Producer Profile

Haynesville Well Economics, Rising Natural Gas Demand Propel Comstock’s Momentum

By Colter Cookson

With associated natural gas from tight oil plays keeping a lid on gas prices, operators of all sizes are dedicating their capital to oil-rich projects. In contrast, Comstock Resources is adopting a contrarian “pure play” strategy by building its entire operation on dry gas in the Haynesville Shale.

“We are bullish on natural gas,” says M. Jay Allison, Comstock’s chairman and chief executive officer. “One of the biggest reasons is liquefied natural gas. The United States already exports more than 7 billion cubic feet of gas a day as LNG. Export terminals now under construction will increase that capacity by 12 Bcf/d, and other terminals that have been approved but not yet built could add 14 Bcf/d eventually.”

Allison points out that almost all the approved export terminals are along the Gulf Coast and therefore near the Haynesville. “It is the premier play for natural gas demand growth,” he asserts. “It will take time for that demand to materialize, but it will come.”

While growing demand may increase wellhead prices gradually, Allison says Comstock’s strategy works regardless. “It is the abundance and affordability of natural gas that makes it valuable,” he argues. “Utilities are switching to natural gas and companies are building fertilizer and chemical plants along the Gulf Coast because they know the industry can provide natural gas reliably and affordably.

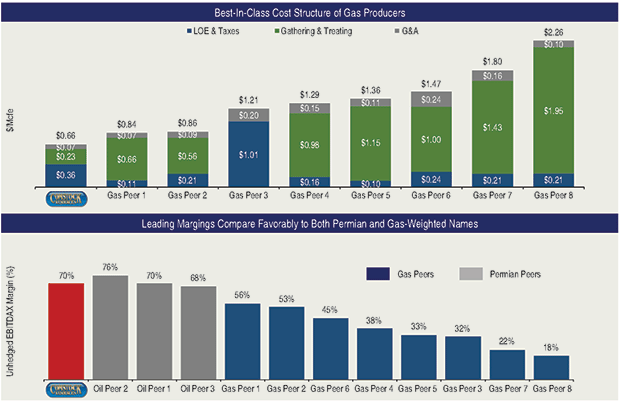

“With prices likely to remain low, the most successful producers will be the ones with low costs,” Allison says. “Comstock’s lease operating expenses average $0.36 an Mcf, with gathering and treating costs at $0.23 an Mcf and general and administrative costs at $0.07–by far the lowest in the industry. Add those up, and we have a total cost of $0.66 an Mcf, making us best in class.”

Top-Tier Acreage

That lean cost structure combines with ready access to the Henry Hub and other premium natural gas markets to provide Comstock’s strong margins, Allison reports. “Our EBITDAX (earnings before interest, taxes, depreciation/depletion, amortization, and exploration expenses) margin is 70%,” he says. “That allows us to compare favorably not only with the other gas-weighted public companies, but also with the best Permian Basin producers.”

With its top-tier Haynesville Shale acreage, ready access to premium natural gas markets and minimal overhead, Comstock Resources can produce natural gas at a low cost. This lets it generate EBITDAX (earnings before interest, taxes, depreciation/depletion, amortization, and exploration expenses) margins comparable with those of some of the best Permian Basin oil producers.

The Haynesville has not always been so lucrative, Allison notes. “In 2010, when gas prices were at $5.10, our Haynesville wells only had a 30% internal rate of return,” he recalls.

As one of the companies that helped pioneer the play in 2007-08, Comstock had the expertise and top-tier acreage to drill some of the play’s strongest wells during its early years, Allison says. Between 2008 and 2011, he estimates, the company drilled 120 wells that targeted the Haynesville and Bossier shales.

“From 2009 to 2011, the Haynesville region was the largest shale gas region in the United States. In 2010, it had 190 active rigs and produced 10 billion cubic feet a day,” Allison relates.

But as gas prices fell, activity followed. By the end of 2012, the region’s total rig count had plummeted to 39, and Comstock was not running any rigs.

