Unconventional Geoscience

3-D Surveys Focus On Resource Plays

By Kari Johnson, Special Correspondent

Successfully developing tight oil and shale gas plays requires the right technology, knowledge, capital and assets. Geophysics is playing a role in all of those areas by helping operators achieve a better understanding of a multitude of reservoir properties that can influence productivities and recovery rates, thereby leading to better decisions about where to drill and how to optimize completion designs to maximize every dollar invested in unconventional resource plays.

Nancy House, principal scientist at Integrated Geophysical Interpretation and president of the Society of Exploration Geophysicists, says resource plays offer an exciting opportunity to expand the role of geophysics across exploration, drilling, completion and production workflows. “As operators become more and more familiar with the unique challenges of unconventional formations, and as they see what advanced geophysical solutions can do in these plays, they are gaining a new appreciation for the contribution that geophysics can make to bottom-line success,” she states.

When resource plays began making headlines more than a decade ago, tight rocks were a mystery in many respects, behaving very differently from conventional reservoirs, she reflects. “Operators in Wyoming started finding these apparently unbounded gas deposits,” explains House. “Every time they drilled a new well, no matter how close or how far away from existing wells, it still seemed to encounter virgin pressure in a lot of zones and permeability could be increased with hydraulic fracturing.”

This initially led to what House calls “a bit of magical thinking” that unconventional assets could be developed in cookie-cutter fashion with little understanding of the subsurface. Reality soon set in, however, and oil and gas companies began developing multidisciplinary teams of geoscientists and engineers to leverage geophysics to identify the rock properties, fluid characteristics and natural fracturing features that have proven critical to optimizing well performance.

House says the challenges of unconventional reservoir development are prompting the geophysical industry to apply everything it has learned through decades of experience in conventional reservoirs as well as the relatively new knowledge gained in unconventional plays–from amplitude-versus-offset and rich-azimuth data acquisition techniques to advanced processing algorithms and borehole microseismic imaging–to determine location, orientation and extent of hydraulic fractures, mechanical rock properties, effective well placement, optimal drilling depths, the most (and least) favorable areas to place hydraulic fracturing stages, fracturing effectiveness, etc., in tight rocks.

The next step in the evolution of geophysics is the routine application of artificial intelligence and machine learning not only in seismic acquisition and processing, but especially in interpretation, House predicts. “We have always had huge datasets and synthesizing it has always been an equally huge task,” she says, noting that with the aid of technologies such as AI, statistical analysis, principle component analysis and self-organizing maps, geophysicists can do more in-depth and thorough analyses in much less time.

“Artificial intelligence and machine learning have sufficient maturity and appeal that SEG is coordinating a multiple-society conference devoted to these technologies,” House remarks. “One need only look at the list of upcoming workshops on SEG’s calendar to see how unconventional reservoirs and advanced technologies are impacting geophysics.”

Along with workshops on traditional geophysical topics such as marine 3-D seismic acquisition and land data processing, she says SEG also is offering workshops on the value of geophysics throughout the unconventional asset lifecycle and applications of AI and machine learning in the geosciences. “It is a new world,” House remarks.

At the same time, she adds that SEG also is sponsoring initiatives to better connect geophysics with engineering and management, including a special session on the business of geophysics at its 2018 annual conference, scheduled for Oct. 14-19 in Anaheim, Ca. “Geophysics has a pivotal role in oil field economics,” House concludes. “That role has been driven in no small part by the multidisciplinary challenges of unconventional plays, and requires geophysicists to be active members of asset teams along with drilling, completion and production engineers.”

High Channel Counts

Dawson Geophysical has been busy in the Midland and Delaware basins in West Texas during the past year, acquiring surveys for operators as well as multiclient data providers, reports Chief Executive Officer Steve Jumper. Projects in these sub-basins of the greater Permian Basin tend to be larger in scope than survey projects in many other U.S. basins, he notes.

“It is not uncommon to have 20,000-25,000 recording channels on a project, with our largest survey having 30,000 channels,” Jumper says.

The high channel counts are driven by project size plus the need for wider-azimuth and full offsets. “That requires a lot of channels, particularly when you are increasing the coverage density of those channels and sources,” Jumper explains, adding that there is room for even higher-density recording in the future to get better subsurface image resolution.

