Oil Market Update

IEA Raises Demand Growth Forecast

PARIS–The International Energy Agency estimates in its September Oil Market Report that global oil demand grew by 2.3 million barrels a day in the second quarter of 2017–the largest quarterly jump in demand in two years–while oil inventories in Economic Co-Operation and Development countries continued declining in August toward the historic five-year average.

“Global oil demand grew very strongly in the second quarter. Consequently, we have revised upwards our growth (forecast) for 2017 to 1.6 million bbl/d.” the monthly report reads. “OECD demand growth continues to be stronger than originally expected, particularly in Europe and the United States, although hurricanes Harvey and Irma are projected to slow U.S. oil demand growth in the third quarter.”

First-quarter 2017 worldwide demand was 96.51 million bbl/d, up from 95.35 million bbl/d in the first quarter of 2016. Growth in the second quarter of 2017 saw demand expand to 98.81 million bbl/d, up year-over-year by 2.4 percent from 95.58 million bbl/d in second-quarter 2016, according to IEA.

“Demand growth is strengthening. Robust demand in OECD countries was a key factor in second-quarter 2017’s global growth of 2.3 million bbl/d, which was the highest quarterly year-on-year increase since mid-2015,” the report states.

Meantime, IEA says global oil supply slipped by 720,000 bbl/d in August–the first monthly decline since April. “The first decline in four months cut supply to 97.7 million bbl/d. Compared to a year ago, output was up 1.2 million bbl/d as non-OPEC continued to show substantial growth,” the agency observes.

The 12 member nations bound by the Organization of Petroleum Exporting Countries’ supply pact raised their compliance rate to 82 percent in August from 75 percent in July. For the year as a whole, OPEC’s compliance rate is 86 percent, IEA reports. At the same time, the 10 non-OPEC countries cooperating with the production cuts achieved 100 percent compliance for the first time in August.

Global Oil Inventories

Looking at global oil stocks, OECD inventory levels bucked historic trends by remaining unchanged in July versus June, when the normal trend has been increased inventories. “Within the OECD total, product stocks are now only 35 million barrels above the five-year average,” IEA says. “Depending on the pace of recovery for the U.S. refining industry post-Harvey, very soon OECD product stocks could fall to, or even below, the five-year level.”

The agency revised downward by 700,000 bbl/d its refinery throughput forecast for the third quarter because of the damage caused by Hurricane Harvey, but projects that U.S. refining capacity will be quickly restored. “This results in global refined product undersupply for the second consecutive quarter. In the fourth quarter, throughput will reach another record level of 80.9 million bbl/d as refiners respond to higher margins in the tight product markets.”

The report notes that oil prices had already settled by mid-September following the disturbances brought by Hurricane Harvey, and with the market moving into shallow backwardation, IEA says it expects markets to tighten and prices to rise modestly through the end of the year. “Disruption to local oil markets along the U.S. Gulf Coast is easing on a daily basis and (Harvey’s) impact on global markets is likely to be relatively short lived,” the report concludes.

Taking the longer view while speaking at a conference in September, Neil Atkinson, head of IEA’s oil markets division, reiterated the agency’s previous warning that the lack of capital investment in new production projects around the world could lead to tight supplies and volatile prices down the road.

“There are still not enough signs of investment beginning to return, and that raises the risk of a tightening of the market in the next five years and a risk to the stability of oil prices,” he said. “There is at least a possibility of going back to the situation we had 10 years ago where oil prices were very, very high at a time when demand was growing.”

OPEC Perspective

In its September Monthly Oil Market Report, OPEC says it has revised global economic growth up from 3.4 to 3.5 percent for 2017. “OECD growth has performed better than anticipated, particularly in the Euro zone and to some extent in the United States, and is now forecast to grow by 2.2 percent in 2017 and 2.0 percent in 2018,” the reports states. “India is expected to grow by 6.9 percent in 2017 and 7.5 percent in 2018. Brazil and Russia are both forecast to expand their recoveries by 0.5 and 1.5 percent in 2017, respectively, followed by growth of 1.5 and 1.4 percent in 2018. China is expected to grow by 6.7 percent in 2017 and 6.3 percent in 2018.”

OPEC forecasts world oil demand growth of 1.42 million bbl/d in 2017, an increase of 50,000 bbl/d over its August monthly report, reflecting better-than-expected economic data from OECD regions and China. In 2018, it projects worldwide demand growth of 1.35 million bbl/d. On the supply side, OPEC says its member countries decreased August oil production by 79,000 bbl/d to average 32.8 million barrels. It expects non-OPEC oil supply to grow by 780,000 bbl/d in 2017 and by 1 million bbl/d in 2018, while OPEC production expands by 500,000 bbl/d in 2017 and 200,000 bbl/d in 2018.

OPEC reports that total OECD commercial oil stocks fell in July for a third consecutive month to a level 103 million barrels lower than in July 2016, but still 195 million barrels above the five-year average. “Crude and products stocks indicate surpluses of 123 million and 72 million barrels, respectively, above the seasonal norm,” the report points out. “In terms of days of forward cover, OECD commercial stocks stood at 62.9 days in July, some 2.7 days higher than the latest five-year average.”

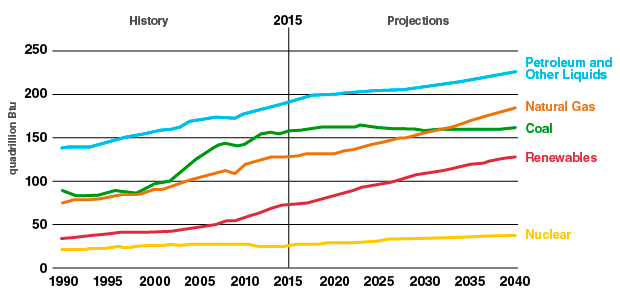

FIGURE 1

Global Energy Consumption by Source (1990-2040)

SOURCE: U.S. Energy Information Administration

Long-Term Outlook

In mid-September, the U.S. Energy Information Administration released its International Energy Outlook 2017 report, projecting that world energy consumption will grow by 28 percent between 2015 and 2040. EIA expects most of the growth to come from non-OECD countries where demand is driven by strong economic growth, particularly in Asia.

The report projects increased world consumption of marketed energy from all fuel sources except for coal demand, which is projected to remain essentially flat (Figure 1). While renewables are forecast to be the fastest-growing fuel source, EIA says it expects fossil fuels to still account for more than 75 percent of global energy consumption through 2040.

“Natural gas is the fastest-growing fossil fuel in the outlook, with global natural gas consumption increasing by 1.4 percent per year,” the report states. “The relatively high rate of natural gas consumption growth is attributed to abundant natural gas resources and rising production, including supplies of tight gas, shale gas and coalbed methane.”

Worldwide, EIA forecasts that natural gas consumption will steadily increase from 124 trillion cubic feet in 2015 to 177 Tcf in 2040. To meet expanding demand, EIA says the world’s natural gas producers will have to increase supplies by 42 percent by 2040, with the largest production increases expected in the United States (10.7 Tcf), the Middle East (11.8 Tcf), China (9.5 Tcf) and Russia (4.8 Tcf).

Although liquid fuels remain the largest energy source through 2040 (with consumption progressively increasing from 95 million bbl/d in 2015 to 104 million bbl/d in 2030 and 113 million bbl/d by 2040), EIA projects that the liquids share of world marketed energy consumption will fall slightly to 31 percent over the next two decades. The agency projects that petroleum and other liquid fuels production will increase by 16.1 million bbl/d by 2040.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.