The Eagle Ford and Austin Chalk

Better Operating Practices And New Approaches Keep South Texas Humming

By Al Pickett, Special Correspondent

As crude oil prices continue to climb, South Texas operators are zeroing in on new horizons in the Eagle Ford Shale and revisiting a formation once thought to be an industry classic: the Austin Chalk. Refined completion techniques are proving there is no shortage of opportunities in either the new or the old.

According to a newly revised U.S. Geological Survey assessment, undiscovered and technically recoverable Eagle Ford resources are pegged at 8.5 billion barrels of oil, 66 trillion cubic feet of natural gas, and 1.9 billion barrels of natural gas liquids. It has been a while since USGS assessed the Austin Chalk, but it has estimated 900 million barrels of oil in only the Giddings Field, the play’s largest field, spanning parts of seven counties in South-Central Texas, which already has produced 526 million barrels of oil and 4.7 Tcf of gas.

To capture the world-class upside, independents are leveraging a number of operational and business strategies. While several companies enhance their core Eagle Ford operating areas through strategic acquisitions, others are taking more novel approaches, such as reconsidering dry-gas production in the play and taking a new look at the Austin Chalk overlaying the Eagle Ford.

Oil migrating through natural microfractures in the Eagle Ford and filling the tectonic features of the porous matrix above is the primary source of oil in the Austin Chalk, observes Scott Martin, chief executive officer of Blackbrush Oil & Gas. In the past, operators targeted naturally fractured zones within the Chalk, using horizontal drilling to connect fracture systems and drain the reservoir, but ignored the primary matrix porosity because of its low permeability. Martin says that is changing, however, as companies apply Eagle Ford-style completion technology to the Chalk.

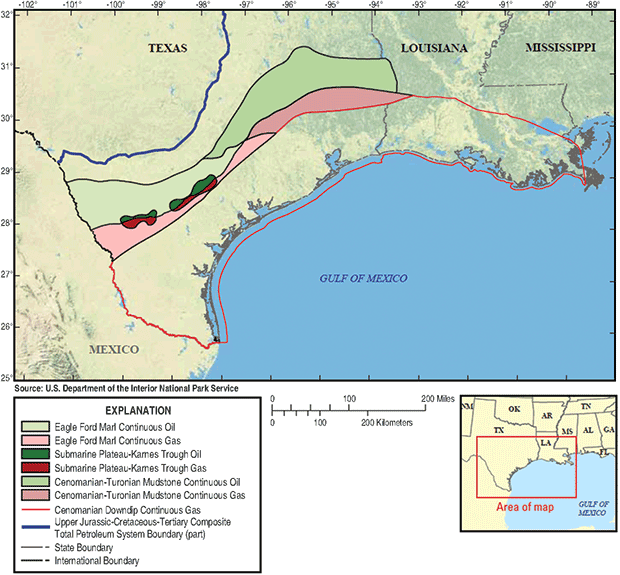

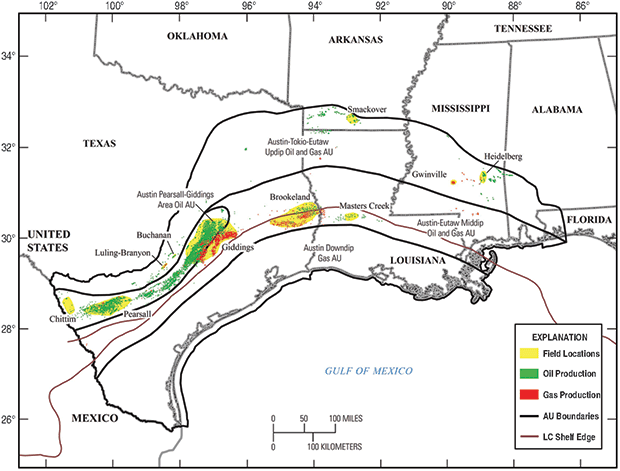

Mirroring the extent of the Eagle Ford in the Lone Star State (Figure 1), the Austin Chalk spans from west to east–from the Pearsall Field near the Mexican border in Southwest Texas to the Brookeland Field bordering the Louisiana state line–but then extends eastward on into Louisiana, Mississippi and Alabama (Figure 2).

