Innovations In Rigs, Bits And Well Designs Drive Drilling Efficiency

By Danny Boyd

Advancements in the science of horizontal drilling have been nothing short of astonishing over the past two decades. Fifteen years ago, a rig may have been on location for a couple of months to drill a one-mile lateral in a shale formation. Today, laterals of three to four times that length are being drilled in a fraction of the spud-to-rig release times, with the amount of footage drilled per rig continuing to climb.

In short, the industry has become extremely good at making hole, safely drilling better completion-ready well bores faster than ever before.

By the quarter, operating companies continue to report record drilling efficiency achievements on wells with laterals extending to four miles. The result is real-world cost savings from fast penetration rates and reduced downtime, even in wells with high dogleg severities and U-shaped “horseshoe” trajectories that tap isolated portions of benches and maximize lease position geometries.

Innovations in rig automation, drill string design, drilling fluid chemistry, and the workhorse polycrystalline diamond compact drill bit continue to allow drillers to get wellbores to total depth in less time across all major U.S. basins, observes Cristi Harrington, vice president of North American sales for drilling contractor, Helmerich & Payne. She says H&P continues to achieve new drilling records on behalf of its customers.

Pre-Covid, the Tulsa, Ok.-based company drilled a well on average every 40 days for a major company in the Delaware Basin. Deploying the latest advancements, that average is down to 15 days, she says.

Each rig is drilling more wells. With about 150 working rigs monthly on U.S. land, H&P’s units have bored 3,500 wells over the past year, including 611 short laterals; 1,200 one-mile laterals; 1,275 two-mile laterals; 450 three-mile horizontals, and about 30 four-mile laterals. Included in the count are 20 horseshoe laterals.

Sustained success and drilling efficiency gains are attributable to repeatability from constant collaboration with operators and predictability that operators want in rig systems and equipment, Harrington says. It is not just about speed for speed’s sake, she insists.

“You can go really fast and knock it out of the park and have a 10-day well cycle, but if on the next well you spend 25 days drilling because of a train wreck, your average is skewed,” Harrington points out. “Operators need predictability from well to well because they need to be able to go to their shareholders and demonstrate they are delivering a certain number of wells as promised. The way to do that is through technologies and collaboration.”

Drilling technology took a leap forward 20 years ago with the introduction of rigs capable of being moved in half the time, drilling deeper, and being upgraded quickly with the latest innovations. The unveiling of H&P’s FlexRig™ coincided with the company introducing the first alternating current (AC) rig as operators initiated the concept of multiwell pad drilling, Harrington recalls.

Helmerich & Payne is leveraging automation solutions to speed up operational processes and monitor rig performance using key performance indicators. An automated rig floor system has been installed on 25 rigs and counting to maximize operational efficiencies while mitigating safety risk and hazard exposures on the rig.

Since then, the company has continued to regularly add automation to speed up processes, utilizing key performance indicators to monitor progress on how fast rigs move, when they move, the number of moves per year, and many other key metrics.

An automated rig floor system has been installed on 25 rigs and counting, she offers. Drillers can make up torque to over 120,000 foot-pounds screwing pipe together with the press of a button to activate a large hydraulic wrench. Retractable slip lifters are also automated, saving rig workers from the back-straining work of pulling up the slips by hand. Color-coded traction control mats identify high-risk areas and mitigate hazards on the floor.

The goal of automation is not to reduce head count on the rig, but to enable workers to focus on a variety of duties during setup and drilling, which speeds the entire process along, Harrington points out. H&P looks to crew up rigs with six employees per shift, up from an average of five currently.

“For us, it is about always staying one step ahead from a pre-planning perspective and getting things ready,” Harrington remarks. “We always want to be one step ahead so we can eliminate any issues as we start really going fast.”

Doing More Work

The pace of drilling from new technologies and systems and increased worker capability is allowing fewer rigs to do more work, estimates Andy Biem, vice president of technical services for Altitude Energy Partners. Comparing today’s data to 15 years ago, about a third of the active rigs are adding double the amount of producible liquids.