Dawson also has recorded multicomponent channels in West Texas using conventional vibrators and receivers for both standard and converted-wave seismic data. The intent is to give operators a better understanding of rock properties and reservoir properties. Jumper says that the company has kept a large three-component crew busy for several years. “I expect to see increases in both 3-C data acquisition and channel density in the coming years,” he offers.

Dawson has a mix of proprietary and multiclient projects acquiring both standard compressional and multicomponent data, but he says multiclient data providers have been the drivers of the most recent activity. “It is a scale and scope issue,” observes Jumper. “In some places, there are such interlocked acreage areas that multiclient studies provide the best coverage for everyone.”

In the complex geology of West Texas, 3-C surveys are giving operators invaluable insights on the properties of stacked multibench zones and fracture orientations–key issues in Permian tight oil plays. “The Midland and Delaware basins have historically been a little tougher seismically than plays such as SCOOP and STACK in Oklahoma, where the challenge is related more to structural concerns that generally can be resolved with high-quality conventional 3-D data,” Jumper states.

Dawson also is doing work with surface-based microseismic applications in SCOOP and STACK. “We have been able to keep some microseismic projects busy in various places in Oklahoma with good results,” Jumper says, noting that some microseismic data analyses are being performed in real time to provide feedback on what each fracture stage looks like and where the treatment energy (i.e., fluid and proppant) is going.

The recent improvements the industry has made in break-even costs, operational efficiencies and well productivities come from a combination of many innovations, ranging from drilling technology to completion engineering and seismic imaging, Jumper observes. “With improved data and analytics, the more information we have and the more we are able to tie subsurface measurements to well results, the more of a predictor seismic data become,” he says.

Jumper notes that although the Permian is the focal point of onshore resource play activity, the basin’s experience in multiphase horizontal resource plays is fairly brief, especially compared with its long history of applying conventional seismic solutions to conventional oil formations. “Geophysical science continues to improve in tight oil plays,” he concludes. “We are committed to helping operators understand their resource plays and employing new technology to shorten cycle times, increase value and enhance cost effectiveness.”

Reservoir-Ready Data

For the past several years, CGG’s data acquisition projects have been focused primarily in the Permian and SCOOP and STACK plays, says Mike Bertness, vice president of CGG’s multiclient & new ventures (MCNV) U.S. land division. He notes that while SCOOP/STACK has deeper targets than the Permian, operators in both basins are looking for high-resolution, high-quality broadband seismic data.

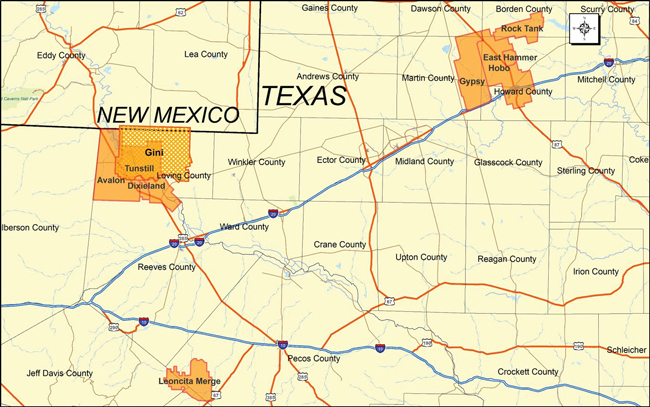

CGG has multiple projects under way in West Texas. Gini is a long-offset, wide-azimuth survey acquired using HPVA slip-sweep simultaneous vibroseis sources and broadband EmphaSeis™ technology. The data will be processed with 5-D interpolation, OVT PSTM and TTI PSDM. Other acquisition projects include Avalon targeting the Wolfcamp and Bone Spring; Leoncita targeting the Woodford, Barnett and Wolfcamp; and Hobo Depth Merge (including the Hobo, Gypsy, Rock Tank and East Hammer surveys) targeting the Spraberry and Wolfcamp.

“Operators need data that has low frequency and is azimuthally symmetrical,” he relates. “They want significant crossline and inline coverage so they can do reservoir optimization and filter noise, particularly in the Delaware Basin.”

