Seismic Acquisition

Advances In Seismic Rejuvenate Shelf

By Brad Torry

HOUSTON–As 2015 begins amid uncertainty about commodity prices, one region in the Gulf of Mexico bears an interesting revival that should survive these prices swings: the “Shelf region.”

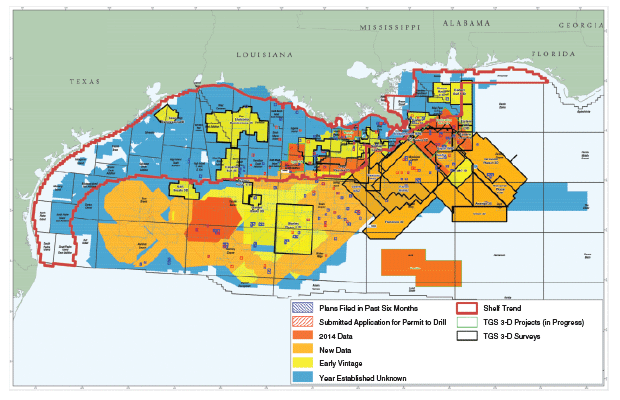

For all intents and purposes, we will classify the Shelf region as the area covered by Outer Continental Shelf blocks in the five-year-term window (see Figure 1), which encompasses the historical post-salt and flex trends. With significant advancements in drilling technology, activity in the Gulf of Mexico over the past 10 years has seen an increased focus on the deepwater exploration prize.

From 2005 to the present, many major exploration and production companies have divested assets on the Shelf to a new breed of independents, many of which have technical teams that departed the majors. In the traditional cause and effect relationship, this has re-established a round of activity in this highly prospective region.

We believe a number of factors are driving this revival: new geologic targets, infrastructure capacity, and new technology (seismic and drilling). Combine this with a willingness to push the envelope to identify and pursue new play concepts and previously inaccessible pay that was not recognizable with available data, and a revival is occurring.

Although the GOM Shelf region has had extensive seismic coverage (Figure 1), the majority of these data are limited to narrow-azimuth ocean bottom cable or streamer data, which means they were gathered with limited offsets and azimuths. With historical production occurring at depths ranging from 5,000 to 15,000 feet (fewer than 5 percent of wells exceed 15,000 feet) in this complex depositional and structural (salt) environment, increased spatial (lateral) and temporal (vertical) resolution from seismic is required to resolve smaller/thinner geologic targets.

Early revival was made possible by advances in data processing algorithms and computational power that led to enhanced subsurface images. However, challenges remain, based on input data.

Where accessible (with accessibility being the key), the acquisition of wide-azimuth (WAZ), multiwide-azimuth (MWAZ) and full-azimuth (FAZ, although gaps remain with streamer acquisition) data acquired with a variety of streamer/vessel configurations has made a material impact, particularly in the deep water. Each of these configurations fundamentally offers long-offset, broad (not full) azimuth data to image prospective zones and unlock subsalt potential.

However, if current Shelf coverage (Figure 1) is limited to only what would be considered modern wide-azimuth seismic (long offsets that have a minimum of 30 percent azimuthal coverage), a significant void in new data coverage becomes evident (yellow and blue areas).

This challenge creates opportunity. Independents have identified the considerable untapped potential. Given the advancement in ocean bottom node (OBN) technology, a step change or new paradigm for new full-azimuthal nodal data (FAN) will support the resurgence of activity in this region.

Why Now?

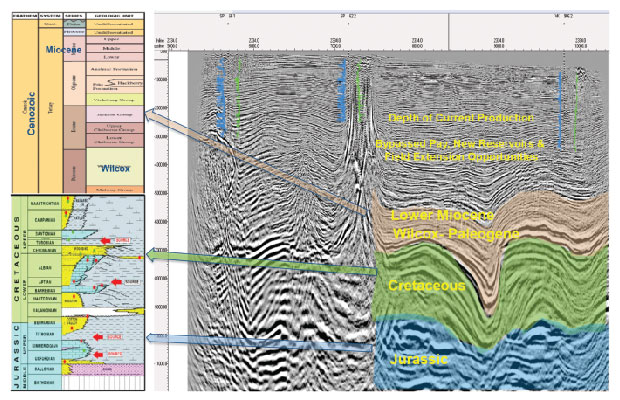

After the last round of major Shelf activity in the early part of the new millennium, most discoveries now are on decline. The new breed of independent operator has recognized the significant amount of bypassed pay, pool extensions, deeper reservoirs, and enhanced recovery opportunities. Add to this an increased understanding of depositional environments (through extending onshore interpretations to the Shelf) and the expanded understanding of salt tectonics, and the region has experienced numerous new ideas and learnings.