His calculation, shared at a recent meeting of the International Association of Directional Drilling in Houston, considers advancements in mud motor technology along with the rig count and differences in producible liquids yield per rig.

“That can only be directly correlated to improvements and advancements in technology and drilling techniques,” Biem says. “We are clearly drilling and producing more footage with less equipment.”

In addition to speeding up the drilling of ultra-long laterals, drilling innovations are helping standardize the use of U-shaped laterals to tap more reserves faster on incontiguous or smaller positions where extended-reach development in one direction is not possible. The approach is being deployed in the Permian Basin, Denver-Julesburg Basin, and the Eagle Ford. In the Permian, production from one U-shaped lateral can equal that of a standard two-mile lateral, he says.

“You drill the curve and then drill a one-mile lateral out, turn the well 180 degrees, and drill a one-mile lateral back toward the rig again,” Biem explains. “By doing that, you have a single well bore with two miles worth of production space, which makes the economics more attractive and allows operators to produce stranded acreage. Some of our operator partners are now targeting different production zones with each lateral leg.”

In most basins, rotary steerable systems are proving to be the best and fastest method for drilling U-shaped laterals, he notes. The RSS provides directional drilling without conventional mud motors and includes an instrument downhole that actively steers the bit and makes slight, constant adjustments to borehole trajectory. The result is a smoother well path with less tortuosity, Biem states.

However, when expense is an issue, some operators still choose conventional, bent-motor bottom-hole assemblies that steer by slide drilling, with the bit periodically being reoriented to direct the drilling curve. Rotary steerables can be faster with more consistent weight on bit because RSS eliminates friction forces, but in some cases, both technologies are utilized on the same project, with certain intervals drilled with a conventional bent-motor BHA and then RSS drilling the curve and lateral, Biem explains.

This year, Altitude has been a part of about a half dozen U-shaped lateral projects, he reports, and the number of similar developments is expected to keep growing. In Texas, U-shaped laterals are already becoming more prevalent, Biem comments, pointing to a tally from the U Driller website maintained by Turning Point Consultants, which cites data from the Texas Railroad Commission.

One of the latest drilling innovations is standardizing U-shaped laterals to tap more reserves on incontiguous or smaller positions where extended-reach development in one direction is not possible. The approach is being successfully deployed in the Permian Basin, Denver-Julesburg Basin, and the Eagle Ford. Image courtesy of Innova.

One U-shaped lateral was drilled in 2019 in Texas, compared to 68 last year and 40 so far in 2025, according to Turning Point, headed by petroleum engineer John Huycke.

According to U Driller, horseshoe laterals in the Delaware Basin provide a 25-40% increase in rates of return compared to development with single-mile laterals in stranded sections based on drilling, completions and facilities costs and production. The cost savings range from $3.5 million to $4 million compared to drilling two, one-mile laterals.

However, the U-shaped laterals typically do not produce as much as a straight two-mile well because most operators do not produce the U, Biem points out. Still, the innovation is being done faster and more efficiently and is an example of the industry thinking outside the box to solve a problem.

“That is what excites me about oil and gas,” he enthuses. “During my time in the industry, I have seen innovators that do not just take the status quo as being the reality. Those who want to think creatively want to make disruptive change and that is exciting to me.

“It is fun to be part of it.”

Constant Improvement

The push to improve and speed up drilling of any wellbore configuration of any length stems mostly from a culture of constant improvement among operators, says Duncan McAllister, PDC product manager for Varel Energy Solutions. That commitment to advancement is shared by service companies and suppliers that are continuing to invest in drilling research and development.

“With everyone committed to this, it is not really surprising when you take a step back and realize how rig fleet capability has probably doubled in 10 years alone in terms of the work a rig can do now in a calendar year,” he says.

Drill bit advancements are helping lead the way. Through trusted operator surveys, drilling engineers typically identify drill bits among the top three elements crucial to improving overall performance, McAllister says. And ongoing advancements in PDC bits are playing a major role in drilling efficiency gains, he points out.

