Delaware Basin Production Surging to Record High

HOUSTON–Total hydrocarbon production in the Delaware Basin-the Permian’s top-producing play-will hit a record 5.7 million barrels of oil equivalent a day on average in 2022, according to Rystad Energy research. Spurred by high oil prices and appealing horizontal well economics, total production is set to leap by nearly 1 MMboe/d, roughly half of which will be new oil production.

Investments in the basin are also expected to jump, surging more than 40% from 2021 levels to reach $25.7 billion this year. Private independents led the Permian revival in 2021. Private operators’ share of the total investment is set to balloon again in 2022, rising 50% from $5.8 billion in 2021 to nearly $9 billion this year.

While private companies are not missing a beat, they now are being joined by majors and some large independents. After cutting their 2021 Delaware investments by 33% versus 2020, majors ExxonMobil, Chevron, BP and ConocoPhillips are expected to raise investments in the basin by 60%, bringing their total to $7.4 billion. Rystad notes that cost inflation on the services side, which is expected to range between 10% and 15% this year, is also a contributor to the higher spending levels among operators of all sizes.

The operator-specific findings are based on Rystad Energy’s research of a peer group of 61 Delaware Basin operators. The forecasts are based on a scenario in which West Texas Intermediate oil futures average $106 a barrel in 2022 before dropping to $70/bbl next year and $50/bbl in 2025.

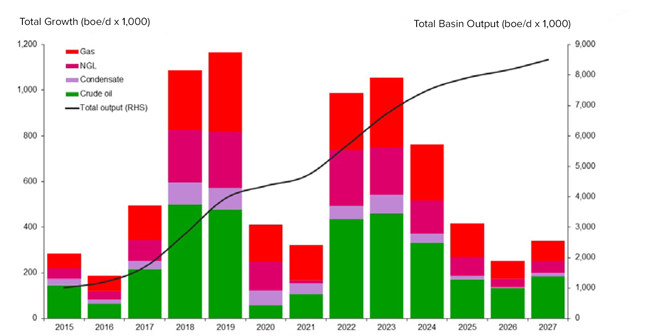

Figure 1 shows actual and projected production growth trends in the Delaware Basin to 2027.

FIGURE 1

Delaware Basin Annaul Production Growth by Hydrocarbon and Total Output

Source: Rystad Energy UCube, Rystad Energy research and analysis

“The Permian Delaware has emerged as the top oil-producing play in the U.S. shale patch, outpacing growth in other oil-rich regions. With oil prices expected to remain elevated, 2022 promises to be another outstanding year for production growth in the region,” says Rystad Energy Vice President Veronika Meyer.

Private operators have reacted quickly to the elevated market, increasing activity and output, Rystad points out. Private companies more than doubled their collective rig count in the basin, from 30 to 73, in a little over a year between January 2021 and April 2022.

According to Rystad, most of the drilling and capital expansion was already guided by the companies at the end of 2021, before Russia’s invasion of Ukraine. Public operators have been reluctant to chase higher production growth and remain focused on capital discipline in the face of cost inflation and labor and equipment shortages.

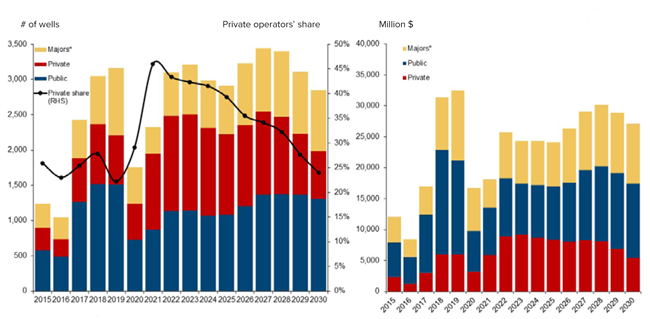

Private operators are contributing significantly to drilling activity in the play. The total number of spudded wells increased 33% last year, with private operators making up 46% of the total (Figure 2). Rystad estimates that the well count will grow by another 32% in 2022, and based on current activity levels, private players are likely to contribute 43% this year.

Majors, driven primarily by ExxonMobil, are also actively increasing their drilling efforts. This peer group is expected to increase drilling by 60% and contribute about 20% of total activity in the play this year, up from 17% last year.

FIGURE 2

Delaware Spudded Wells (Left) and Investment (Right) by Company Type

Source: Rystad Energy UCube, Rystad Energy research and analysis

*The majors considered are ExxonMobil, Chevron, BP and ConocoPhillips (ex-Shell acreage)

Changed Dynamics

The Permian Delaware play extends across Lea and Eddy counties in southeastern New Mexico and across the line into West Texas. Acreage in the western part of the Delaware, including Culberson and western Reeves counties in Texas, tends to have higher gas content. Estimated ultimate recovery rates can be relatively high in this region. While acreage in both Texas and New Mexico is being actively developed, New Mexico has gained momentum over the past couple of years, with rapidly increasing activity.

Activity in the basin before 2014 was primarily dominated by vertical drilling, but the share of horizontal drilling has picked up rapidly, fueling the growth. Production additions in 2019 reached nearly 1.2 MMboe/d year over year. Even when the pandemic battered the shale industry, the Delaware delivered between 300,000 and 400,000 boe/d in growth in 2020 and 2021, Rystad says.

However, the play’s production dynamics have changed. The majors and public independents focused on meeting aggressive production growth targets and investing cashflow largely dominated the growth trend before 2020. This year, according to Rystad, public players are maintaining capital discipline, and prioritizing returns to shareholders while keeping reinvestment rates at between 30% and 40%.

High oil prices have incentivized several large producers, including EOG Resources and Occidental Petroleum, to increase activity from last year’s fourth quarter and still deliver on their reinvestment objectives. Even so, Rystad says it is the private operators that have stepped up the game since the beginning of last year, responding quickly to higher oil prices. Mewbourne Oil Company, which is focused on developing acreage in New Mexico, is now running 16 rigs in the Delaware-second only to EOG-while Tap Rock Resources made it into the top five drillers with a stable rig count of seven in the play.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.