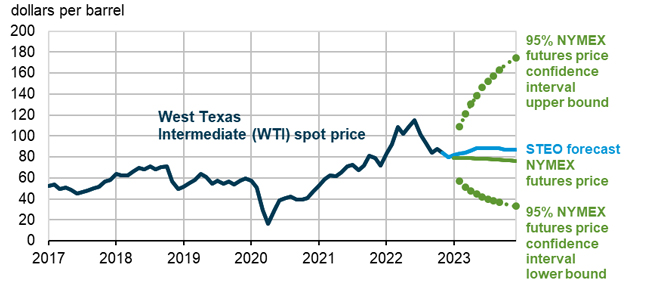

EIA Sees WTI Remaining Above $80 in 2023

The spot price for West Texas Intermediate will average $95 a barrel in 2022 and $86/bbl in 2023, the U.S. Energy Information Administration projects in its latest Short-Term Energy Outlook, which was published Dec. 6. The agency sees the average price remaining at or above $80 every month of 2023 (Figure 1).

EIA estimates that the spot price for Brent crude, like WTI, will be higher this year than next, averaging $101/bbl in 2022 and $92 in 2023.

November’s average Brent spot price was at $91, EIA calculates. “Although the average November Brent price was slightly lower than in October, daily spot prices reached almost $100/bbl on November 7, before ending the month at $86/bbl,” the agency observes. “The price declines were largely the result of market concerns about global economic growth, as well as COVID-related lockdowns in China that have reduced China’s oil demand.

FIGURE 1

West Texas Intermediate Crude Oil Price

Data Source: EIA, CME Group, Bloomberg and Refinitive, an LSEG business

Note: Confidence interval derived from options market information for the five trading days ending December 1, 2022. Intervals not calculated for months with sparse trading in near-the-money options contracts.

“Despite the recent drop in crude oil prices, we still expect that falling global inventories of oil in early 2023 will push Brent prices back above $90/bbl by the beginning of the second quarter of 2023,” EIA predicts. “Although we expect some downward oil price pressure could emerge in the second half of 2023 based on our forecast of rising oil inventories, that pressure will likely be balanced by the ongoing possibility of supply disruptions or production growth that is slower than our forecast.”

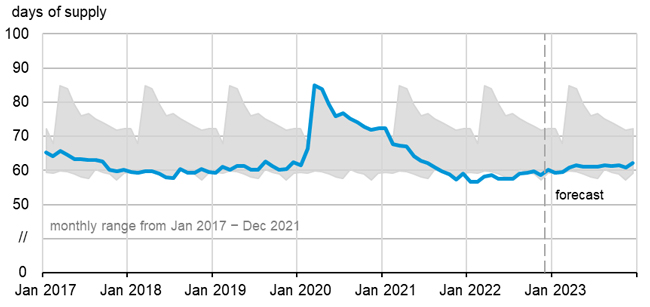

Inventories will remain tight, EIA assesses. “Although we estimate that petroleum inventories have increased thus far in the second half of 2022, commercial petroleum inventories in OECD countries spent most of 2022 at their lowest levels in five years on a days-of-supply basis, and we expect that they will remain near the bottom of their recent five-year (2017–2021) range throughout 2023,” EIA reports. Figure 2 shows the agency’s inventory estimates.

Replenishing inventories will take long enough that the market will have limited slack in 2023, EIA says. The agency indicates that “any unplanned supply disruption has the potential to increase oil prices quickly and significantly.”

One area of uncertainty is how much sanctions on Russia will affect global prices, EIA comments. The European Union implemented a ban on seaborne imports of crude oil from Russia on Dec. 5 and is set to ban petroleum product imports beginning on Feb. 5, the agency notes.

“We expect that most of Russia’s crude oil exports that will no longer go to Europe will find a destination elsewhere,” EIA acknowledges. “However, we expect Russia’s oil production will continue to decline in 2023, largely because a number of countries will decrease their imports of crude oil and petroleum products from Russia.”