Add new technology (WAZ, FAN, and short-leg horizontal drilling) with proper application, and these opportunities have led to strong return on investment for operators and the identification of new potential geologic fairways.

Examples of this can be found in the success of companies such as Energy XXI, which has increased reserves and production from existing fields, and Freeport McMoRan with its deep exploration drilling program (Davy Jones, Blackbeard and Lafitte prospects). Although the final verdict on these deeper wells remains outstanding, I believe they have and will provide significant geotechnical information that will lead to ongoing exploration and development on the Shelf.

Figure 2 provides an excellent visual summary of the concepts that are returning people to the Shelf. The final piece of information that needs to be added to this equation is modern geoscience data. The industry’s ability to integrate and model these data from source to sink, and to understand their complexities from local stratigraphy to basin-scale, thermal maturation models, has reopened the door to prospectivity.

What exactly do I mean by this? I have mentioned the application of WAZ data and improvements in imaging algorithms. However, much of this has not been available on the Shelf, except for long-offset 2-D data. But with the commercial application of full-azimuth nodal surveys using ocean-bottom node technology, new, industry-leading seismic images are within reach, and provide an advanced path to continued development and the future for the Shelf.

Operations And Logistics

The Shelf region holds a number of unique operational and logistical challenges for exploration, drilling and production, not the least of which are the Bureau of Ocean Energy Management’s five-year lease term conditions. As BOEM enters its 2017-22 planning cycle, many requests have been made to make Shelf lease terms similar to the 10-year terms on deepwater blocks.

Considering, however, that BOEM is not likely to make such a change, companies must execute exploration and development plans within the guise of the current cycle time. To optimize those plans, operators require superior data that meet the current and future demands of exploration, field development, and infrastructure planning and utilization.

For most geoscientists, the natural alternative would be to acquire new WAZ data. Unfortunately, the water depths (10-300 meters) and amount of infrastructure prohibit acquiring new data.

The turn radius for line changes required for modern WAZ configurations (often 10-20 kilometers), the setback distance for obstructions (generally 500 meters), and the required run-in distance to meet the obstruction setback distance, in simple terms are not attainable on the Shelf.

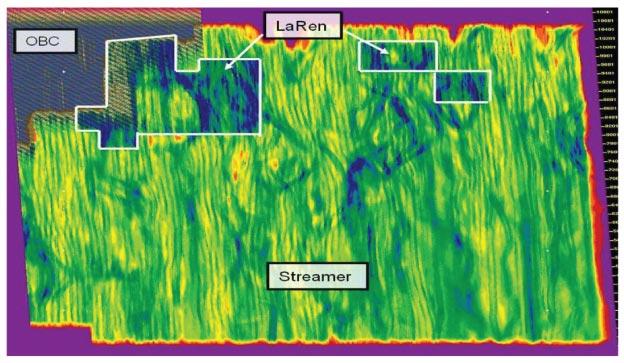

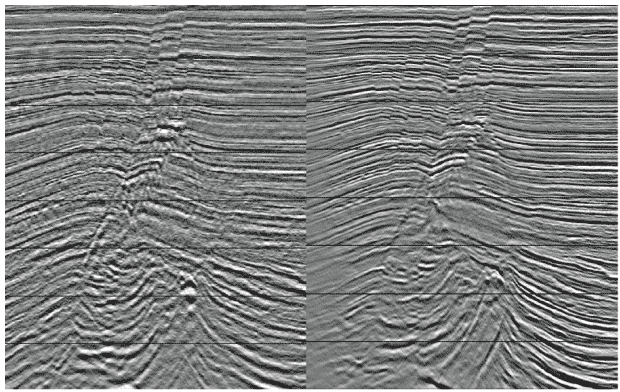

Figure 3 provides an example of coverage loss resulting from avoiding infrastructure. These significant gaps in data create imaging challenges that cannot be overcome other than by “infilling” with short-offset ocean bottom cable or early vintage narrow-azimuth (NAZ) data.

