Cost Management is Critical in Plays of All Sizes

Javier Sloninsky

RYE BROOK, N.Y.–The discipline of project cost management generally is assumed to be associated with large offshore and deepwater projects. This is logical, given the hallmarks of these plays are large lease positions with high well counts, long productive lives, and dynamic production profiles. With high levels of activity in terms of equipment and manpower, offshore plays also rely on technology and have large capital requirements.

Yet the ability to manage project costs is just as important for onshore plays, where margins tend to be tighter, per-well production volumes lower, and construction projects smaller and more geographically dispersed. With independents dominating the onshore sector, tracking expenses and optimizing delivery has never been more critical as unconventional projects continue to diversify in scale, scope and complexity.

The cost of building and operating upstream oil and gas facilities has continued to rise, driven by strong oil prices and increasing demand for oil field goods and services. Rigs are in high demand and command premium rates because of rising fuel and labor costs, while spending increases in worldwide oil and gas construction reflect significant growth in activity, tighter markets, and continued project cost inflation.

North America leads all regions in terms of upstream spending. Analysts at IHS Global have forecast total capital and operating expenditures of $392 billion this year. IHS Global also warns that the U.S. boom in unconventional plays is placing further pressure on goods and services. Unconventional production is expected to account for $128 billion of total North American upstream spending in 2012.

Increasing cost and margin pressure across the industry means low-cost operators are at a huge competitive advantage over a project’s full life cycle. The overriding challenge for oil and gas firms, therefore, is much the same regardless of company size or type of play: to measure, forecast and improve on project cost performance.

Managing Assets

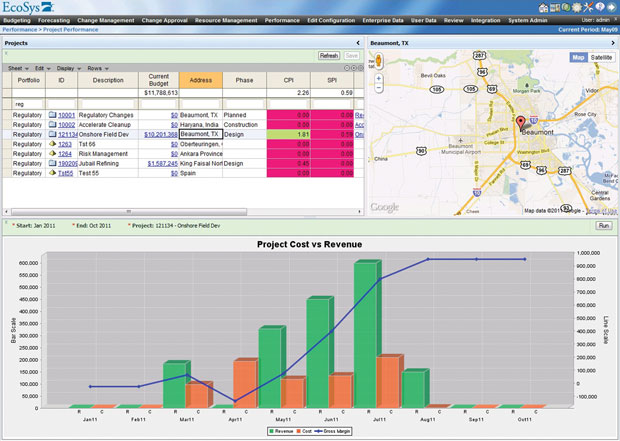

This project performance portal in EcoSys EPC allows users to filter select projects–in this case regulatory projects. The portal locates the project on a map and also compares project costs and revenues. Multiple sources of data are integrated to provide visibility into gross margins and other performance metrics, such as a cost performance metric that measures earned value over actual cost.

Project cost management software systems serve as a bridge between a company’s financial and project scheduling systems. They provide the visibility into metrics and performance necessary to manage projects and capital assets proactively, and help companies merge their capital investment strategies and project execution requirements to realize true return on investment.

By allowing a company to better control all cost and financial aspects of a project throughout its life cycle–from initial estimates and budgeting, through to forecasting, measuring progress, change control and finally reconciling actual expenditures–project cost management solutions provide better visibility into how a project is performing. Better visibility allows project management teams to make proactive decisions to improve performance during delivery, and also make it much easier to evaluate performance across multiple projects, assign resources and assess a rolled-up portfolio view of performance.

Cross-project visibility helps ensure that the strategic objectives of the company are being achieved, helps manage resources better (balancing supply and demand, and allocating resources), and enables more efficient procurement (through economies of scale).

Some of the greatest benefits arise from the ability to standardize information and processes while retaining needed flexibility. For example, work breakdown structures can be built from standard templates and tailored to address specific project differences, while at the same time being aligned to organizational hierarchies and accounting cost codes for improved reporting and budget approval.

Cost control systems must be robust enough to handle the complexity of large projects, including funding sources, multiple currencies, contracts and voluminous data. By contrast, small projects may not require this level of overhead, but quicker and easier planning for resources, and reporting under a standardized process, can be just as beneficial in terms of optimizing delivery.