After reviewing its portfolio in search of a way to pull out of the downturn, Comstock decided in November 2014 to return to the play and learn if lengthier laterals and enhanced completions would improve Haynesville economics. “We had drilled extended-reach laterals in the Eagle Ford and knew how well they were performing in the Marcellus and Utica,” Allison explains. “The Haynesville is a world-class gas asset, so we figured we could replicate that success in the play.”

To test that theory, in 2015 Comstock drilled nine Haynesville wells and one Bossier well. “Some of these wells paid out in eight or nine months,” Allison says. “The enhanced completions were working, so in 2016, we drilled another 15-16 wells. We had to lay all our rigs down in February and March of that year, when gas prices fell to $1.61, but by 2017, we were back at it.

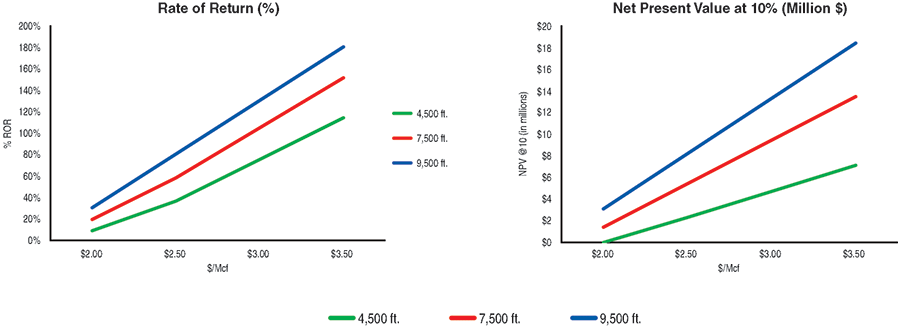

“The wells’ economics are phenomenal,” he acclaims. “At a gas price of $2.50 an Mcf–which is what we are getting today–we can generate an IRR above 60%.”

Abundant Infrastructure

The impressive IRR comes in part from low transportation and gathering costs. “From 2008 to 2012, the industry built more pipelines in the Haynesville than it needed,” Allison recounts. “When gas prices were consistently reaching $5-$7 an Mcf, several large operators bought leases for $30,000 an acre. They made long-term commitments to ensure they could get their gas to market.”

Even after prices fell, those companies continued to drill to secure their leases. Despite that, production dropped from 10 Bcf/d in 2012 to 6 Bcf/d in 2015.

By employing modern completion techniques, Comstock Resources can generate compelling returns from its Haynesville Shale acreage even if gas prices stay in the $2-$3 range. The company says it is well-positioned to help meet growing natural gas demand in the United States and abroad.

“By the time we returned to the Haynesville, many of the pipelines were operating at 50% capacity,” Allison estimates. “The pipeline companies needed our gas as much as we needed their infrastructure, so we were able to form great relationships with them.”

With its top-tier acreage, low transportation costs, and ever-improving completion designs, Allison says, Comstock had plenty of compelling drilling opportunities even at low gas prices. But to take advantage of them, it needed capital. Complicating that situation was the considerable extent to which public markets had soured on oil and gas investments.

A Powerful Partner

The solution came on Jan. 5, 2018, when Comstock got a phone call from Dallas Cowboys owner Jerry Jones. “Before talking to us, he’d caught lightning in a bottle with an investment in the Bakken Shale,” Allison remarks. “Shortly after he re-entered the oil and gas industry by buying nonoperated interests there, service costs in that play went down as oil prices went up. Jerry wanted to put the high profits from the Bakken wells to work in the Haynesville.”

Jones went after Comstock specifically, Allison says. “He had watched our management team for two decades,” he comments. “In 1999, I met him and asked him to invest $30 million in convertible preferred stock. He passed on that opportunity, but when I saw him at a Christmas party 10 years later, he remembered it. He told my wife and I that if he had accepted my offer, he would have made $600 million.

