Growing Demand Necessitates Investments In LNG Export Terminals

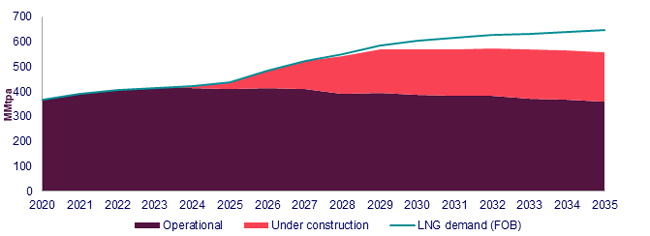

LONDON—The global liquefied natural gas sector will need 90 million tonnes per annum of new supply by 2035 to sate growing demand, according to Massimo Di Odoardo, vice president of gas and LNG research at Wood Mackenzie.

Speaking at Wood Mackenzie’s Gas, LNG and the Future of Energy 2023 conference, which took place Nov. 14-15 in London, Di Odoardo told delegates that the market would continue to be volatile, Wood Mackenzie relates.

“There is no immediate cure, as most supply under construction will not be available until at least 2026,” Di Odoardo said. “As a result, buyers still face some years of high—and volatile—prices before the next wave of LNG supply rebalances the market and improves affordability.”

Recent market dynamics offer a stark reminder of how susceptible energy markets are to external shocks, including conflicts, geopolitical tensions and supply disruptions, Di Odoardo reflected.

“The global gas market has staged a remarkable recovery since Russia’s invasion of Ukraine in early 2022 but remains easily spooked,” he assessed. “The conflict in Israel/Gaza, possible pipeline sabotage in the Baltics and the threat of strike action at Australian LNG facilities all pushed spot prices up 35% through October.”

A record 200 MMtpa of new supply is under construction as players bet big on Asia’s push to reduce its dependence on coal and Europe’s need to replace Russian gas, Di Odoardo observed. With Europe increasingly dependent on LNG, and with limited flexibility from pipeline imports and coal, Europe and Asia both will rely on global LNG availability. This will expose the market to continued price volatility, he said.

“At times of excess LNG supply, prices could be extremely low as the market tries to absorb more LNG than required, possibly testing the economics of U.S. LNG,” Di Odoardo predicted. “But as markets tighten, for example during cold winters across the Northern Hemisphere, prices could be extremely high as both Europe and Asia scramble to secure marginal cargoes, meaning volatility will persist also after the market has rebalanced in the second half of this decade.”

Wood Mackenzie’s projections suggest that even with 200 MMtpa of new supply under construction, demand will outpace supply (Figure 1).

Growing Demand

Despite declining European gas demand, the anticipated drop in domestic production and imports from Algeria as the decade progresses suggests that LNG demand across the continent will not peak until 2030.

“The recent signing of 8 MMtpa of LNG contracts from Qatar and its partners Shell, TotalEnergies and Eni to Europe through 2053 underpins supplier confidence in the longevity of European LNG demand,” Di Odoardo said.

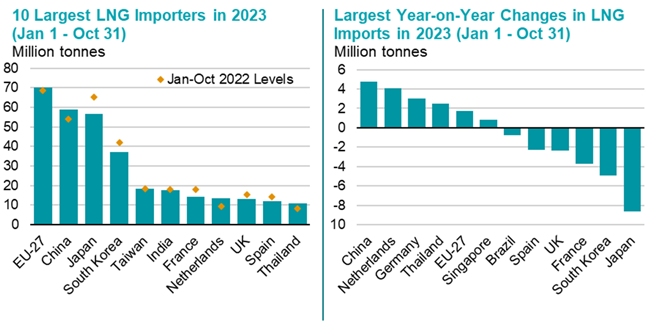

Asia, the traditional major market for LNG, also will see demand growth, with imports into China and several other emerging markets in the region doubling by 2030, Di Odoardo forecast. He cited China as the key market and predicted that LNG demand would increase 12% in 2023, while longer-term demand growth is underpinned by the 50 MMtpa of LNG contracted over the past two years. Other emerging markets in Asia also will need to grapple with declining domestic supply, boosting LNG import requirements.

While increased economic growth in Asia will be the major driver of LNG demand, Di Odoardo argued that economic growth alone will not be enough. “Domestic policies across Asia must increase their focus on decarbonization and ensure appropriate pricing and infrastructure developments,” he advised. “LNG developers must also play their part, ensuring affordable LNG supply, if Asia’s full potential is to be unlocked.”

Global Growth

Global LNG trade hit a record high in 2022 and should grow 25% to 500 million tons annually in five years, according to a new report by the International Energy Forum.

