Automation & Computing

Back-Office Software Simplifies Tasks

By Colter Cookson

Automating producing wells and remotely monitoring equipment in the field have long been considered operational best practices. However, the economic shutdown in response to COVID-19 has renewed the industry’s focus on the value of implementing technologies than can cost-effectively automate routine daily tasks and digitize paper-based processes.

“Given how much uncertainty we face, automating is becoming a top priority for many operators,” says Brent Rhymes, chief executive officer of WolfePak Software. “It can reduce operating expenses by allowing each person to monitor more assets and increase income by giving people the real-time information they need to make better decisions.”

These benefits no longer need to be restricted to companies with the funds and expertise to deploy complex supervisory control and data acquisition systems, Rhymes argues. “Gone are the days when a company needs to be one of the top 50 producers to leverage automation,” he says. “Smart phones, Internet-connected sensors and cloud technology have significantly reduced the infrastructure needed to get data from the field to the back office.”

According to Rhymes, there is a vast universe of companies that can benefit from greater automation. “In mid-April, WolfePak surveyed 236 upstream, midstream and service companies about the challenges associated with remote work,” he relates. “Seventy-seven percent identified accessing paper documents such as job tickets and invoices as their biggest challenge.”

Paper-based documents are often re-keyed into the company’s enterprise resource planning or accounting systems, a process Rhymes warns can be time-consuming and error-prone.

Mobile Power

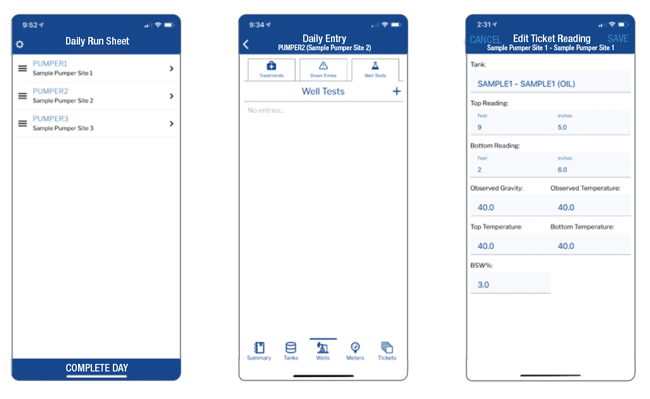

To collect production data more quickly and reliably, Rhymes suggests equipping pumpers and production managers with apps that allow them to record data using smart phones or tablets. There are several options available for this task, including a new app WolfePak commercialized in May.

User-friendly mobile apps offer a fast and affordable way for producers that previously had pumpers fill out paper forms to get data from the field to the back office more quickly, WolfePak reports. The company adds that eliminating the need to re-type paper forms improves data accuracy.

“Mobile data entry apps can generate a significant positive return,” he says. “For one client, switching to an app cut three steps from the data collection process. Instead of waiting to get a ticket from the field, typing it into a spreadsheet template and importing that spreadsheet into the enterprise resource planning system, the company has almost instant access to the data in its ERP system.”

WolfePak’s app can compare pumpers’ readings with those of purchasers to identify discrepancies and catch possible mistakes, Rhymes notes. He adds that it can generate automatic schedules based on the operator’s service guidelines.

“To ensure quick adoption, look for an app that runs natively on both Android and iOS devices, integrates easily with back-office systems, and has an intuitive interface for both pumpers and back-office workers,” Rhymes suggests.

“Security also is important,” he advises. “In addition to using strong data encryption, the app should allow producers to limit what data each user can see. It should also support two-factor authentication so an unauthorized user who guesses a user’s password has another hurdle to clear before accessing that information.”

Rhymes also encourages companies to teach employees security best practices. “The more employees are aware of the potential for security threats, the less likely they are to click on a link that installs malware or gives an outsider access,” he explains.

