McKinsey Offers Supply Chain Strategies

LONDON—Like their counterparts throughout the world economy, many U.S. oil and natural gas companies are wrestling with challenges that jeopardize their ability to obtain personnel, material and supplies when they need them, reflects a March report by McKinsey & Co. Fortunately, the firm maintains, operators have options to shield themselves against inflationary pressures, as well as labor and supply instability.

“Supply chain uncertainty is a major headache for many sectors across the world,” McKinsey observes. “For oil and gas companies, volatile costs and labor and material-supply uncertainties threaten everything from field operations to project delivery. Minimizing these supply chain risks could help oil and gas firms better secure their labor and materials while cutting costs by up to 15%.”

The firm released the analysis, “How Oil and Gas Companies Can Secure Supply-Chain Resilience,” on March 6. The report offers a three-part plan that it says will help oil and gas companies assess their supply-chain risks, explore risk-mitigating levers and adjust their mindsets to build resilience in the face of a supply chain crunch.

Kinks In The Chain

Although producers face many challenges, McKinsey indicates timely procurement has risen to the top of the ranks. “Oil and gas companies are grappling with the business fallout of sustained global inflation, geopolitical developments in Europe and Asia, and increasing economic headwinds,” the firm details. “Industry leaders say that of all the urgent challenges they face, supply chain uncertainty is the most pressing. Supply chain risks are affecting field operations and project delivery, and traditional mitigation strategies are proving inadequate.”

When suppliers struggle to provide labor and materials on time, the potential consequences include new inefficiencies, steeper costs, budget overruns and missed deadlines, McKinsey relates, which is why supply chain security has catapulted to the top of executives’ concerns.

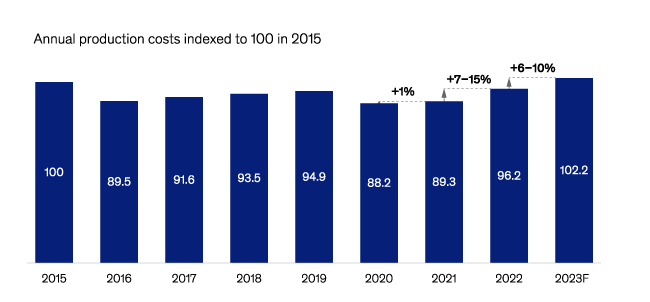

The major contemporary supply chain security risks center on cost volatility and unpredictable labor and material supplies. Regarding inflation, the firm reports, the industry’s costs climbed 7%-15% in 2022 (Figure 1). Although the possibility of a global economic slump may mitigate upward cost pressure going forward, McKinsey acknowledges, the industry’s inflationary trend is on pace to continue at a rate of 6%-10% in 2023, with much of that attributable to labor uncertainties and climbing raw materials costs.

FIGURE 1

Industry Production Costs

Information from 26 oil and gas companies, including seven majors, three NOCs, and 16 independents.

Forecasts for 2023 based on latest PI data and responses to industry survey.

Source: S&P Capital IQ; McKinsey Energy Insights

“In addition, primary operation tasks, such as regular maintenance and inspections, are becoming more expensive as labor rates grow at more than 9% per annum,” the firm notes, adding that costs for standard materials, including casing and tubing, are climbing 5% a year.

According to the report, cost increase types run the gamut, with offshore operations seeing marine and aviation logistics costs balloon alongside those for vessels and emergency work. The inflation extends to matters far more mundane. “Inflation has also hit non-technical areas,” the firm illustrates. “Food prices at offshore installations have risen by around 10% and underlying labor costs for catering are expected to experience similar growth, indicating that offshore premiums may return.

“Operators that remember the 2010-14 oil-price boom are acutely aware of inflation’s sharp bite as they struggle to control their current operating expenditure costs,” McKinsey adds. “Managing cost volatility can ensure resilience in the oil and gas industry.”

The industry’s major supply challenges include labor unrest, stretched agency staffing pools, absences and departures, McKinsey considers. “This has created a vicious cycle: More work is carried out under emergency conditions, which is increasingly expensive,” the report describes. “In many areas, the situation has been exacerbated by a heavy reliance on a small number of suppliers with few alternatives. A high staff-absence rate of 6%-8% has been observed, and anecdotal evidence shows an estimated 5%-10% no-show rate for flights to offshore sites.”

Project delivery schedules grow progressively more erratic as lags continue to grow for both long-lead (12-18 month) and short-lead (two-six week) equipment, the firm describes. Moreover, it says, dwindling vessel and spare-parts inventories also are challenging availability, and a tight rig market makes drilling schedules increasingly unpredictable.

Addressing the Challenge

“Robust safeguards against cost inflation and supply risks could allow oil and gas companies to operate in a secure environment with predictable lead times, maintain operational and capital planning to support production, and ensure a stable cost base,” McKinsey says. “Organizations that are taking measures to secure their supply chains and avoid market volatility are seeing significantly less inflationary pressure, saving about 15% on costs. At the same time, securing the supply chain reduces risks in operations and project delivery while maintaining a license to operate and deliver growth.”