“When he called us, he knew we had core acreage that had been derisked in a basin with strong economics and tremendous growth potential,” Allison says. “He also realized that we needed cash, which he had. We said, ‘If you put your Bakken assets into Comstock as a source of cash flow, we have a winner,’ and he agreed.”

Through that transaction, Jones secured more than 80% of the company’s stock. Allison points out that the investment marks the seasoned businessman’s first investment in a public company. “Jerry is a fantastic partner,” Allison says. “He has been in the oil and gas business for 50 years, so he has seen the peaks and valleys.

“He also is adamant that our board of directors remain independent,” Allison adds. “It’s common for a majority stockholder to put representatives on the board, but Jerry has no plans to do that. He wants to earn a reputation from the minority stockholders that he is a great partner, because ultimately, he will only make money if the stock’s price goes up.”

So far, Jones has invested $1.1 billion in Comstock. “Every investment he’s made in us has been above the prevailing stock price,” Allison mentions. “He believes in Comstock and puts his money where his mouth is.”

Jones has said publicly that if the opportunity is right, he has additional funds to invest in Comstock. “Given how cold the stock markets are toward upstream companies, it is hard to get capital from investors or banks for big moves,” Allison says. “Jerry has given us capital when it otherwise would be unavailable.”

A Transformative Acquisition

With a $475 million investment from Jones, last summer Comstock acquired Covey Park Energy, a much larger Haynesville producer backed by Denham Capital. “When the transaction closed on July 16, we became the basin leader overnight,” Allison says. “We went from 87,000 net acres in the Haynesville and Bossier to 309,000 net acres in the play. Our reserves jumped from 2.4 trillion cubic feet of gas to 5.4 Tcf, and our production grew from 422 million cubic feet of gas a day to 1.1 Bcf/d.”

Covey Park also owned 500 miles of gathering lines and had a strong marketing department that knew how to leverage its acreage’s proximity to interstate gas pipelines, Allison adds.

The acquisition gives Comstock ample room to grow, he assures. “The combined company started with 2,000 net drilling locations, and about 69% of those are long-lateral wells, which offer the highest net present values. We have a 77% working interest in those wells, operate 90% of them, and hold 94% by production.”

Both companies knew improved scale would be essential if they wanted to trim operating and transportation costs even further. Despite the compelling case for the acquisition, it took nine months and 50 meetings before it became a reality.

“We both had great companies, and neither management team wanted to combine them if doing so would create something mediocre or bland,” Allison explains. “We needed to make sure the combined company would maintain a robust inventory of drilling prospects, a lean cost structure, strong operations teams, and access to premium markets.”

The more the two management teams talked, the more they became convinced the combination would be beneficial, Allison says. Eventually, the question became how to maximize its benefits. “Between the two companies, we had drilled more than 200 wells with enhanced completions in the Haynesville since 2015,” he mentions. “We both had strong management teams, and we wanted to have the best of the best with the company.”

As an example, Allison says, Comstock blended Covey’s marketing team with its own, with Covey’s vice president of marketing assuming the same role at Comstock. “Already, she has negotiated new gathering contracts and marketing arrangements that allow us to market more gas off first-of-the-month index pricing, which will improve the correlation of our hedges,” he says.

Others who have stayed with Comstock include Covey’s vice president of mergers and acquisitions and its vice president of operations (who took that role at Comstock after its former vice president of operations became chief operating officer). “Almost half the combined company’s 209 employees came from Covey,” Allison says. “In addition to strong executives, it had skilled and creative technical people.”

Sharing Best Practices

Those technical people include a team of data scientists, who are developing algorithms for Comstock to implement tailored drawdowns on every well. “The idea is to manage the choke to maximize ultimate recovery,” Allison outlines.