Adoption Drivers

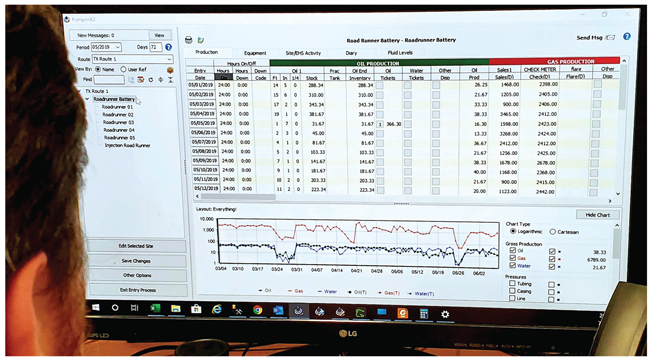

Organic growth or acquisitions often prompt oil and gas companies that have long managed wells with spreadsheets to look for software that can help them capture daily operational and production data from the field more quickly, says Rick Hornock at PRAMS Plus LLC.

“For most companies, spreadsheets become too cumbersome to keep using when the well count reaches somewhere between 50 and 80,” Hornock relates. “However, we occasionally see companies get to 200 or 300 wells with spreadsheets, especially if they have Excel™ wizards on staff who are comfortable writing macros and scripts to automate common procedures.”

By converting daily production data into useful graphs and automatically generating reports for executives, business partners and regulatory agencies, software can help back-office staff work efficiently, PRAMS Plus says. The company reports its tools enable each back-office analyst to oversee 500 wells.

If companies try production software but the implementation goes poorly, employees will be reluctant to use the software and even may revert back to spreadsheet-based processes, warns Reagan Duecker, PRAMS’ business development director. “Software adoption is something companies need to get right the first time, because it becomes increasingly difficult to change once processes are in place,” he stresses.

To ensure the field adopts the change, Hornock recommends looking for a provider with a simple interface and accessible customer support. “At PRAMS, we decided to model the pumpers’ interface after the 30-day gauge sheets they have been using for decades,” he says. “It usually only takes minutes of training before the pumpers say, ‘I get it. Thanks.’”

After pumpers enter data, it is synced with the back office once an Internet connection becomes available, Hornock describes. Because accurate data is paramount, the daily data goes through edits at the time of entry and back on the server. The operations analyst/tech generally takes a final look in the morning before the daily or weekly reports go out to management or partners. Hornock adds that the daily production data seamlessly feeds the monthly reporting trued up to the sales statements.

A single analyst can oversee at least 500 wells, estimates Duecker. “We do everything we can to take away tedious tasks and put informative and helpful analytics in front of employees so they can spend time improving their business. In other words, we want them to work on the business, not in it.”

As part of that effort, Hornock says the software can send routine updates to business partners and automatically generate reports required by state and federal agencies. “Getting the data into the format each agency wants is a huge benefit,” he says. “If an operator has a reputation for being accurate and timely, regulators are far more likely to give the company the benefit of the doubt if the circumstances warrant it.”

The PRAMS software starts at $10/well per month with volume discounts, Hornock says. “Our intent is to offer a disruptive, simple pricing model, which includes all our software modules, unlimited users and unlimited support. We want our clients to feel comfortable calling or e-mailing us when they have questions so we can solve their problem and get feedback on our software.”

A Human Touch

For many service companies, downturns prompt deep reflection, suggests Vince Dawkins, president of Enertia. “When our industry hurts, so do we,” he says. “We are asking ourselves what we can do to help customers. Because ERP software is often adopted during acquisitions, we have to be especially adept at working with people who are going through emotionally tough or aggressive mergers.

“Engaging and supporting customers is key,” he stresses. “We reach out to end users so they have a chance to ask questions and explain the challenges they’re facing, which may give us an opportunity to show how our software can simplify their day-to-day tasks. We also try to convey that the software is there to unify the organization’s culture and create more opportunities for growth.”

To help producers manage costs and make sound decisions, Enertia Software says it is enhancing its platform’s reporting capabilities and applying artificial intelligence to improve data accuracy.

Enertia is upgrading its reporting functionality to reduce generation times and present information in new ways that can help operators make sound decisions in tough environments, Dawkins says. He adds that it is stepping up training efforts to ensure customers are leveraging every possible benefit the software offers.

“As we develop the software, we often draw on innovations from outside the industry,” he comments. “For example, we are applying artificial intelligence to speed up data’s journey from the field to the financial department, improve data accuracy, and streamline reporting and decision making.”

Downturns can be prime times for companies to research and implement ERP software, Dawkins argues. “These companies want to go through training and tinker with the software while activity is slow so they can run at full speed once markets turn,” he explains.