Thankfully, with the development of OBN technology, these challenges can be averted and the capability to acquire new seismic data with all the offerings of MWAZ, FAZ and more has become a reality. Industry has the ability to deploy a regular grid of seismic receivers within 100 meters of offshore structures and with no limit to offsets and azimuths. We can avoid feathering issues caused by surface currents, and are not limited by operational speed and deployment capacity (number and length of streamers).

Ocean Bottom Nodes

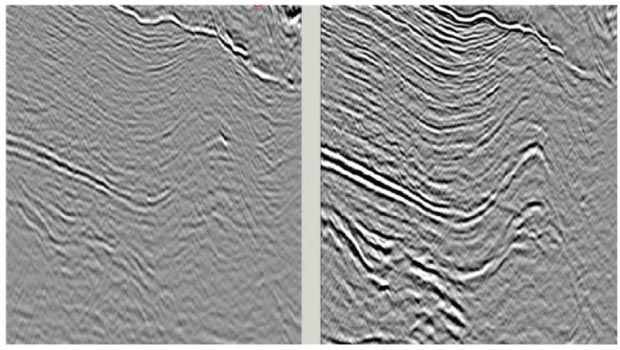

In the history of geotechnical data, the ability to integrate, analyze and simulate has never been greater. Industry’s greatest challenge still remains the quality of input data. As discussed earlier, the last round of activity on the Shelf saw application of new imaging technology for seismic data and WAZ data, where accessible. An example of this can be seen in Figure 4, which represents the uplift from NAZ streamer data to MWAZ streamer data.

So, how does one get the same advantages on the Shelf? All has changed with development of ocean bottom nodes. With the ability to record data continuously for 45 days utilizing autonomous nodes deployed on the seafloor, combined with the ability to deploy equipment in any and all configurations, true full-azimuth data are now a reality.

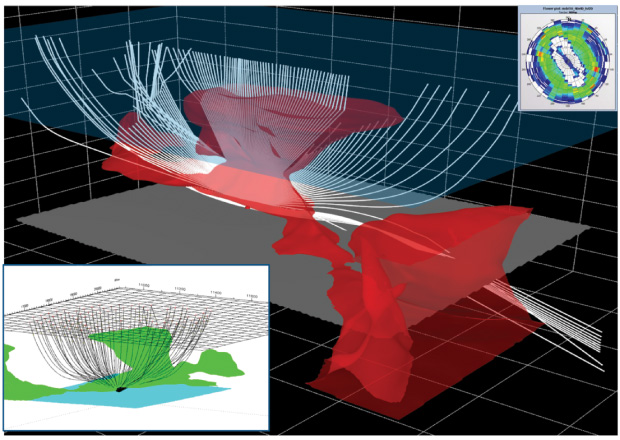

Looking to forward modeling (data driven solutions) using advanced full-image rays to determine what is required to image salt structures and the subsalt, one sees that all azimuths and offsets up to 20 kilometers are valuable for optimizing the subsurface image (Figure 5). The good news is that we no longer are limited by vessel/streamer configurations.

Today’s limitations are optimizing operational efficiencies using configurations that meet the technical objectives (modeling-based) in a cost efficient manner. Essentially, we now have the ability to apply a land seismic configuration on the bottom of the seafloor with minimal impact, and to acquire true full-azimuth surveys with long offsets to image Miocene- through Jurassic-aged reservoirs.

For lack of a better phrase, let us call what is being offered by OBN technology to effectively image both post- and presalt reservoirs with optimal spatial (lateral) resolution, “geometrical freedom.”

Increased Resolution

It is important to also discuss some of the benefits outside of survey configuration (spatial resolution) for OBN seismic data. Each individual node contains four seismic sensors: one hydrophone and three geophones (one vertical component and two horizontal components).