Offshore Transparency

Historically, technology investments in offshore oil and gas plays have centered on furthering subsea capabilities or drilling advancements, as opposed to implementing business-driven technology such as cost controls and project management software.

In large part because of the high volumes and profit margins achieved by oil and gas companies in the past, most companies have been slower to adopt cost control technology because they did not feel the pressure, nor did they need to pay closer attention to cost or project overages. As a result, many oil and gas producers and operators continue to rely on manual methodologies to manage their schedule and cost data.

But as the scale and complexity of offshore development have continued to grow, management teams have found themselves unable to obtain reports fast enough to ensure timely and accurate insight into project performance. And the larger the project, the more stakeholders are involved, including owners, contractors, partner companies, and even competitors delivering different parts of the project. With different stakeholders inputting data within their own silos, there is little transparency in any direction.

For example, when an owner hires a contractor for a large project, the owner often doesn’t have true transparency on how the project is progressing. While the contractor may come close to delivering new production capacity, if it isn’t producing oil by the deadline, then both oil and revenues fail to flow.

However, if the owner has the ability to track the project as it progresses, he is able to uncover issues before they become problems. Likewise, contractors can see problems as they begin to emerge and correct them before delays and overruns cut into margins.

There is compelling evidence that data silos and a lack of transparency–from the accounting and project control departments all the way to corporate executives and other stakeholders–are a recurring source of frustration. Research by Schlumberger Business Consulting found that 28 percent of large oil and gas projects in 2011 ran more than 50 percent over budget, compared with only 10 percent in 2000. These significant overruns in cost and schedules resulted in missed targets for peak production and reserves, as well as operability issues.

SBC concluded that a clear line of sight on large projects was paramount, if management teams were to maintain and understand key risks and make informed decisions. It also identified the need for a more integrated approach across an entire project life cycle in order to mitigate some of the common technical challenges and enable better governance decisions to maximize value and minimize risk.

Onshore Performance

Onshore plays are economically viable from a few dozen barrels of oil or 10,000 cubic feet of natural gas a day upward, but are by no means less profitable than large-scale deepwater projects. As onshore exploration has matured, major oil and gas companies have relinquished assets to smaller and more focused independent operators, who now dominate the sector.

In smaller scale onshore oil and gas projects, wells typically cost $6 million-$10 million to drill and complete. Often there are multiple projects running concurrently in multiple locations. Gas gathering networks, in particular, can become very large, with production from thousands of wells situated several hundred miles apart.

Programwide visibility of project performance and the ability to manage costs effectively, therefore, is essential to manage cash flow and maximize revenue and profitability–especially given that onshore daily outputs per well are smaller and margins are tighter than in offshore plays.

The maturity of most onshore plays means there also is a need to work over existing assets, revitalize aging fields, and preserve end-of-life wells. However, uncertainties associated with these “brownfield redevelopments” often are underestimated. Management and engineering teams must supplement old subsurface data with new surveys and seismic data, new designs must be integrated with existing equipment, and expensive facility upgrades must be aligned with day-to-day activities such as shutdowns.

Successful brownfield approaches, therefore, rely on seamless planning and project execution. A project cost management solution can help operators optimize performance by establishing work packages based on previous experience with deliveries, and then applying that from project to project. This not only enables companies to reduce cost through “repeatability,” but also allows operators to extend their “span of control” through standardized best practices.

Unconventional Diversity

Although independent producers are leading the energy transformation in the United States, shale gas and tight oil plays also are attracting massive capital investments from well-known brands and international companies, which are partnering with independents to re-enter the U.S. onshore market.