How long it takes to implement and learn software can vary widely, reports Jonathan Dancy, one of Enertia’s project managers. “A typical implementation runs six-nine months, but we have done some in as little as two months,” he details. “We completed a recent project for a large public customer in only five months, even though we had to adjust to social distancing mandates.”

During implementation, Dancy encourages operators to make employees available to participate in the process and go through training. “It is easy to get distracted by day-to-day objectives, but allowing time for training, continuing education and professional development is critical to getting the most from any ERP software,” he says.

Software Selection

When companies select and implement software, they often make mistakes that undermine its benefits, warns Elizabeth A. Gerbel, founder, president and CEO of E.A.G. Services Inc., a consulting firm that specializes in back-office software.

“Many companies have paid for back-office software only to walk away from it,” she says. “When people are looking at software, they usually want an easy answer, which makes it tempting to imagine that the program with the most compelling demo is exactly what they want and will solve their problems.”

Instead of looking at software as a solution, Gerbel recommends viewing it as a tool or a means to an end. “Ideally, companies should think about the information or capabilities they need, then look for software that supports those goals,” she says.

The selection process must involve people from every department that will use the tool, Gerbel advises. “When accounting buys a system and tells the land department to use that system’s land module, the new software rarely goes over well,” she relates. “But when landmen are involved from the beginning, they are likely to be less resentful even if their preference gets overruled as long as the reasoning makes sense and they feel their voices were heard.”

Implementation Best Practices

Gerbel cautions that people frequently underestimate the amount of work and thought required to unlock new software’s benefits. For example, she says many companies who license business intelligence or data visualization tools initially assume it will be easy to create custom reports when they need to see data in new ways.

“In today’s price environment, we are helping operators create more detailed reports on lease operating expenses and track spending so they can identify and investigate potentially unnecessary costs,” Gerbel says. “We are also tracking joint interest payments so they can get more money in the door by reminding partners about overdue bills.”

These reports often need to draw on hundreds or millions of data points that may be spread across several systems, Gerbel notes. “If we tried to get the data when the client wanted the report, generating it would take too long,” she remarks. “Instead, we have to schedule data ‘pulls’ so they are efficient while refreshing the data frequently enough that it is useful. That way, all the client has to worry about is providing accurate data and looking at the report.”

Because reports are only useful if the data behind them is sound, Gerbel encourages companies to clean data when implementing new software. “It is not necessary to have perfect data, but it is a good idea to consolidate duplicate records as much as possible,” she details. “During conversion projects, we often find the same well in multiple systems with different numbers and slightly different names, which could lead to it being counted several times.”

Gerbel suggests verifying that interest percentages match up across joint interest billing and revenue systems. She also stresses that meaningful training is vital to the success of any implementation project.

“Training must get beyond how to click through a system,” she urges. “It needs to walk through the scenarios people encounter during their day-to-day tasks, so they have the hands-on experience with the system to feel comfortable using it. If they do not, it will be easy for them to revert to spreadsheets.”

Outsourcing

According to Gerbel, many producers prefer to outsource back-office functions so they can focus on their core business of finding and producing oil and gas. “These companies range in size from private equity-backed startups that have just made their first acquisition to established firms with thousands of wells. Some outsource almost all back-office functions, while others keep most tasks in house,” she describes.

“Outsourcing can be a quick way for a company to make the leap from spreadsheet-based processes,” she says. “A reputable partner will already have systems in place for most back-office functions, including accounting, land and production, as well as experience migrating producers’ data into those systems. It still takes time to connect systems and tailor reports to show data the way the client prefers to see it, but that is much faster than a complete software implementation.”

E.A.G.’s outsourcing arm has on-boarded small companies in fewer than 30 days and larger ones in three months, Gerbel illustrates. She adds that outsourcing sometimes saves costs.

“That is partly because outsourcing firms have the scale to negotiate the lowest-possible licensing fees for software,” she explains. “However, the bigger factor is staff utilization. Performing the back-office work associated with 1,200 wells requires three or four people that each perform separate functions. Those people are critical, but if they only work for one company, often they will be idle.

“Outsourcing firms can keep their experts busy throughout the month because each one works for several clients,” Gerbel says. “Having said that, we build some flex time into our schedules so we can respond to unusual events that may cause a spike in a company’s workload, such as an acquisition.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.