Both regions present their own challenges. “The Permian, and particularly the Delaware Basin, has a lot of near-surface problems that we do not see in Oklahoma,” notes Bertness. “But Oklahoma also has more trees, more people, more farming and more dramatic weather.”

Crosslines in Oklahoma have 30-40 line patches because the objectives are relatively deep, with some well depths exceeding 13,000 feet. With decreasing receiver line spacing, more lines are required for the crossline offsets used in azimuthal analysis, Bertness says.

“In both basins, trace density, group interval and line spacing are important,” he goes on. “Demand for high-quality broadband seismic also is strong because it yields rock properties, hydrocarbon indicators and fracture characteristics from the improved amplitude analysis.”

Bertness says CGG incorporates additional data into its seismic data analysis, including well cuttings, well cores and sonic logs when available. “Typically clients provide some wells and we also incorporate publicly available well data,” he explains.

Cuttings are scanned for organic content, petrophysical models are used to calibrate the model, and petrosystems map kerogen quality and hydrocarbon accumulation. “All of these data sources help tie well and seismic data with the overarching goal of helping operators pick better well locations, better drilling directions and better frac designs,” says Bertness.

“A design geophysicist from our MCNV group works directly with clients to identify zones of interest, offset requirements, proper line and shot spacing, and fold,” Bertness comments. “The result is reservoir-ready data. It is shot and processed so that it is AVO-compliant, has full-azimuthal distribution to support fracture analysis, has offsets needed in the full-azimuthal direction, and group intervals close enough so that gathers can address statics. This is what the industry is asking for.”

CGG’s acquisition contractors acquire surveys using cableless nodal systems, which provide greater agility and flexibility. With CGG’s use of its proprietary high-productivity vibroseis acquisition (HPVA™) technology, CGG’s contractors can slip-sweep vibrators to shoot up to six miles a day. “Nodal systems enable us to quickly move the equipment to keep pace and keep cost similar with much higher trace density on the ground,” he states.

Multiple Projects Underway

CGG has multiple projects under way in West Texas, according to Bertness. Gini is a long-offset, wide-azimuth survey acquired using HPVA high-productivity slip-sweep vibroseis sources with advanced broadband EmphaSeis™ technology and multicomponent recording. The project covers 494 square miles, targeting the Wolfcamp Shale. The data will be processed with 5-D interpolation, offset vector tile prestack time migration (OVT PSTM) and tilted transverse isotropy prestack depth migration (TTI PSDM), which ties to well data to provide a more accurate subsurface image, he reports.

To address statics and noise issues in the Delaware Basin, CGG is using EmphaSeis, a broadband vibroseis sweep, together with slip-sweep acquisition that allows for faster and denser sampling while still capturing low-frequency data. During processing, the harmonic noise is identified and modeled so that it can be subtracted from the data while preserving amplitude, according to Bertness. Static tools include near-surface refraction tomographic statics and refraction full-waveform inversion (FWI). Depth migration also has a positive effect.

The Avalon project also targets the Wolfcamp as well as the Bone Spring formation. Processing is complete on the 282 square-mile survey and includes 5-D interpolation, OVT PSTM, TTI PSDM and a reservoir optimization package (ROP), Bertness says. CGG purchased data for Leoncita, providing coverage near the Alpine High play, targeting the Woodford and Barnett shales and the Wolfcamp. Processing on this 157 square-mile project is ongoing and also includes 5-D interpolation, OVT PSTM and TTI PSDM.

Another significant CGG survey and merged data project is the Hobo Depth Merge, which includes the Hobo (348 square miles), Gypsy (241 square miles), Rock Tank (106 square miles) and East Hammer (23 square miles) surveys. “This project targets the Spraberry and Wolfcamp,” Bertness comments. “Both Hobo and Gypsy time processing products are complete, the Hobo ROP is complete, and the Gypsy ROP is scheduled for completion in the third quarter. The data merge is in progress and the final merged product will be a TTI PSDM, which will be available by the end of the year.”

CGG also has several projects in progress in the SCOOP and STACK plays. The Yukon survey covers 219 square miles over the Meramec, Osage and Woodford formations with the Oswego and Hunton formations as secondary targets. Processing includes 5-D interpolation, OVT PSTM and ROP. Final PSTM data are now available, with ROP data scheduled for later this year.