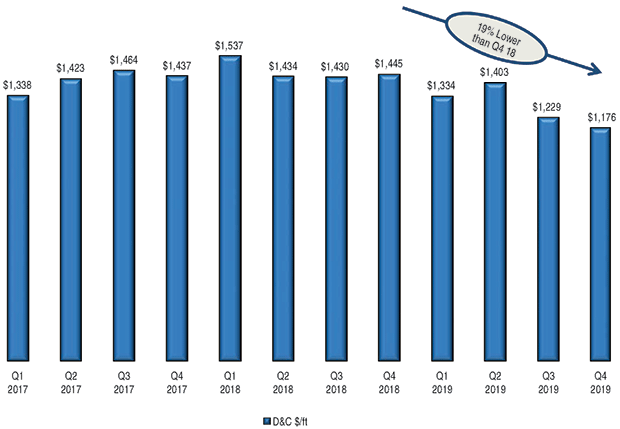

Comstock Resources is reducing its drilling and completion costs by pairing longer laterals with best practices learned from Covey Park Energy, which it acquired in July. Comstock predicts its costs will continue to drop as it finds new ways to simplify its completion fluids and shorten pump times.

Comstock has been applying the managed choke program for a year and a half. So far, Allison says the results have been impressive. “We think we will be able to produce as much or more from each well and get it quicker,” he reports.

“We also are adjusting our well completion designs,” Allison reveals. “By changing the amount of sand and water we use per stage, occasionally pumping cross-linked gels, and removing unnecessary clay and scale inhibitors, we have reduced completion fluid costs. At the same time, we are shortening pump times to below two hours a stage.”

Drilling times have been shortened by three or four days, Allison reports. The 8,000-9,000 psi bottomhole pressures that make Haynesville wells so prolific also mean they are expensive to drill compared with ones in less overpressured basins. However, Allison says well costs continue to improve. “This year, we have cut our drilling and completion costs from $1,445 a foot to $1,176 a foot, and I could see us getting below $1,100 soon,” he comments.

The acquisition has helped Comstock cut its overhead per unit of production in half, Allison adds. By going from a total of 310 employees to 209 and consolidating Covey’s corporate offices in Dallas into Comstock’s headquarters in Frisco, Tx., a Dallas suburb, Allison says the company expects to reduce G&A costs from $61 million across both companies to $30 million going forward.

Bolt-On Growth

On Nov. 1, Comstock extended its acreage yet again when it acquired a private Haynesville Shale operator through an all-stock transaction. The acquisition includes 3,000 net acres, 75 gross producing wells, and 44 future drilling locations, Allison describes. He says Comstock will continue to consider bolt-on acquisitions.

“We are trying to be the premier natural gas company in this new era of energy, and to do that, we need size,” he says. “However, we must also maintain our high margins and low costs.”

Allison adds that the company is trying to shrink its leverage ratio below two, a goal to which both the Covey Park acquisition and the smaller bolt-on acquisition contribute. In fact, he reports, every purchase the company has made since February 2017 has reduced its leverage.

“As part of our efforts to generate free cash flow, we are moving from nine rigs in 2019 to six in 2020,” he says. “The reduced activity will protect our balance sheet and ensure we can hit our goal of generating approximately $200 million in free cash flow this year. Most of that will go to reducing our leverage.”

Even with only six rigs operating, Allison predicts Comstock will increase its natural gas production 6%-8%. He credits the company’s strong operations and quality acreage.

At its 2020 activity levels, Comstock has a 30-year drilling inventory. “We have a long-term view,” Allison says. “We see natural gas not as a mere bridge fuel but as a key fuel. With its abundance and accessibility, U.S. gas in general and Haynesville gas in particular will supply growing demand in the United States and in countries such as Mexico, China, South Korea and Japan.”

Noting that Comstock’s predecessor once owned the world’s most valuable silver mine, which helped fund northern states during the Civil War, Allison says the company has a legacy to uphold.

“Eighteen months ago, I would not have believed Comstock would be producing 1.3 Bcf/d-1.4 Bcf/d,” he reflects. “We are grateful for the opportunities we have had. We got here by treating people well and doing things the right way, and that is how we plan to continue to grow.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.