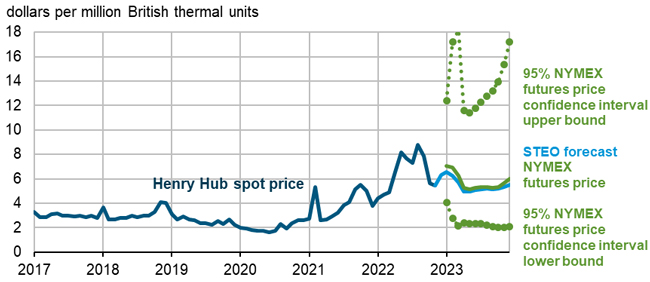

Natural Gas

Natural gas spot prices at Henry Hub likely will exceed $6.00 an MMBtu in the first quarter of 2023, up from November’s monthly average of $5.50, EIA projects (Figure 3). The agency attributes the increase to higher winter natural gas demand and rising LNG exports.

FIGURE 3

Henry Hub Natural Gas Price

Data Source: EIA, CME Group and Refinitive, an LSEG business

Note: Confidence interval derived from options market information for the five trading days ending December 1, 2022. Intervals not calculated for months with sparse trading in near-the-money options contracts.

Regarding winter weather, EIA calculates that in October and November, U.S. population-weighted heating degree days were up 13% from last year and 4% higher than the 10-year average. “Based on forecasts from the National Oceanic and Atmospheric Administration, we expect the entire winter (October–March) to be colder than last winter, with 7% more HDDs in the United States compared with last winter and 2% more than the 10-year average,” EIA adds.

Despite the cold temperatures, the agency predicts natural gas prices “will begin declining after January as U.S. storage levels move closer to the previous five-year average, largely as a result of rising U.S. natural gas production. However, the possibility of price volatility remains high.”

EIA forecasts production to average between 100 Bcf/d and 101 Bcf/d in 2023, about 2% more than in 2022. “Production in our forecast for 1H23 is limited by pipeline constraints and declining natural gas prices. In 2H23, more pipeline infrastructure expansion projects are set to come on line and contribute to increases in dry natural gas production,” EIA envisions. However, “the pace at which these projects are completed is a notable uncertainty in our forecast, and delays could result in lower production than we expect.”

The agency’s production forecast increased between November’s Short-Term Energy Outlook and December’s. “Although we continue to expect natural gas production in the Permian Basin to be limited early in 2023 by the lack of pipeline capacity to bring associated natural gas production to market, we expect that these constraints will be resolved earlier than we had previously assumed,” the December outlook explains. “This change also contributes to slightly more crude oil production in 2023 than we had previously forecast.”

Exports

Natural gas exports should increase in 2023, driven largely by growth in LNG exports, EIA assesses. The agency points out that U.S. LNG exports peaked in the first half of 2022 as facilities operated close to capacity and a new export terminal, Calcasieu Pass, came on line. Exports then fell as a fire at Freeport LNG in June shutdown the facility, removing about 2.0 billion cubic feet a day of capacity.

“The Freeport facility recently announced plans to come back on line in December and to increase output to about 2.0 Bcf/d of gas in January 2023,” EIA relates. “When Freeport LNG resumes, we forecast U.S. LNG exports will establish a new record close to 12.5 Bcf/d in March 2023. We expect LNG exports will then reach 12.7 Bcf/d by the end of 2023.”

No new export terminals are scheduled to come on line in 2023, EIA notes. The agency says average exports for the year should be around 12.3 Bcf/d as facilities work to meet demand from Europe and Asia.

Like LNG exports, natural gas pipeline exports should set records in 2023. “Pipeline exports reached almost 9.0 Bcf/d in November, near (their) previous record. We forecast natural gas pipeline exports will reach record highs between 9.0 Bcf/d and 10.0 Bcf/d through the upcoming winter months,” EIA details.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.