CGG also has a 262 square-mile dataset called Chickasha Merge in the SCOOP/STACK area. This project includes both time and depth products and depth-based ROP to identify rock properties, total organic content, kerogen levels and faults in the Osage and Woodford, with the Oswego and Hunton as secondary targets.

“Our acquisition, processing and interpretation techniques, including HPVA processing, static solutions, velocity analysis, waveform inversion, and 5-D interpolation, help us fulfill our commitment to providing reservoir-ready data,” says Bertness.

Using More Seismic Data

A relative newcomer to onshore acquisition activities, TGS has compiled an impressive library of multiclient seismic data and well logs. Since 2011, the company has observed a general move among oil and gas companies to use more seismic data in shale plays, driven by economics and risk reduction, says Katja Akentieva, the company’s senior vice president of onshore and geological products.

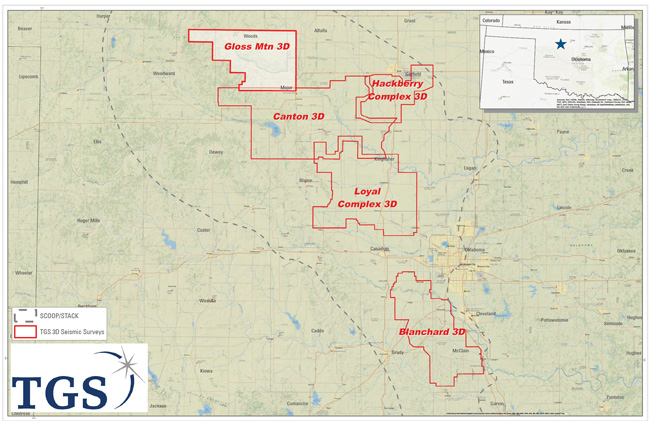

TGS’s Canton and Gloss Mountain 3-D surveys target multiple intervals on the eastern flank of the Anadarko Basin in the northern extension of the SCOOP/STACK trend in Oklahoma. The 452 square-mile Canton project borders the previously acquired Loyal Complex 3-D survey area to the south, while Gloss Mountain covers 348 square miles to the north of Canton. Preliminary data also are expected soon from the newly acquired West Hackberry 3-D survey covering 300 square miles to the east of Canton.

“Seismic reduces the break-even cost of shale wells and improves production by better positioning wells and the associated horizontals,” Akentieva remarks. “The fact is that the geological complexity of the SCOOP and STACK, the Permian, the Marcellus/Utica and other resource plays is too challenging to drill without quality seismic data.”

Seismic also plays a big role in keeping today’s long-lateral horizontals in zone and away from trouble spots, Akentieva points out. With high-resolution seismic, engineers can steer the wellbore properly for maximum reservoir contact. “Beyond drilling, we are starting to see seismic used in the completion phase depending on the play, formation and basin,” she offers.

In the past year, the onshore business for TGS has started to experience a recovery, with oil and gas companies stepping up activity as oil prices have improved, according to Akentieva. In addition, in terms of operator appetite for acquiring new seismic data, TGS is seeing good momentum and willingness to pre-commit, she adds, noting that one way oil and gas companies responded to the down cycle that began in late 2014 was to embrace the multiclient data model.

“Over the past four years, seismic spending has shifted dramatically from proprietary surveys acquired exclusively for one client to multiclient surveys, moving from 40 percent in 2014 to 70 percent today,” Akentieva observes, motivated by operators’ realization that they could reduce cost by treating data as a shared commodity. “The competitive advantage comes in the interpretation of the data, not in exclusive ownership of data,” she points out.

TGS licenses one of the world’s largest libraries of geoscientific data, including seismic, well logs, gravity, magnetic and basin studies. “We use these data to help identify areas that might benefit from seismic acquisition,” explains Akentieva. “We also use the data to calibrate inversion projects and offer the data as a resource to our clients.”

Seven Onshore Projects

TGS has at least seven onshore North America seismic acquisition projects scheduled for 2018, according to Akentieva. In Oklahoma, the company has announced the Canton and Gloss Mountain projects located on the eastern flank of the Anadarko Basin in the northern extension of the SCOOP/STACK trend. With these surveys, TGS expanded coverage north from the STACK area, while observing exceptional initial production rates achieved in the area, she relates.