Innovations in hydraulics and cutter force management, and the availability and extensive use of more complete data, are pushing the envelope of PDC design, he says.

Hydraulic advancements at Varel include patented curved nozzles that better direct drilling fluid to the cutting structure and simultaneously improve bit cooling and cleaning, according to McAllister.

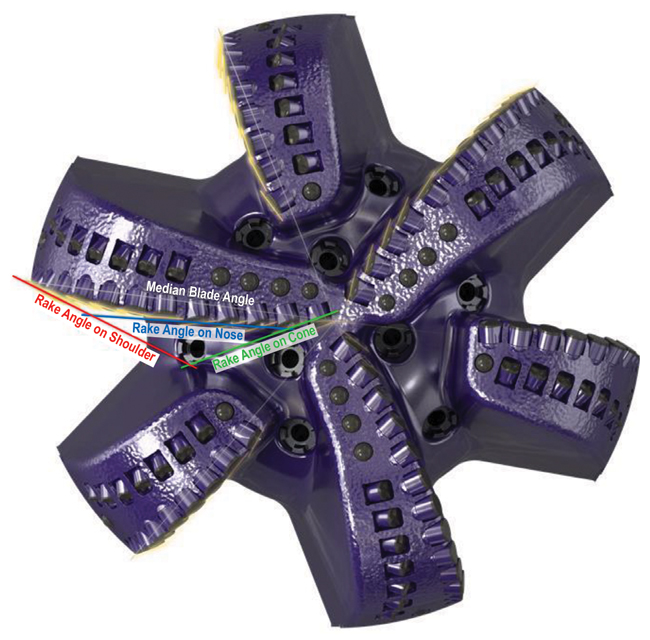

Ongoing advancements in PDC bits are playing a major role in drilling efficiency gains. Varel Energy Solutions’ PDC bits include innovations in hydraulics and cutter force management, including cutter designs to maximize cutting efficiency and durability while simultaneously ensuring strength, impact resistance and abrasion resistance for improved overall performance.

Hotter bits degrade faster, so cooling is essential to extending bit life and avoiding premature trips that slow the entire process. Inadequate cleaning also can lead to bit balling or inefficient evacuation of cuttings that reduces drilling rate. With the increased hydraulic capacity across a modernized rig fleet, it is important to focus on maximizing the hydraulic efficiency of PDC bits, he says.

In addition to hydraulic innovation, cutter force management is imperative to drive progress in the field, McAllister goes on. PDC design in its simplest form from the early days onward is best described as cutter force management and better management enabling faster drilling, he details. A recent development for Varel has been using a side rake to create a weight on bit (WOB) reducing effect. All these different elements become part of the company’s methodology for selecting the right bit for each application and then matching the right PDC cutter to the mitigate specific dulling mechanisms.

Selection must include the right diamond shape, diamond type, and cutter attributes such as strength, impact resistance, and abrasion resistance to heighten cutting efficiency/durability, as well as overall performance.

Radical improvement in abrasion resistance has increased cutter durability on PDC bits by about 100 times over the past decade, he adds.

Innovations in bit design are also boosting PDC performance, McAllister points out. Instead of the cutter being straight as it bores into the formation horizontally, Varel’s technology can include a “rake” design that allows the cutter to be tilted at the back or side at an angle. The change redirects radial or lateral force in the intended drilling direction rather than contributing to WOB. While increasing the back rake angle has historically been a common practice for increasing the aggressivity of PDC bits, there is a point of diminished returns. This method of cutter force management offers a new solution for improved drilling efficiency, he explains.

The boost occurs when the appropriate blend of back and side rakes are applied to the rock and essentially enable the bit to “screw itself into the formation,” as he describes.

Gaining rate of penetration with the same weight on bit or sustaining ROP with lower weight on bit allows for greater output. An example of this would be when wellbore tortuosity creates weight on bit limitations in extended reach laterals, McAllister notes. Moreover, using this WOB reducing design technique has shown to mitigate downhole vibration and reduce occurrences of cutter and BHA component damage.

