EIA Projects Growth In Both U.S. Oil And Gas Production

WASHINGTON–According to the latest analysis from the U.S. Energy Information Administration, oil prices in the triple digits will persist for some time.

The February Short-Term Energy Outlook (STEO) forecasts Brent prices averaging $116 a barrel in the second quarter and $102/bbl through the second half of 2022. EIA notes that Russia’s invasion of Ukraine has roiled global markets already dealing with a tight oil supply/demand balance and inventories at multiyear lows.

“The invasion of Ukraine and subsequent sanctions on Russia and other actions (have) created significant market uncertainties about the potential for oil supply disruptions,” EIA observes. “These events are occurring against a backdrop of low oil inventories and persistent upward oil price pressures.”

Global oil inventories have fallen steadily since mid-2020, with inventory draws averaging 1.8 million barrels a day from the third quarter of 2020 through the end of 2021. “We estimate that oil inventories fell further in the first two months of 2022 and that commercial OECD inventories ended February at the lowest level since mid-2014,” EIA states.

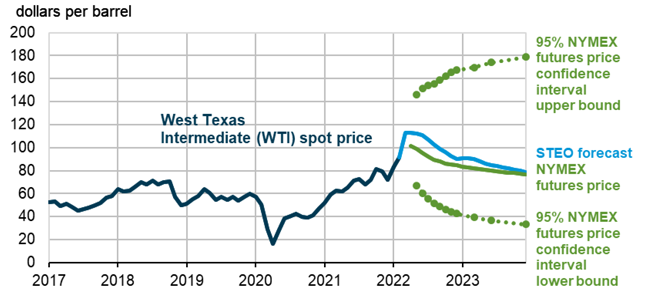

However, EIA’s forecast calls for inventory draws to ease and gradually turn into builds. “Although we reduced Russia’s oil production in our forecast, we still expect that global oil inventories will build at an average rate of 0.5 MMbbl/d from the second quarter of 2022 through the end of 2023, which we expect will put downward pressure on crude oil prices,” the STEO states. “However, if production disruptions in Russia or elsewhere are more than we forecast, resulting crude oil prices would be higher than our forecast.”

In addition, the degree to which oil producers respond to current oil prices, as well as the effects macroeconomic developments might have on global oil demand, will be important for oil price formation in the coming months, the agency notes.

Market Impacts

For now, EIA says the low inventories, soaring prices and uncertainties about the supply and demand impacts of war in eastern Europe (and resulting economic sanctions imposed on Russia) are being manifested in a variety ways in oil markets.

WTI Price and NYMEX Confidence Intervals ($/bbl)

Note: Confidence interval derived from options market information for the five trading days ending Mar 3, 2022. Intervals not calculated for months with sparse trading in near-the-money options contracts.

One such result is extreme backwardation, with near-term prices dramatically higher than longer-dated futures prices. The spread between crude oil front-month contracts and third-month contracts (the “1-3 spread”) reflects heightened calls on crude oil inventories in the very short term, driving the Brent 1-3 spread to its highest level on record at $7.06 in early March. The WTI 1-3 spread was not far behind at $6.15/bbl.

The spread between Brent and WTI prices has also widened, averaging $6.40/bbl in early March to reflect the more significant supply risk Russia’s invasion of Ukraine presents to European oil markets as opposed to the U.S. market. The Brent-WTI spread has reached as high as $8.14 compared to an average $3.38/bbl in January.

Looking at demand, the STEO projects that global consumption of petroleum and liquid fuels will average 100.6 MMbbl/d in 2022–up 3.1 MMbbl/d from 2021–and continue to increase by another 1.9 MMbbl/d in 2023 to average 102.6 MMbbl/d. But again, the agency cautions that war in Europe imposes a high degree of uncertainty about forecast economic growth and oil consumption.

EIA sees U.S. oil production responding to higher prices, although domestic crude production fell by 200,000 bbl/d month over month in December (the most recent monthly data available) to below 11.6 MMbbl/d. “We forecast that production will rise to average 12.0 MMbbl/d in 2022 and then to record-high production on an annualized average basis of 13.0 MMbbl/d in 2023,” EIA says, pointing out that the previous annual record was 12.3 MMbbl/d in 2019.

Natural Gas

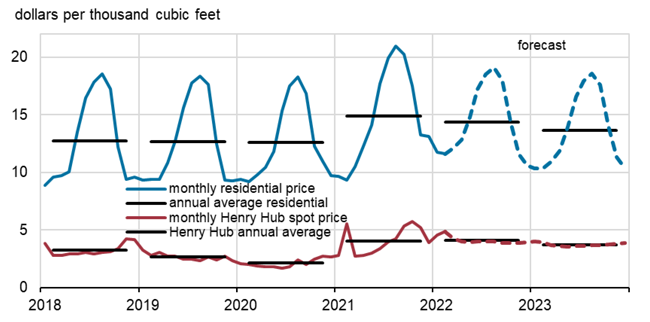

In February, Henry Hub natural gas spot prices averaged $4.69 per MMBtu, which was up from an average of $4.38/MMBtu in January. Natural gas production fell slightly relative to January, in part as a result of temporary freeze-offs in producing regions. The production drop contributed to inventory draws outpacing the five-year average in February.

“We expect production will rise from February levels, contributing to a lower average Henry Hub price of $4.10/MMBtu for March. We expect the Henry Hub spot price will average $3.83/MMBtu in the second quarter, $3.95/MMBtu for all of 2022, and $3.59/MMBtu in 2023.”

As of the third week of March, Henry Hub spot prices were in the $4.80 range and prompt-month NYMEX prices were above $5/MMBtu.

Looking through the end of the winter heating season, the STEO projects that natural gas storage inventories will end March at 1.5 trillion cubic feet-which would be 10% less than the five-year average at the end of the withdrawal season-and be replenished to 3.5 Tcf by Nov. 1 and the start of the winter 2022-23 heating season. That would put inventories 4% below the five-year average.

U.S. liquefied natural gas exports averaged 10.9 billion cubic feet a day in February, down from 11.2 Bcf/d in January. Similar to last year, U.S. LNG exports in February were limited by fog in the Gulf of Mexico that affected vessel traffic and led to piloting services being suspended for several days on the Sabine Pass, Lake Charles and Corpus Christi waterways. Although exports fell in February, they nevertheless averaged among the highest monthly volumes on record.

“We expect high levels of U.S. LNG exports to continue in 2022, averaging 11.3 Bcf/d for the year, a 16% increase from 2021,” STEO states.

U.S. consumption is forecast to average 84.6 Bcf/d this year, up 2% year over year, while domestic dry natural gas production is expected to average 96.7 Bcf/d this year, up 3.1 Bcf/d over 2021. Similar annual growth is anticipated in 2023, when EIA says dry gas production will rise to an average of 99.1 Bcf/d.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.