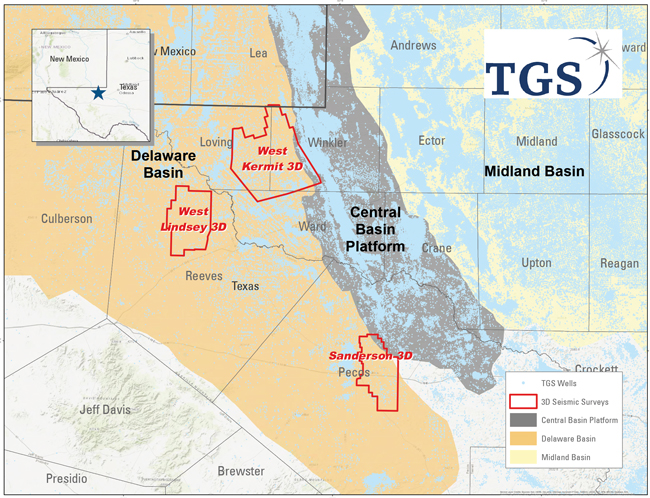

In the Permian Basin, TGS is acquiring data in three 3-D surveying projects–West Kermit, West Lindsey and Sanderson–that extend from the edge of the Central Basin Platform across the eastern flank of the Delaware Basin. The surveys target the Wolfcamp and Bone Spring, but also image the deeper Paleozoic section.

Canton covers 452 square miles targeting the Chester, Osage and Meramec intervals and Gloss Mountain spans 348 square miles across Major and Woods counties just north of the Canton project and earlier Loyal Complex 3-D.

“The Mississippian in this trend is a complex environment with facies and rock property variations, plus a structural overprint with complex faulting at deeper levels,” according to Akentieva. “These projects should improve well targeting, well positioning and lateral drilling hazard mitigation.”

Seismic attributes are a key focus, revealing subtle faults and fracture zones. “Clients want to understand rock property variations along the longer trend. We are also working on some advanced seismic attributes and inversion techniques to offer the industry enhanced value in identifying possible sweet spots,” she adds.

Preliminary data from the recently acquired West Hackberry 3-D survey is expected to be available soon, Akentieva reports. This project covers 300 square miles targeting the Meramec and Chester formations, mainly in Garfield County.

In the Permian Basin, meantime, TGS is acquiring data in three projects–West Kermit, West Lindsey and Sanderson–that extend from the edge of the Central Basin Platform across the eastern flank of the Delaware Basin. These surveys target the liquids-rich Wolfcamp and Bone Spring formations. The surveys also capture imaging of the deeper Paleozoic section. “We feel that the Wolfcamp, in particular, offers great prospectivity in this flanking trend,” Akentieva says.

Sanderson is 177 square miles, largely in Pecos County, Tx., while the West Lindsey survey covers the western flank of the Delaware Basin’s Wolfcamp trend. In both areas, operators are looking for stratigraphic variations and subtle structural variations, according to Akentieva. Because of the structural complexity of the Delaware, TGS recommends depth migration and offers PSDM as part of its multiclient library, she points out.

“There is a real drive across the Permian for more seismic data to better predict rock and geomechanical properties, understand fluid variations, and identify fairways,” Akentieva observes. “Our technology has been evolving to provide tools that are most suitable for Permian plays, including algorithms trained for environments with statics, noise and structural complexity.”

In British Columbia, TGS has initiated operations on the 95 square-mile Dawson Phase II 3-D survey in the Montney trend, beyond the developed area to the west covered by Dawson Phase I. The Triassic is the primary target, but both the overlying Cretaceous formation and deeper Paleozoic potential will be imaged with high resolution.

“This dataset will be used to target new well locations and predict drilling hazards, which is very important in that particular complex environment,” comments Akentieva. “We are finding subtle structural variations in the Montney formation itself, and generating seismic attributes that help predict rock and geomechanical properties.

“TGS continues to strengthen its onshore position with new seismic investments in prolific and high-potential onshore plays across North America,” Akentieva concludes. “Our growing onshore seismic library, integrated with our extensive database of well data and interpretive products, positions TGS to help our customers develop the best data-driven subsurface models and provides the industry with the tools to increase productivity and well results.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.