Comprehensive risk assessments that illuminate exposure to inflationary pressures and estimate the budgetary impacts of inflation and supplier availability can help oil and gas companies secure the supply chain, McKinsey counsels. Such evaluations help operators understand, manage and mitigate supply chain risks by focusing on availability, inflation and supplier risk on a category level, it says.

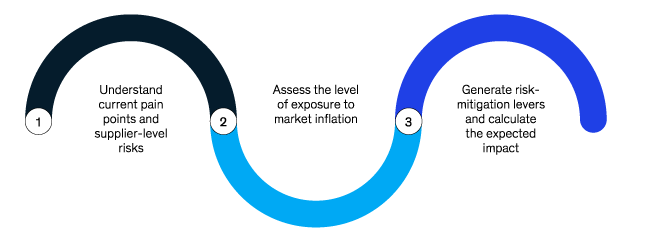

According to the firm, a prudent risk-assessment strategy (Figure 2) incorporates three fundamental steps:

- Understand the current pain points and risks at the supplier level;

- Assess the level of exposure to market inflation; and

- Generate risk-mitigation levers to calculate the expected impact.

McKinsey suggests operators improve their understanding of suppliers’ pain points and risks by holding workshops and engaging with function teams to establish why suppliers are not meeting expectations.

“Once pain points and root causes have been established, organizations can then create a category-level picture of where certain risks exist and identify whether mitigation is required,” the report says. “A supplier-level risk analysis will help highlight specific risks within certain suppliers and categories. Once a clear picture emerges, a company can then analyze tier-two and three suppliers to identify connectivity and reliance throughout the supply chain. Finally, a holistic risk profile can be created by applying the above steps to different moving parts—consider commercial, operational and execution risks to construct a complete picture.”

Meanwhile, properly assessing market inflation exposure requires reviewing contracts for mechanisms to mitigate it, such as risk/reward ratio, managed service options and supplier consolidation, McKinsey says. Operators can compare their findings with a view of market inflation across key industry indices, each tailored to different categories.

And then, the firm says, creating risk-mitigation levers and calculating the expected impacts involves mitigating actions across operations and the project portfolio, and estimating their impacts on future costs. “A mechanism to appropriately share risk with suppliers, linked to performance, could be established,” McKinsey offers. “Thereafter, contract-performance management and supplier relationship-management processes could be refined to ensure long-term sustainability.

“The assessment can be carried out jointly with procurement leads and business representatives in a cross-functional task force to ensure effectiveness,” the report adds. “The scope can be clearly defined while linking it to a timebound delivery plan and prioritizing levers based on impact and feasibility.”

Shifting Gears

Organizations seeking to ease supply-chain reliability risks can pivot away from a cost-cutting focus toward a robust bottom-up strategy with concrete levers informed by market intelligence, expert input and risk analysis, McKinsey advises.

“To increase the probability of success, the levers would likely need to be embedded in the organization’s strategy and accompanied by accountability measures,” it describes. “These levers could include the quantification of potential impact for the first year and full run-rate implementation, and the use of key performance indicators to track performance, where relevant. The syndication and alignment of each lever, with clear accountability lines and actionable steps on how each one should be progressed, could also help ensure success.”

Furthermore, the report says, implementing those levers easily can be paired with contract-performance optimization and supplier-relationship management across people, processes and practices, all of which may help the transformation endure.

“Typical high-impact levers include early procurement in strategic projects to accelerate long purchase times by adjusting the sanctioning period, revising the approval gating process or enabling earlier budget approvals,” McKinsey suggests. “Improving the risk/reward ratio in major contracts to incentivize performance and consolidate contract volumes could also add impact. When it comes to staffing, enhancing offshore execution efficiency and digitizing inspection data could make the workplace more appealing. Incorporating personnel retention schemes into contracts could also help retain talent.”

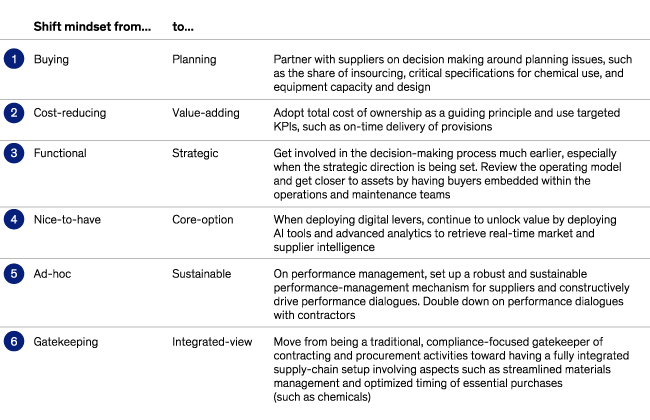

Supply-chain management must evolve to improve its resilience to external shocks, the firm says, and can be realized by shifting mindsets (Table 1).

“As the supply chain environment grows increasingly volatile, oil and gas companies may need to better manage the associated risks to ensure their resilience,” the report concludes. “Performing a three-step risk assessment of the supply chain and applying six management mindset shifts could help mitigate risks and ensure long-term financial sustainability.”

The McKinsey & Co. report can be found at https://www.mckinsey.com/industries/oil-and-gas/our-insights/how-oil-and-gas-companies-can-secure-supply-chain-resilience#/.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.