the well pad, including plungers, fluid ends, and you guessed it, electric frac units. These units claim to reduce the total equipment on the well pad while providing a massive reduction in CO2, in line with similar Evolution and U.S. Well Services technologies. The technical specs are pretty solid in “theory” and Liberty is pushing this out into “practice” very soon.

We wonder if the transition will be smoother now that the technology has grown over the past handful of years. Keep in mind that Liberty is still ingesting all that the Schlumberger merger last year has to offer while optimizing its current product lines.

Full Utilization

Back in December, we called for improving pricing dynamics toward the end of the second quarter, and this is on pace per early first quarter earnings transcripts. The Primary Vision Frac Spread Count continues to rise toward what we view as full utilization, and will move that agenda up if oil prices continue their ascension. This will be the first time in years that operators start paying more for oil field services, but that is where the buck will stop.

Pressure pumpers will have to create unique partnerships with operators or tap their improving credit lines to place electric spread orders that often double the price of traditional equipment. The return on investment just is not there quite yet. Nothing happens, anyway, until the market sees COVID-19’s exit strategy.

We do believe this is the tipping point, however. The point where all the current landscape of gear becomes fully utilized and pumpers will have to consider the next generation of equipment to stay relevant. Spreads are getting a bit larger, so the active horsepower is close to 12 million right now. If we combine all the electric spreads working, we get to roughly 900,000 horsepower. This is a conservative estimate adding in three additional “practice” spreads from ProPetro, Halliburton, and NexTier.

Without further technology adoption, capital deployment, accelerated partnerships, sector consolidation, continued regulatory and governmental push, we would expect electric spread technology to stay around 10% of the total frac supply for the next 18 months. This is the tipping point, but we need more guidance before we can turn the page on diesel-powered frac equipment.

Oil field service companies have begun addressing the needs to repair or refurbish equipment as well as rebuild some inventory to maintain seamless operation. National Oilwell Varco reported earnings on April 27 where it highlighted the slow shift in the oil field service markets. Orders are picking up as companies assess their needs to bring back remaining cold-stacked equipment and replace worn components in the field. NOV highlighted “green shoots” in the wellbore technologies sector as the order book started to pick back up.

With the frac spread count now at 220-ish, the next leg of activation will require either rebuilds, repairs or new equipment. It will take time, but we agree with NOV’s comments as it saw a strong March lead into an improved April. The pick-up in orders has been slow, but it is starting to accelerate. We believe that order book continued to strengthen in April, supported by NOV Chairman, President and Chief Executive Officer Clay Williams’ comments on the earnings call.

“The amount of idle equipment available to be parted out falls as activity resumes and dwindling spares and consumables must be restocked as utilization improves. . . We are beginning to see the early signs of this in certain areas as rigs and frac fleets go back to work,” Williams states. “As the oil field goes back to work, customers will soon start to worry about nontrivial cash investment required to reactivate rigs and equipment.”

Regrouping And Rebuilding

As oil field service companies regroup after deploying spreads ahead of schedule, we will see a steady rise in rig counts to help replenish DUCs and stabilize available inventory. This also will give service companies time to address labor shortages as costs move higher and require potential signing and stage bonuses. There is rising competition for personnel as other job opportunities provide strong salaries and a certain amount of sustainability.

The oil patch has seen many booms and busts, which only have accelerated over the past 10 years. The uncertainty of being a crew hand means the salary has to compensate, which will be passed on to the oil and gas company customer. These conversations have started already as drilling and completion programs are refined for the remainder of the year.

The U.S. political climate has darkened for fracturing, but the benefits of the process, when done correctly, greatly outweigh any current alternatives. The utilization of field gas and other initiatives will provide lower costs and reduced pollution, helping to offset some of the biggest knocks against the industry. The adoption of new technology and efficiencies has accelerated, which will help keep costs reasonable and support stable activity throughout the rest of 2021. Political risk remains in terms of new policies–including pipeline restrictions and federal land drilling–but the industry is prepared to tackle the challenge and companies have residual permits to maintain seamless operation (for now).

The growth in U.S. completion activity will continue to drive higher and is supported by elevated pricing as we head into the summer months. Decline curves have stabilized, and while production growth will not be explosive, it will be steady as the energy sector gets back to work. The use of algorithms, machine learning, and other advancements are still being adopted and explored to increase efficiency and optimize estimated ultimate recovery rates. We know the U.S. energy industry is up for the challenge to continue delivering efficient and affordable energy to the markets in a clean and sustainable manner.

MATT JOHNSON is president and chief executive officer of Primary Vision, which provides market intelligence and consulting on the hydraulic fracturing sector, including weekly counts of active U.S. frac spreads. A diverse background allows Johnson to view issues from a variety of perspectives to find optimal and innovative solutions to domestic and international engineering, exploration, research and development, management, sales, and operations challenges. He also serves as program director at Primary Vision Network, a platform for discussing relevant industry topics. Before joining Primary Vision as national account manager, Johnson was vice president of business development at BAR Co. Inc. He holds a bachelor’s from Johnson & Wales University.

MARK ROSSANO is founder and chief executive officer of C6 Capital Holdings in Glen Head, N.Y., providing investment and consulting services to clients in multiple sectors. He has 14 years of experience spanning the venture capital, private equity and consulting markets. Before establishing C6 Capital Holdings, Rossano served as an energy industry analyst at Bloomberg, a senior energy analyst and macroeconomist at Elevation, an energy analyst and strategist at Candlewood Investment Group, an energy analyst and strategist at South Ferry Capital Management and an associate at Morgan Stanley Investment Management. He holds a B.A. in economics from Loyola College in Maryland and an M.B.A. in finance from Syracuse University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.