“The ‘quiet’ Austin Chalk is more of a true reservoir,” comments Martin, whose company was the first to successfully complete Austin Chalk horizontal wells in Karnes County, Tx. “We call the Chalk in Karnes County quiet because it is not as naturally fractured as is the Giddings Field in Lee and Frio counties, Tx., but it does have porosity development. It requires a frac.”

He says Blackbrush discovered that by accident. It was drilling a vertical Edwards well, which historically has produced a stacked pay. The cementer made a mistake, and the company lost the bottom of the hole.

“So we started looking uphole,” Martin recalls. “We perforated a short vertical section in the Austin Chalk, and it came in at 350 barrels a day. In that area, the Chalk is much better than the Eagle Ford. We started developing the Upper and Lower Eagle Ford intervals, as well as the Austin Chalk.”

Austin Chalk reserves are estimated at greater than 855,000 barrels of oil equivalent per well in Karnes County.

Although Blackbrush later sold its Karnes County position to EnerVest Ltd., the company still has 300,000 gross (160,000 net) acres in both the Eagle Ford and Austin Chalk.

“We knew there should be other areas that look like this,” adds Martin, who says Blackbrush will drill about 50 wells this year in the Eagle Ford and Austin Chalk.

He says Blackbrush has begun exploring leaseholds from the Mexican border to Florida. The Austin Chalk is believed to run 650 miles from the Mexico-Texas border through central Louisiana and Mississippi.

“We have taken a significant position in Washington and Fayette counties, Tx., between San Antonio and Houston, which have multiple zones,” he offers. “We drilled our first well there this year. It is in the dry-gas/condensate window.”

Washington County wells are producing 20 million-25 million cubic feet a day, according to Martin.

Finding “Quiet” Areas

Martin says Blackbrush also has acquired a “nice position” in Louisiana, where the Austin Chalk is being targeted by a number of companies. He says there are plenty of opportunities in the “quiet” areas of the Chalk that have been overlooked previously as operators drilled in the naturally fractured portions. Martin says it is not usual for there to be a naturally fractured area, then a quiet area, followed by another fractured area that has been drilled previously.

Blackbrush also has a “gas leg” on the southwestern extension of the Eagle Ford in McMullen and LaSalle counties, Tx., where wells are making 15 MMcf/d-20 MMcf/d. Martin says that even with pipeline constraints and low prices, the gas wells along the Gulf Coast and in South Texas are still very viable with some of the best gas markets in the United States.

Blackbrush Oil and Gas has drilled laterals ranging from 4,500 feet to 9,000 feet. Average Eagle Ford laterals are 5,500 feet, Martin states.

Blackbrush Oil & Gas began completing Austin Chalk horizontals in Karnes County, Tx., after it lost the bottom of the hole in a vertical Edwards well and looked up hole. After completing a short lateral in the chalk that made 350 barrels a day, the company began a program developing the Upper and Lower Eagle Ford intervals as well as the Austin Chalk.

“We revised our frac design and proppant methodology, which have enhanced our production greatly,” he reveals. “We are using more proppant, but we have made a number of tweaks to try to drive down costs.”

Blackbrush also owns the exclusive lower-48 rights to a waterless fracturing technology that was patented by a Canadian company for using gelled propane as the carrier fluid. Martin explains that GASFRAC went bankrupt a few years ago, allowing Blackbrush to buy the U.S. license rights and equipment.

“We have found we can fracture the wells using condensate and butane,” he reports. “It is very economical. We will do testing on shallow Eagle Ford wells that are not as overpressured. We believe we can double the reserves. We will start that program next year.”

Martin says using condensate or butane to fracture a well is cheaper than using water because it saves the cost not only of buying the water, but also disposing of it. With this technology, he says, Blackbrush will be able to recapture the frac fluid and sell it.

