Financial Update

Large U.S. Producers Leverage Stronger Prices To Lock In Hedge Positions

By Shane Randolph, Josh Schulte and Jeff Nicholson

HOUSTON–Oil and natural gas prices are as volatile and unpredictable as ever. Without the protection of effective hedging programs, producing companies’ cash flows are subject to the whims of the market. Those without hedges will benefit from prices moving higher while those with hedges in place may lose upside, but when prices move the other direction, companies without hedges on their produced volumes are fully exposed to the downside risk.

Finding, developing and extracting hydrocarbons is very capital-intensive. Companies obviously need sufficient cash flows to support expenditures on field activities, as well as service debt, comply with debt covenants, and support general and administrative costs. Hedging programs are developed with the primary purpose of providing a level of cash flow to increase the likelihood of meeting those basic capital needs. However, in today’s capital-constrained environment, where companies are committed to budgetary discipline and operating within cash flows, hedging takes on even more significance as a means to protect margins and mitigate price risk.

Opportune’s annual upstream hedging survey shows that 27 of the 30 companies evaluated, or 90%, had hedging programs in place at the end of 2020. That was an increase from 83% at year-end 2019 and more in line with previous years. For example, at the end of the tumultuous year of 2016, 97% of the surveyed companies were hedged, and that percentage had declined only slightly to 93% at the conclusion of 2018.

The survey includes the hedging activities of the 30 largest public exploration, drilling and production companies as disclosed in their Dec. 31, 2020, 10-K filings. Of the 27 companies with hedges in place, 73% had hedged crude production while an equal 73% had gas hedges in place to exit the year.

After bottoming out last spring primarily as a result of pandemic uncertainty, both oil and gas prices began trending higher during the last quarter, affording producers some hedging opportunities. The survey results not only show that hedging remains a mainstay activity for many oil and gas producers, but also indicates that some producers are hedging their crude oil production farther into the future than they have in recent history.

The survey provides as much information as possible based on regulatory filing disclosures. U.S. generally accepted accounting principles form the minimum disclosures companies must provide in their filings to provide users with an understanding of:

- An entity’s use of hedges;

- How the hedges and hedged production are accounted for in the filing; and

- How the hedges affect financial statements.

- While the accounting rules require companies to disclose the level of derivative activity, there can be variance in practice as to how much information a company discloses about instrument types, hedging volumes and the average hedged price.

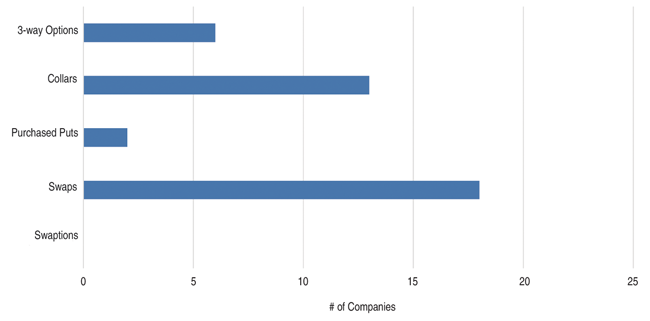

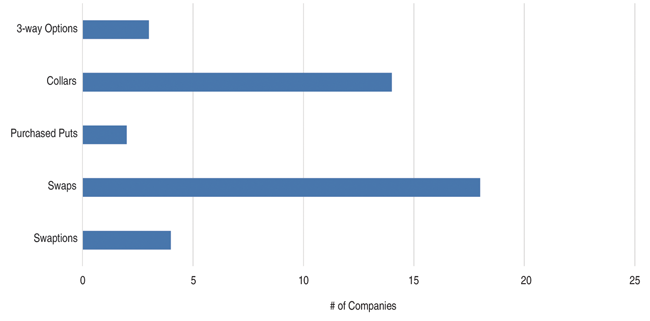

Hedge Instruments

Not all hedging strategies are created equal and different types of instruments provide different levels of downside protection in an oil and gas company’s hedging portfolio. For a producer, swaps provide the highest amount of downside protection. However, swaps limit upside price participation. This leads producers to utilize purchased puts–which can be costly–or costless collars, which allow a producer to participate within a range of price movements.

Other instruments noted in the survey were swaptions and three-way options. Swaptions, which often are used to raise strike prices by allowing a counterparties to increase the volume or lengthen the tenor of the contracts at their discretion, continue to represent a minority of the instrument types that public companies use.

