Energy Exports

Annual Exports Exceed Imports For First Time Since 1952

WASHINGTON–U.S. energy exports reached an all-time high in 2019 while U.S. imports were the lowest since 1995, marking the first time in 67 years that annual energy exports exceeded gross energy imports, according to the U.S. Energy Information Administration.

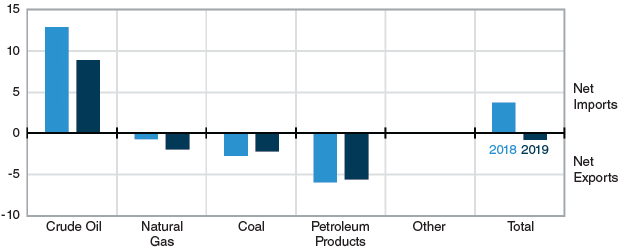

Net imports have decreased every year since 2016, and EIA says last year’s change in U.S. energy trade was driven largely by decreases in net crude oil imports and increases in net natural gas exports. Net trade of the other energy sources remained similar to 2018 levels.

In 2019, the United States continued to be a net importer (importing more than it exports) of crude oil and to a much smaller degree electricity, and a net exporter of natural gas, petroleum products, coal and biomass. The agency points out that net change in U.S. energy trade–from 3.6 quadrillion Btu (quads) of net imports in 2018 to 0.8 quads of net exports in 2019–was the largest since 1980.

U.S. crude oil net imports decreased 31% or 4.1 quads (equivalent to 1.9 million barrels a day), from 2018 to 2019. Whole gross imports of crude oil decreased, EIA reports that gross exports of crude oil increased. Canada was both the largest source of U.S. crude oil imports and the largest destination for U.S. exports.

Gross exports of petroleum products are the largest category of U.S. energy exports, but in 2019, gross exports of petroleum products decreased from a record high in 2018. The United States has been a net exporter of petroleum products in each year since 2011. Canada was the largest source of petroleum product imports in 2019, and Mexico was the largest destination.

Meanwhile, gross exports of U.S. natural gas reached a record of 4.7 quads (12.8 billion cubic feet a day), up 29% from the previous year and continuing a five-year trend of annual increases, EIA says. Gross U.S. natural gas imports also fell 5% from the previous year. The United States has been a net exporter of natural gas since 2017. Canada was also the largest source of natural gas imports, and Mexico was the largest destination for exports.

Growing U.S. exports and shrinking imports were enabled by record oil and gas production. According to EIA, 2019 marked the first time since 1957 when domestic energy production exceeded energy consumption on an annual basis. The United States produced 101.0 quads and consumed 100.2 quads last year. After both U.S. energy production and consumption hit record highs in 2018, production grew an additional 5.7% in 2019 while consumption declined 0.9%.

Crude oil and natural gas plant liquids production totaled 31.8 quads last year, and natural gas production totaled 34.9 quads, both all-time highs. U.S. renewable energy production remained constant between 2018 and 2019, growing by only 0.1 quad. Meantime, coal production decreased for the third year in a row, falling by 1.1 quads to its lowest point since 1974.

U.S. natural gas consumption has increased 35% since 2000 and reached a new peak in 2019. Renewable energy consumption has grown by 88% during the same period, and its share of consumption was roughly the same as coal in 2019. Since 2008, U.S. coal consumption has decreased nearly 50%, primarily because coal has been displaced by natural gas and renewables in the electricity sector.

Gas-Fired Power Growth

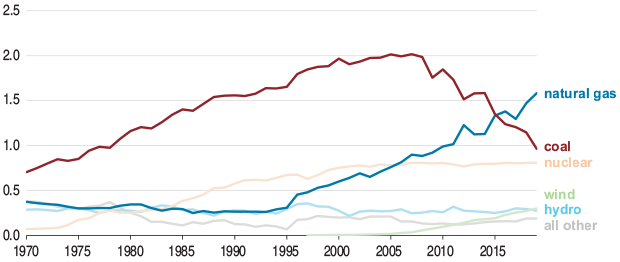

U.S. natural gas-fired electricity generation reached a record 1.6 million gigawatthours in 2019, up 8% compared with 2018, according to a report from EIA.

At the same time, output from the coal-fired generating fleet dropped to 966,000 GWh, the lowest level since 1976. The decline in coal generation levels was the largest percentage decline in history (16%). Although lower electricity demand in 2019 was partly responsible for less coal-fired generation, the agency says the primary driver was increased output from natural gas-fired plants, and to a lesser degree, wind turbines, which generated 300,000 GWh.

Natural gas now accounts for the largest share of generating capacity in the Northeast, South and West regions of the country. Although down nearly 50% from 2010, coal remains the top generating fuel in the Midwest, followed by nuclear and natural gas. Of the total 23,000 megawatts of new generating capacity installed last year, 39% was onshore wind, 36% was natural gas and 23% was solar, EIA data show.

The utilization rate of U.S. coal-fired generation capacity declined from 67% in 2010 to 48% last year, supplanted largely by combined-cycle natural gas turbine (CCGT) plants. Contrasted to the coal fleet, the utilization rate for CCGT plants has been trending upward, and averaged 57% of capacity in 2019, the report states.

“The increased availability of low-priced natural gas has been the biggest factor in decreasing coal-fired generation,” EIA says in the report. “Highly efficient CCGT plants burning relatively low-cost natural gas have reduced the amount of time a coal plant is called on to dispatch power into the grid. This factor has lowered average coal plant utilization rates and pushed some coal plants into early retirement.”

Although coal at U.S. power plants costs less than natural gas, for coal to be competitive, its delivered cost must be at least 30% lower to make up for the differences in efficiency between a typical coal-fired plant and a typical natural gas-fired plant, the report notes. These differences are even larger for more efficient natural gas-fired combined-cycle plants. Coal plants must also offset higher costs for emission control equipment and other operations, it concludes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.