South Texas Expansion

On July 31, TPG Pace Energy Holdings Corp. announced the completion of its previously announced business combination with EnerVest’s South Texas Division. In connection with the closing, TPGE has changed its name to Magnolia Oil & Gas Corporation. EnerVest will serve as operator of Magnolia Oil & Gas’ properties.

Forming Magnolia created a large-scale, pure-play South Texas operator with top-tier Eagle Ford and Austin Chalk assets with approximately 50,000 boe/d of production, according to a second quarter filing. Magnolia says it acquired EnerVest’s 360,000 total net acres in South Texas, which consists of approximately 14,000 net acres in one of the most prolific sections of Karnes County and 345,000 net acres in the emerging, high-growth-potential Giddings Field. The acreage position is almost entirely held by production (62 percent oil and 78 percent liquids).

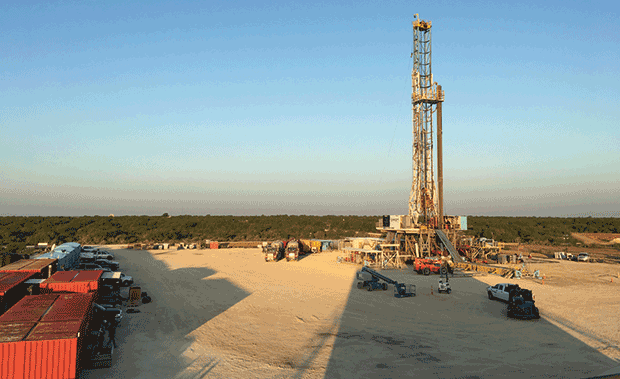

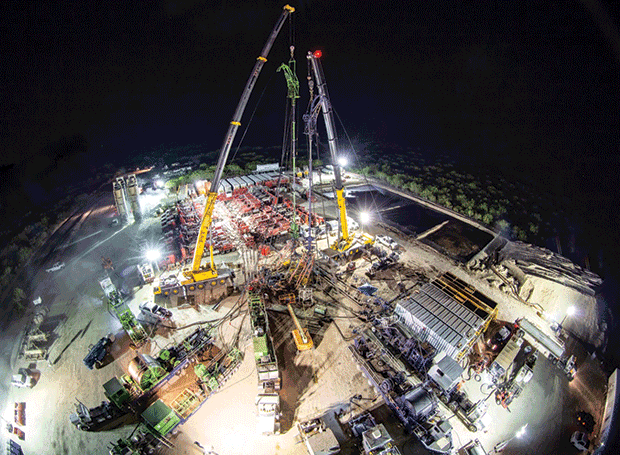

Orion Drilling Company’s fit-for-purpose Rig 12 is shown drilling here on Freedom Oil & Gas’ Wilson pad in Dimmitt County, Tx. Freedom reports the Wilson pad wells are being drilled to 6,500 feet deep, with 7,700-foot laterals, and are spaced 600 feet apart.

“In creating Magnolia, we have a unique opportunity to build a new company anchored by what we consider to be some of the highest quality oil-producing acres in the country,” CEO Steve Chazen said in making the announcement. “Magnolia’s acreage in Karnes County has some of the best economics in the United States and, when coupled with the upside of the Giddings Field, is a great fit with our criteria.”

The Karnes County acreage was acquired in 2016 by EnerVest from Blackbrush, Gulftex Energy and Alta Mesa Resources for $1.3 billion.

The Austin Chalk in the Giddings area is the primary target for Magnolia, which announced in its second-quarter operational update that it was operating two rigs in Karnes County and one in the Giddings Field. Magnolia says it expects to continue to utilize one completion crew through 2018, and plans to add a second rig in the Giddings Field in 2019 to further appraise its opportunities there.

Then in August, Magnolia announced the acquisition of Harvest Oil & Gas Corporation’s South Texas assets. “Harvest represented our largest nonoperated working interest owner and the assets are a natural fit for Magnolia,” Chazen states.

The acquisition adds 15 net locations to Magnolia’s core Karnes County inventory and approximately 114,000 net acres to its Giddings Field position.