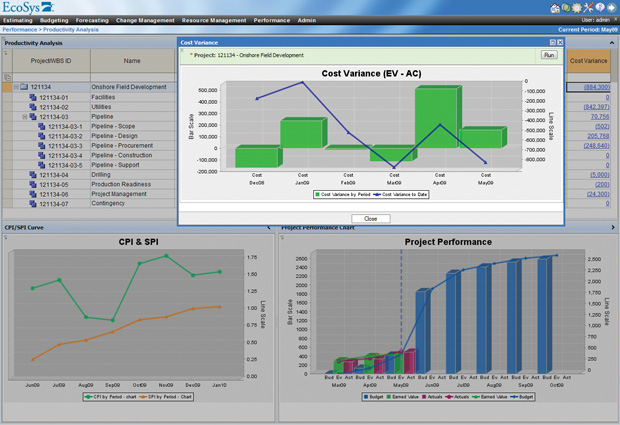

The highlighted frame in this EcoSys EPC productivity dashboard shows cost overruns by period and cumulatively for an onshore field development project. The layers below provide project performance metrics: in this case, variances between budget and actuals; and earned value management, which is a methodology to measure, forecast and improve performance.

IHS Global predicts the industry will invest $1.9 trillion in shale gas projects between 2010 and 2035, with especially strong capital expenditures in the near future growing from $33 billion a year in 2010 to $48 billion in 2015. What is more, IHS believes the unconventional revolution in oil essentially could double the economic benefits experienced in unconventional natural gas.

However, the firm also warns that one of the lessons learned in shale gas is that developing lease positions requires a scale of operations that many smaller and midsized operators simply cannot handle easily, particularly the amounts of capital needed.

Nevertheless, there is plenty of scope for operators and producers to optimize project performance in unconventional plays, because they typically are managing large numbers of smaller but repeatable projects. For example, tight oil plays use the same basic technologies as shale gas, and in some cases, even the same reservoirs. Here, as with conventional onshore plays, a project cost management solution can provide repeatability across multiple small-scale projects, although system flexibility also is a key requirement.

Every unconventional production project is different with respect to what is required in order to unlock its economic potential. Project scale and scope can vary dramatically, while there often is a need to mobilize quickly.

Older project cost management systems were designed to work within a single project, but next-generation platforms incorporate modular designs that make it easier to customize them, and to manage multiple programs and projects simultaneously. Then, management can easily track the performance of entire regions or divisions without the manual compilation that traditionally was required for this broader view.

Advanced project cost management solutions also can support annual re-evaluations, which are particularly important for shale gas and tight oil formations that have undergone rapid development, and where resource potential, related costs and production remain uncertain. They also help firms identify and track trends that emerge from historical analysis, which then can be used to more accurately forecast outcomes.

And, if the trend is anything other than desirable, the data will serve as a predictive red flag, helping to proactively plot a new course.

Cost Management Systems

Many oil and gas firms report being overwhelmed by the sheer volume of data being generated today, and say they lack the right technology tool sets to track costs effectively. Although project cost management challenges are broadly the same for onshore, offshore, and unconventional plays, the major difference is the scale and scope of the operations and how many moving parts there are.

The solution to these challenges lies in data collection and ensuring integrity. The goal should be a single source of data that can be accessed in real time for reporting project specifics through role-based dashboards, on-demand cost reports, and Web-based access. Effective cost controls not only improve profitability, but are the key to building accurate budgets, maintaining data integrity, measuring project expenditures, and delivering timely and accurate reporting.

Ultimately, project cost management software systems should provide the ability to measure, forecast and improve performance across an entire project portfolio. These three elements are critical and should serve as a philosophical basis for all oil and gas producers and operators:

- Measure project costs, progress, productivity and contract status;

- Accurately forecast schedules, cost at completion, and cash flows; and

- Use forecasts to improve scenario modeling and take corrective actions as needed.

Javier Sloninsky is the managing director of EcoSys, which provides best-in-class enterprise project cost and portfolio management software. Sloninsky has 16 years of leadership and hands-on experience in the commercial software industry, and has advised organizations such as American Electric Power, SunTrust Banks, Technip, and the U.S. Department of Defense on cost management and project-control best practices. Before co-founding EcoSys in 2000, Sloninsky served as a product manager at Eagle Ray Software Systems (acquired by Primavera Systems, now part of Oracle).

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.