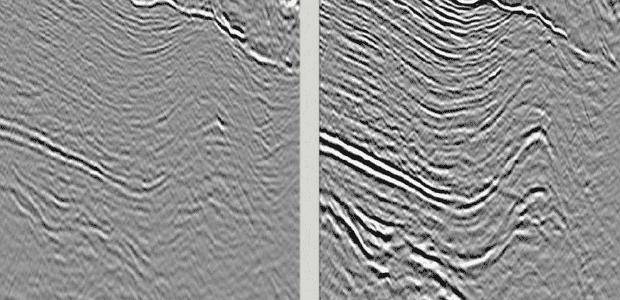

Observations from early test data (Figure 6) confirm the increased temporal (vertical) resolution of nodal acquisition. Traditional (streamer) seismic frequencies in the 20-50 hertz frequency band can resolve geologic formations/reservoirs on the order of 40 to 100 meters. Doubling this with nodal data (40-100 Hz) permits resolution of thinner geologic zones (20-50 meters) and potential detection in the subdekameter range (less than 10 meters).

This increased resolution is critical for identifying zones of bypassed pay and reservoirs not previously resolved, for improving structural definition for short-leg horizontal drilling, and ultimately for providing improved field development. Another way to view this uplift is from a medical perspective: It can be compared to going from X-ray resolution to MRI resolution.

The improved resolution improves our diagnosis and ability to view and analyze the data in different ways to provide optimal images of the subsurface, reduce drilling risk, and improve important metrics such as estimated ultimate recovery, and 2P (proved, probable) and 3P (proved, probable and possible) reserve estimates.

Secondary benefits not often discussed include:

- The general static positioning of the receivers on the seafloor can be repeated for future 4-D (time lapse) monitoring of a proven field.

- Receiver arrays on the seafloor record both the up- and down-going wave field, which permits both to be processed and the differing data to be used in advanced noise elimination applications.

- Subsurface structural positioning is improved compared with streamer data (i.e., the source is the only moving part).

These benefits accrue from the primary vertical component (and hydrophone) data. Additional long-term benefit from horizontal components remains in its infancy. As technology continues to develop, shear-wave data pose significant potential for delineating reservoirs and identifying hazards.

Cost/Value Proposition

This discussion would not be complete without considering costs. Because the deployment and operational efficiencies of the technology are still in their infancy, there remains much to learn. In comparison with early NAZ streamer data, the quantum advance most likely is 10-to-1. However, when compared with current MWAZ/FAZ operational costs, we estimate FAN to be equivalent (per unit area).

The primary difference is speed of data collection, which remains an estimated 5-10 times slower than streamer operations (on a square unit coverage area). This points to the importance of planning surveys in the exploration cycle to ensure data are captured and processed to meet critical deadlines.

The more important question, however, is value. In most market conditions, cost reduction typically is viewed as a primary objective. I believe the difference lies purely in differentiating investment and cost.

Based on drilling costs in the tens to hundreds of millions of dollars, is it better to spend $5 million on seismic data to get a 50 percent solution with four prospective targets, or to spend $15 million to get a 65 percent solution with six prospects (or two confirmed prospects, since the other two were “false positives”)? Having experience with portfolio ranking and Monte Carlo risk analysis, I think most people would take the second option.

As the industry embarks on its first collection of true multiclient, FAN seismic data, I believe the paradigm shift is on us. One dataset with multiple data volumes (p-wave, hydrophone and shear wave) that maximizes capture of full offsets and full azimuths in one pass is, fundamentally, the highest trace density per unit area of any seismic technology available.

To again draw on a medical analogy, this is equivalent to capturing an X-ray, CT scan and MRI at the same time, and having the ability to repeat the test 10 years later to see what has changed.

Data volumes created with this technology should provide a paradigm shift in how the industry acquires data, and provide new and improved subsurface insight. They will uncover bypassed pay and untapped reservoirs, and will improve drilling success, field development, and the discovery of new, deeper zones. The future of the Shelf is bright for those willing to embrace technology and the operational conditions inherent in all that is exploration.

Happy hunting.

Brad Torry is director of geosciences and Gulf of Mexico project development for TGS-NOPEC Geophysical Co. ASA. He spent the first half of his 29-year career as a senior geophysicist/team leader. The second half has been spent as founder, president and chief executive officer of Arcis Seismic Solutions in Calgary, which was acquired by TGS in 2012. Torry has extensive operational and interpretation expertise in hydrocarbon prospect/trend delineation, including economics and risk analysis. His seismic related experience includes program design and implementation; signal processing, interpretation and analysis; quality, health, safety and environmental control; procurement; regulatory affairs; and contract facilitation.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.