Low Cost, High Liquids

Houston-based Freedom Oil & Gas announced in August that it was moving forward with horizontal well development on its Eagle Ford Shale acreage in Dimmitt County, Tx., in a continuous drilling program with a dedicated rig. That follows a successful test of its position through drilling six wells that achieved better than expected initial results, according to CEO J. Michael Yeager.

Houston-based Freedom Oil & Gas has obtained a 9,500-acre contiguous position in the Eagle Ford Shale. Chief Executive Officer J. Michael Yeager reports the company is producing 45-gravity oil from the Lower Eagle Ford, which commands premium Light Louisiana Sweet-based pricing.

“We moved into Dimmitt County when oil was $40 and declining because we had faith in it,” he explains. “We started accumulating acreage in 2015 and 2016. We now have a 9,500-acre contiguous position.”

Freedom first drilled two wells on the Wilson pad that came on line a year ago with 30-day initial production rates of 1,250 boe/d.

“We are a tiny company,” Yeager continues. “We raised more money from our stockholders and drilled four wells on the Hovencamp pad, about 1.5 miles west of the Wilson pad. Those wells averaged 1,187 boe/d (with 500 psi average wellhead pressure). Based on those results, we raised money to begin our continuous drilling program.”

Freedom executed a six-month contract for a fit-for-purpose rig with Orion Drilling Company and has the option to extend it an additional six months. Yeager says it anticipates at least 12 more wells, the first of which has been drilled already.

“This continuous pace of development should allow us to improve our operating efficiency, reduce operating costs, and drive growth in production, reserves and cash flow,” he claims. “Over the last year, we have obtained a substantial amount of information about the optimum drilling and completion techniques on our acreage, constructed substantial field infrastructure and established valuable relationships with quality service providers. We believe we now are well positioned to apply the knowledge we gained to carry out this continuous program.”

Development Strategy

The first three wells in the continuous program will be the Vega 1, 2 and 3 horizontal wells on the original Wilson pad. Yeager says the first two Wilson wells will be shut in during drilling for safety reasons, and then the rig will move to another location to continue drilling after the Vega wells are finalized.

He points out that these wells will be 6,500 feet vertical depth with 7,700-foot laterals. Freedom is drilling the wells 600 feet apart. It drilled the first Vega well in only 11.7 days.

“These wells are fairly inexpensive by industry standards,” Yeager maintains. “They are about $5.3 million: $1.3 million for drilling and $4.0 million for fracturing, cleanup and everything else.”

Freedom is drilling in the Lower Eagle Ford, and its wells are 80 percent liquids (65 percent oil and 15 percent NGLs) and 20 percent natural gas.

“Because our crude is lighter (45 degrees API), we are getting premium Light Louisiana Sweet-based pricing, $5-$7 above West Texas Intermediate,” he lauds. “Some days, our price is close to $80 a barrel. So our wells are less costly with a high liquids strategy and premium pricing.”

When Freedom drilled its first two Wilson wells, its perforation clusters were 40 feet apart. Yeager says it decreased that to 20 feet in four Hovencamp wells.

“Because of that, we obviously are using more water and a lot more-but smaller-sand,” he reveals. “We get about 30 percent of that back as produced water. We will continue to use more sand, but since we have to purchase our water, we are testing how much is the right amount. We don’t have a disposal well on our acreage, so that means we have to handle the water twice.”

Yeager notes that the Eagle Ford shale is 400 feet thick in that part of South Texas. As a result, there are two intervals to target. “We have identified 200 locations on our acreage in the Eagle Ford alone,” he adds. “The Eagle Ford is one of the greatest source rocks in the world, and has been the source for the Austin Chalk. Others around us have started drilling horizontal wells in the Austin Chalk, but we haven’t tested that yet.”

Dry Gas

While many are targeting the oil and wet-gas windows in the Eagle Ford, Houston-based SilverBow Resources Inc. is bucking the trend, putting its efforts into what CEO Sean Woolverton calls the “re-emergence of Eagle Ford dry gas.”