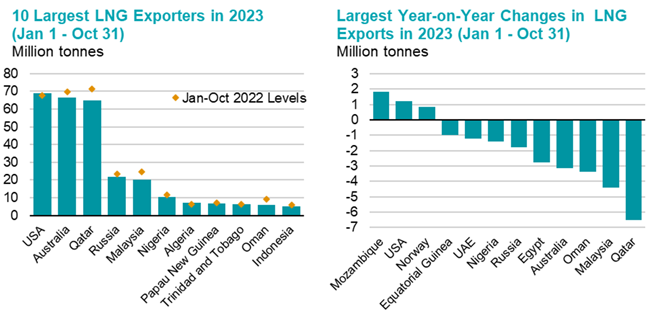

The report, Fragile Equilibrium: LNG Trade Dynamics and Market Risks, observes that China has overtaken Japan to become the world’s largest LNG importer, while the United States became the top LNG exporter in 2023 (Figures 2 and 3). The report was produced by IEF and Synmax, a satellite data analytics company.

“LNG is in greater demand than ever before and continues to drive economic growth and enhance energy security across the world,” says Joseph McMonigle, IEF’s secretary general.

“The versatility of LNG saved Europe from an energy crisis and in Asia, LNG is a vital part of the energy mix. It has helped to lift millions of people out of energy poverty,” he adds.

LNG accounts for about 15% of all gas supply worldwide, IEF calculates. One of LNG’s advantages LNG over pipeline gas is that it can be transported over large distances, routed to new demand centers at short notice and traded on the open market, the forum notes. It says this makes LNG particularly in demand during market disruptions.

Geopolitics has become the most significant driver of remapping LNG trade flows and investment, the report finds. It says Russia’s invasion of Ukraine in 2022 transformed energy markets, with Russian gas production falling 21% in the last two years, hitting a 14-year low in 2023.

Faced with the sudden loss of pipeline gas, European buyers turned to LNG to fill the void. Europe’s surging demand propelled global LNG prices to unprecedented heights and created a supply squeeze for emerging economies, exacerbating a delicate market situation, the report recounts.

In Europe, LNG’s share of gas demand rose from 12% a decade ago to more than 50%, the report says, adding that Europe’s regasification capacity is expected to grow another 48% by 2030.

“LNG is now an integral part of Europe’s energy mix, acting as a base load and replacing the role of Russian pipeline gas,” the report assesses.

Other Importers

Southeast Asia will be the new LNG import hotspot over the medium term, the report projects, with demand poised to double by the end of the decade thanks largely to Singapore, Vietnam and the Philippines.

“Ten new importers are expected to join the market in the next two years alone. Growth will be driven by adopting LNG for cooking and power generation,” the report says.

U.S. LNG exports have surged 135% since 2019, and the United States now delivers to 36 countries, the report tallies. It will remain the largest source of LNG supply growth in the future, with export capacity expected to grow 17% by 2025 and another 43% by 2028.

“Natural gas has been a major driver of climate progress by reducing emissions from the power sector in Europe and North America over the past 30 years and is expected to play a critical role in the energy transition in Asia and Africa for decades to come,” McMonigle remarks.

Even with their growth, LNG markets remain fragile because of strong demand amid growing geopolitical risk, the report says.

“Despite robust starting inventories, the European Union’s import situation will likely be tense and fragile this winter,” the report warns. “The critical challenge is that the European Union’s gas supply security depends on the weather in Europe, China’s and Japan’s LNG demand, and weather-related or technical outages in the Gulf of Mexico. Any slight disruptions in supplies can have significant impacts.”

Supply disruptions and volatile prices have far-reaching effects on emerging economies, the report says. South Asia, including India, Pakistan and Bangladesh, slashed LNG purchases 16% last year, the report illustrates. Many buyers in the region withdrew from spot markets altogether, and suppliers under long-term contracts in some cases defaulted on deliveries to obtain higher profits in other markets.

“A lack of access to affordable natural gas led to fuel shortages and increased use of carbon-intensive fuels, contributing to higher carbon emissions. This impacted countries’ energy strategies and LNG’s perceived reliability and affordability,” the report states.

China’s Role

Having become the largest LNG importer in the world this year, China’s share of active global LNG contracts is expected to rise to nearly 25% of global supply by 2030, bolstering the role of Chinese companies in LNG trading, the report says.

The energy crises of the past few years have underscored the importance for governments to invest in diverse energy sources and technologies, including gas and LNG infrastructure, the report suggests. However, it continues, European governments are wary of overcommitting to gas infrastructure, and gas demand in Europe is expected to fall as countries progress toward net-zero greenhouse gas emissions.

“Europe has accounted for 31% of LNG contracts signed this year, while Asia Pacific has accounted for 46%. As things stand, Europe could be buying approximately 70% of its LNG from the spot market in 2030,” the report forecasts.

U.S. Pipeline Expansions

More than 20 billion cubic feet a day of natural gas pipeline capacity under the jurisdiction of the Federal Energy Regulatory Commission or the Railroad Commission of Texas is under construction, partly completed or approved to deliver natural gas to five U.S. LNG export terminals that are under construction, according to the Energy Information Administration’s Natural Gas Pipeline Project Tracker.

Each LNG terminal—Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande and Port Arthur—has one or more pipelines being developed to facilitate delivery of natural gas to the terminal for liquefaction and export. About 12.2 Bcf/d of pipeline capacity is under construction, EIA reports. For details, see EIA’s Natural Gas Weekly Update for the week ending Nov. 8.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.