Of the public oil and gas companies reviewed, swaps continue to be the preferred instrument for both natural gas and crude oil (Figures 1 and 2). A strategy with both swaps and collars was common for both oil and natural gas. The types of instruments used for gas remained generally consistent with the prior year, although there was a notable increase in the number of companies with natural gas collars.

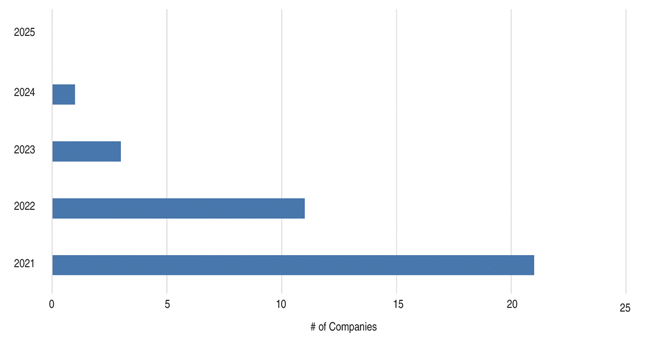

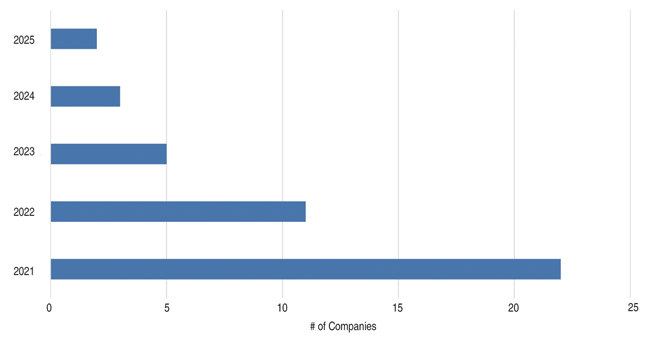

Companies executing a hedging program face the challenge of how far out into the future they should hedge their production. If commodity prices increase with time, they largely forfeit the upside. However, should prices drop, hedging allows the company more time to weather the storm. Based on the survey results, companies commonly hedged some level of the prompt 12-month period representing 2021. A handful of companies hedged crude in 2023 and 2024 (Figures 3 and 4). This is much longer than in prior annual surveys, when most companies had hedges on only the prompt two years of crude production. Hedging lengths for natural gas have remained largely consistent for years, with most companies hedging the first 24 months, and some companies hedging out to 2025.

Price Levels

Because a hedging program is intended to make cash flow more predictable, the price levels at which companies execute hedges often are heavily influenced by operating budgets and debt compliance.

Of the 27 companies that disclosed hedges on their books at the end of 2020, 24 provided their average floor prices for West Texas Intermediate Cushing crude, Henry Hub natural gas or both. The average swap price for crude was $44.69 a bbl for 2021 and $43.88/bbl for 2022, while natural gas was $2.69 an MMBtu for 2021 and $2.58/MMBtu for 2022. The average put price (non-three-way) for crude was $39.25/bbl for 2021 and $38.69/bbl for 2022. Natural gas was $2.54/MMBtu for 2021 and $2.50/MMBtu for 2022.

Consistent with prior surveys, few companies disclosed the amount of their forecasted production that was hedged as of Dec. 31. Only four companies disclosed what percentage of forecasted production was hedged. For the companies that did disclose this information, the average crude hedge level was 80% of forecasted 2021 production. For natural gas, it was 79% of forecasted 2021 production. Note that these hedge levels include coverage provided by three-way options.

The implementation of an effective hedging program can be a tool that helps ensure cash flow certainty and provide a longer reaction time in the event of a price collapse. Upstream oil and gas management teams should consider the various hedging alternatives and strategies available to help meet their needs during these volatile times.

SHANE RANDOLPH is a managing director at Opportune LLP, a premier hedge execution advisory and financial advisory firm for the upstream sector. He oversees the risk management, derivatives, stock-based compensation, and complex securities service offerings of Opportune. Randolph holds a B.S. in accounting and an MBA from Oklahoma State University.

JOSH SCHULTE is a manager in Opportune LLP’s commodity risk management advisory group. He assists companies with developing and executing complex risk management programs. Schulte holds a B.S. in mathematics from the University of Texas at Austin.

JEFF NICHOLSON is a senior consultant in Opportune LLP’s derivative reporting practice, where he assists companies with the reporting and analysis of derivatives and complex securities. Nicholson has a B.S. in business administration and management and an M.S. in finance from the University of Colorado.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.