With 100,000 Eagle Ford acres in Webb, LaSalle, McMullen and Live Oak counties, Tx., SilverBow Resources Inc. is bucking a trend by completing dry gas wells. Drilling four-six wells a pad with average lateral lengths of 7,500 feet, according to Chief Executive Officer Sean Woolverton, SilverBow is bringing in wells with estimated ultimate recoveries of 12 billion-15 billion cubic feet from the Lower Eagle Ford, and 10 Bcf-12 Bcf from the Upper Eagle Ford.

“Petrohawk’s Eagle Ford discovery well in 2008 was a dry gas well in LaSalle County,” points out Woolverton. “The industry was chasing dry gas in the shale reservoirs at that time. There was tremendous activity in the wet and dry gas windows from 2008 to 2012. Then the oil play started to emerge, which coincided with the drop in gas prices.”

Woolverton joined SilverBow in March 2017 and put together a new management team while the company increased its acreage from 65,000 to 100,000 acres and began targeting the dry gas window. Today, its wells are producing 80-83 percent gas and 17-20 percent liquids, which are split evenly between oil and NGLs.

“People ask me why we produce gas when prices are sub-$3,” he ponders. “There are several reasons. There was a very attractive entry cost because most companies were chasing oil. And gas is very attractive when you look at full-cycle returns. The Eagle Ford is a world-class reservoir, and those initial gas wells 10 years ago used shorter laterals and smaller stimulation designs much different from what we are using today. Many of those wells were not drilled in the primary zone, either.”

SilverBow has 100,000 acres in the dry gas window on the western side of the Eagle Ford play in Texas’ Webb, LaSalle, McMullen and Live Oak counties. Woolverton says the wells on the western side of its leasehold in Webb and western LaSalle counties average 9,000 feet deep, while wells average 11,000-13,000 feet deep to the northeast in LaSalle, Live Oak and McMullen counties.

Pad Development

SilverBow completed a six-well pad in Webb County for $5 million a well. Woolverton says the company still is delineating its acreage in McMullen and Live Oak counties where exploration well costs are higher. However, Woolverton says he believes development well costs will come down to $8.0 million. The company is drilling four-six wells a pad on the western side of its leasehold, and two wells a pad to the northeast, where it still is delineating its acreage.

“Our average lateral length is 7,500 feet,” he continues. “Our longest lateral is 11,500 feet. Our interwell spacing is 660-880 feet. We can’t put them as close because they are gas wells.”

Woolverton notes that SilverBow has moved from 600-800 pounds per foot of proppant to 2,500-4,500 pounds per foot. “We have tested a range of fluids, too, from hybrid cross-linked gel and slickwater to pure slickwater,” he adds.

SilverBow has moved from 300- to 165-foot fracture stages, and from six-seven clusters per stage to 10 or more clusters. In its western acreage, where the company has drilled more than 60 wells, its estimated ultimate recoveries are 12 billion-15 billion cubic feet a well in the Lower Eagle Ford. Woolverton says it is testing the Upper Eagle Ford, where EURs range from 10 Bcf-12 Bcf. In its newer area in McMullen and LaSalle counties, EURs are 10 Bcf-14 Bcf.

“It is different rock (in Webb County compared with McMullen and Live Oak counties),” he explains. “On the western side (Webb County), it is shallower with lower pressure, but higher porosity. On the northeastern side (McMullen and Live Oak counties), it is deeper with higher pressure, but lower porosity.”

Another advantage of the Eagle Ford’s dry gas window, according to Woolverton, is its proximity to the Gulf Coast, where gas prices range from a 5-cent discount to 5 cents above the Henry Hub price, compared with as much as a 75-cent discount for gas produced in the Appalachian Basin. An increasing amount of SilverBow’s gas is sold internationally, either moving by pipeline to Mexico or being liquefied for export.

“The demand growth over the next five-eight years on the Gulf Coast is significant,” he assures. “We are in position to take advantage of that.”