In addition to bit design upgrades, more complete data collection to gauge downhole conditions during drilling continues to boost speed and efficiency by helping optimize drilling designs and more quickly identify solutions through accurate problem identification, McAllister adds.

More operators are providing Varel with access to electronic drilling recorders, which yields in-depth data on drilling efficiency, including on bottom ROP. In one case, McAllister says the data helped an operator avoid damaging bits by identifying a harder compressive strength rock layer shallower than expected.

Varel’s team was able to recommend a reduced parameters through the hard stringer to avoid bit damage. The role of PDC bits in the market has not changed, and providers remain eager to continue to push the performance limitations through an iterative approach that focuses on problem identification.

Data-Based Bit Design

Extensively analyzing data to identify the best drill bit for each well is making a major difference for operators in South Texas and elsewhere drilling 8.5-inch and 8.75-inch hole sections in record times, says Daniel Lopez, senior application engineer for Ulterra.

Ulterra is analyzing in-depth drilling data to identify the best drill bit design for each specific 8.5- and 8.75-inch application in the Eagle Ford Shale, where Ulterra bits have successfully drilled 10 of the longest Eagle Ford laterals over the past year.

Data deployment in the Eagle Ford has helped Ulterra provide bits that have made hole in 10 of the longest laterals over the past year, include a four-mile lateral, he points out.

Drilling challenges include drilling vertical depths up to 12,000 feet in Webb County on the western edge of the play, where total drilling depth can exceed 27,000 feet. Lopez says operators in the region want more vertical, curve, and lateral (VCL) wells drilled in one BHA without trips, an uncommon feat in most regions.”

“It is obviously a challenge to be able to balance the durability of a bit in drilling in these extended-reach laterals anywhere from 90 hours to 170 hours,” Lopez says. “Durability also must be combined with speed for operators looking to reduce rig time. The bits and BHAs need to get the build rates they want to land the curve and then be able to keep that motor and bit in the hole to TD the well.”

For its data analysis, Ulterra considers multiple parameters, such as differential pressure and average weight on bit, and well details including the length of every lateral drilled, BHA design, mud motor size and spec to help identify the right bit to use on subsequent wells, he explains.

When examining data for one Eagle Ford client, the team noticed that ROP differed on adjacent wells drilled with the same motors, BHAs and bits, but that were drilled in different geographical directions in the same bench.

“The northwest heading laterals were drilled about 31% faster than the southeast heading with the same operator drilling with the same rig,” Lopez recalls.

Ulterra also looked at stages of the motor to determine how much torque the motors generated drilling each direction. A 9.5-stage motor compared to an 8.4-stage motor—a couple of turns difference on the stator and rotor—resulted in a 20% increase in performance in the faster lateral. The finding helped the company more effectively tailor drilling solutions for each project, he reports.

In all applications, bits must be manageable and have good tool face control and good yields when building angle, especially in the first part of the curve. Bits that prove to be aggressive enough in the beginning should also be durable in low-energy and high-vibration environments farther down the lateral, Lopez states. The right responsive bit can then stay on course to avoid slides as much as possible which slows down drilling.

The best general solutions in the Eagle Ford have involved using steel bits, which are more malleable and ductile compared to more brittle matrix bits made of tungsten carbide material, he says. Hardfacing on the outer layer of cutting edges of steel bits also increases durability and wear resistance. Ductility helps the bit hold up in extended laterals, Lopez comments, and the latest bit designs allow for optimum control while drilling.

Speed and durability are often viewed as opposing considerations when formulating bit and drill string design, but achieving both is imperative in long laterals drilled in the Eagle Ford and elsewhere, he says.

He references Ulterra’s six-blade steel bit as a case in point. It is getting attention because of its demonstrated versatility. A five-blade bit can be used to drill faster because each cutter removes more material per revolution, he says.

“A lot of times, it depends on operator preference and on our recommendation for a particular area and a particular direction being drilled,” Lopez concludes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.