He says SilverBow expects 40 percent growth in the second half of this year, going from the 160 MMcf/d it reported in its second-quarter report to more than 200 MMcf/d. Woolverton anticipates that growth will continue into 2019.

“We are a low-cost operator,” he states. “This play hasn’t been looked at hard since 2008. With new technology and lower entry costs, we have a great story as a small-cap company with great growth potential.”

Region’s Largest Player

WildHorse Resource Development Corporation brought on line 28 gross (26.2 net) Eagle Ford wells and five Eagle Ford refracs in the second quarter in what it calls the “Northeast Eagle Ford play.” It reported second-quarter daily production of 46,700 boe/d (72 percent oil, 15 percent natural gas and 13 percent NGLs).

In the Eagle Ford, WildHorse’s Irene, Inez and Lero wells were brought on line late in the first quarter in Brazos County, Tx., with average IP-30 rates of 788 boe/d (89 percent oil) on an average 6,404-foot lateral, according to the company’s second-quarter operational update.

WildHorse also is testing the Austin Chalk, the update notes. The JRG C 1H, a well located in southern Burleson County that was brought on line at the end of the first quarter, reached a peak IP-30 rate of 747 boe/d (43 percent natural gas, 45 percent NGLs and 12 percent oil) on a 5,843-foot lateral. The company says it plans to bring on line four more Austin Chalk wells in the third quarter or early in the fourth quarter.

In late September, WildHorse announced it had closed two agreements to acquire a combined 20,305 net acres in the Eagle Ford, Austin Chalk, and other intervals in Burleson, Brazos, Lee, and Washington counties.

In addition to those acquisitions, the company says it has leased 10,700 net acres in the Eagle Ford and Austin Chalk, giving it a total of 31,005 net acres acquired for $43 million this year. WildHorse owns 418,000 net acres in the Eagle Ford.

“The acquisitions are an excellent fit with our existing position. With the bolt-on of another 31,005 net acres, we continue to fill in our acreage position and increase our working interest and operational control across the field,” says Chairman and CEO Jay Graham. “Our status as the largest player in the region allows us to acquire acreage at extremely attractive valuations. We are committed to solely consolidating the Northeast Eagle Ford, and will continue to prudently add similar acreage where it makes economic sense and adds value to our shareholders.”

In-Field Gathering

WildHorse also announced in September it planned to construct a wholly owned and operated in-field oil and produced water gathering system. The $50 million system is expected to be completed by the middle of next year.

“The gathering system will be the first phase in developing a midstream opportunity that can further improve our already superior realizations. With an in-field oil gathering system, we can reduce trucking by delivering our barrels from the wellhead to a central point,” Graham details. “In addition, the oil and produced water gathering system will lower our lease operating expenses on a boe basis and allow us to facilitate completions using recycled water.”

The initial phase of construction consists of 50 miles of oil- and 55 miles of water-gathering pipelines. Both lines will utilize the same rights of way, where practical, to reduce costs, according to the September announcement. The water gathering line is expected to reduce produced water transportation and disposal costs by 50 percent, equating to an expected $0.25 a boe improvement to lease operating expenditures.

The company adds that the gathering system’s additional oil take-away capacity should deliver $1.00 a barrel improvement in realized oil prices.

WildHorse says it also is evaluating proposals for constructing a third-party, long-haul pipeline, which would give the company the ability to transport 100 percent of its oil to premium Gulf Coast markets, including the rapidly growing export market, while providing further transportation cost reductions.

Mirroring trends in other basins, including the Permian, to build local frac sand mines, WildHorse also reports that it is ahead of schedule in constructing an in-field sand mine in its Eagle Ford/Austin Chalk play area. Originally expected to come on line in the first quarter of next year, first sand loadings now are expected as soon as in Nov. 1, with full operational capacity by the end of November.

With in-basin sand supplies, the company says it anticipates saving $400,000-$600,000 a well and improving Eagle Ford internal rates of return by up to 16 percent.

Earlier this year, WildHorse announced it had been selected for a U.S. Department of Energy study alongside the Texas A&M Engineering Experiment Station to develop a field laboratory in the Eagle Ford. The team has been awarded $8.0 million from DOE to test next-generation monitoring of hydraulic fracturing and enhanced oil recovery.

WildHorse will contribute three wells for testing: one existing well for refracturing and two new wells.

In making the announcement, Graham said, “We are very excited to be working with Texas A&M and the DOE to help add to the public knowledge of the Eagle Ford trend and how our natural resources can best be utilized over the life of a reservoir. We look forward to lending WildHorse’s expertise to the leading petroleum engineering program in the country.”

San Miguel Redevelopment

Houston-based Sierra Pines Resources International has a unique oil redevelopment project under way on the southern tip of the old Big Wells Field in Dimmitt County, south of San Antonio. Chesapeake Energy Corp. is drilling Austin Chalk and Eagle Ford wells on the same acreage, but Sierra Pines has the leasehold on the shallower zones above the Chalk.

“It is a logistical exercise to make sure we don’t collide wellbores,” admits CEO Bruce Ganer. “But it has not been that difficult.”

The company’s redevelopment project is unique in other ways as well, Ganer continues. Sierra Pines is doing a waterflood using horizontal drilling, but not fracturing the wells. Instead, it is using the laterals to contact more rock in the formation.

“To my knowledge, no one has done this before,” Ganer states. “It is a bit of a science project.”

He says 39 vertical wells had been drilled previously on Sierra Pines’ 3,300 acres. The company is drilling horizontal wells in the undeveloped acreage and is using a waterflood with horizontal wells in the area that was drilled earlier.

As of the end of September, Sierra Pines had drilled two 8,000-foot laterals. After the initial production, Ganer says it will use one lateral as an injector and the other as a producer. It plans to start injecting water in October.

Ganer says most of his career has been spent drilling vertical wells in South Texas, although he was involved in drilling horizontal wells in both the Barnett and Haynesville shale plays. “We are combining the utility and doing a hybrid of that with this San Miguel project,” he reflects. “So far, our engineering has been spot on.”

A third-party study projects reserves in excess of 6 million barrels of oil from the redevelopment project, Ganer reports. The initial two wellbores are producing 60-100 bbl/d. Ganer says he knows that will taper off quickly, but he is hoping production will be rejuvenated by the waterflood.

Sierra Pines plans to drill 16 wells total this year, continuing its two-well pattern of one becoming the injector and the other the producer. It will drill eight wells in the Big Wells Sand and eight in the Goodluck Sand, which are both part of the San Miguel formation.

Ganer says he believes new technologies in drilling, completions and EOR methods will allow Sierra Pines to achieve a significant improvement in oil recovery, even without fracturing, which obviously reduces the cost of the project.

Core Eagle Ford

Marathon Oil has 145,000 net acres in the Eagle Ford Shale, much of it in what it calls the core in Karnes County, Tx. President and CEO Lee Tillman reported at the Barclay’s CEO Energy-Power Conference in September that Marathon’s Eagle Ford production averaged 106,000 net boe/d in the second quarter, a 2 percent increase from the prior quarter.

He says Marathon brought 39 gross company-operated wells to sales in the second quarter with average 30-day IPs of 1,880 boe/d (66 percent oil). The Karnes City NE six-well pad in its core acreage delivered an average IP-30 of 2,330 boe/d (72 percent oil).

Marathon has seven other pads–ranging from two to six wells per pad and lateral lengths from 4,590 to 8,070 feet–in Karnes County with average production rates ranging from 1,357 boe/d to 2,118 boe/d (46 percent to 79 percent oil).

Tillman notes that Marathon is continuing to confirm extension of its core acreage to the southwest of Karnes County into the majority of Atascosa County, Tx. For example, he reports, the Guajillo 10 South five-well pad in Atascosa County achieved an average IP-30 of 1,660 boe/d (75 percent oil) with average lengths of 4,440 feet.

Like other companies in the Eagle Ford, Marathon is enjoying significant cash flow from strong LLS-based oil realizations, according to Tillman.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.