Restarting Wells

Onshore Operators Restoring Shut-In Oil Volumes

HOUSTON–Most U.S. onshore operators will restore nearly all shut-in oil volumes by the end of the third quarter, with only a handful maintaining some level of curtailment for the rest of the year, according to analysis from Rystad Energy.

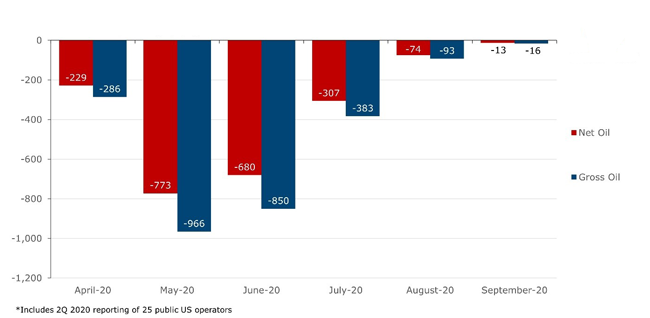

Based on second-quarter earnings statements from 25 public oil and gas companies, Rystad estimates that curtailments from the 25 operators peaked in May with a net 772,500 barrels a day (965,600 bbl/d gross) taken off the market. Total cuts decreased to a net 680,300 bbl/d in June. In July, only about 306,500 bbl/d in net volumes still remained curtailed. That is expected to fall to a net 74,300 bbl/d (92,900 bbl/d gross) in August, with nearly all production set to be reactivated by the end of September (Figure 1).

The production curtailments were implemented in April (228,700 bbl/d net) and May (543,800 bbl/d net), driven by both economic and technical considerations, with operators shutting in lower margin wells and reducing flowback on others. A gradual recovery in oil prices beginning in the second half of May and a stronger overall market outlook prompted many producers to re-evaluate their initial shut-in plans.

“As a result, the actual total cut in May for several operators was lower than earlier guided, and June curtailments decreased month-on-month,” observes Veronika Akulinitseva, Rystad’s vice president of North American shale and upstream. “Nearly all operators said they did not face any issues in bringing volumes back online as per schedule, as they had already worked on issues such as maintaining reservoir pressure and well integrity even before they began moderating output or shutting in wells.”

EOG Resources has elected to retain 25,000 bbl/d of cuts until September, but the company noted that its curtailed volumes are being restored faster than originally anticipated, the report points out. In its quarterly statements, EOG Resources highlighted that nearly all wells it has reactivated to date had exhibited a degree of flush production due to a buildup of bottom-hole pressure. The wells quickly returned to their pre shut-in profiles, but the initial flush rate resulted in better-than-expected overall performance, helping EOG beat its second-quarter production guidance, Akulinitseva notes.

Restarting Production

As prices started to improve in late May and early June, only a few of the 25 operators deepened their cuts, with some–including ConocoPhillips, Chevron and Noble Energy–sticking to their original plans, while many others began to restore volumes.

According to Akulinitseva, ConocoPhillips prefers voluntary curtailments over hedging as a tool for dealing with price volatility, allowing it to retain complete exposure to a recovering market. In its quarterly statements, the company explained that it takes decisions on curtailments month by month, but had planned to bring back full production by the end of September. Chevron’s curtailed volumes are at the lower end of guidance, with production set to be restored in August with improved oil prices. Most of Noble Energy’s cuts were back online by the end of July.

The other 22 operators surveyed cumulatively restored 182,430 bbl/d in June, which given the deeper cuts of ConocoPhillips, Chevron and Noble Energy, amounted to net gain of 92,180 bbl/d in overall production for June, erasing 12% of the cuts made in May, Rystad calculates.

The pace of reactivation has accelerated since July. “Our analysis shows that as much as 373,800 bbl/d of net production, or 48% of the cuts made in May, was restored in July, followed by an additional net volume of 232,200 bbl/d slated to be back in August,” Akulinitseva details. “Only a handful of operators intended to wait until September to reactivate the last of their curtailed volumes.”

Apart from EOG and ConocoPhillips, Oasis Petroleum and Matador Resources reported that they had expected to keep about 15% of curtailed production offline until September.

Although the vast majority of U.S. operators intended to fully reactivate curtailments in the third quarter, a select few aimed to keep a percentage of volumes offline for the time being, Rystad says.

Pioneer Natural Resources, which cut 7,000 bbl/d of production in the second quarter from wells with higher operating costs, said that it intended to bring only about 1,000 bbl/d of that total back online. The company added that some volumes may never come back, depending on the cash flow outlook of each well, according to Akulinitseva.

Apache, having curtailed 7,500 bbl/d in May, said it had the option to reactivate wells when it thinks the time is right, but anticipated that 4,500 bbl/d may not return to production in 2020. PDC Energy also indicated it planned to keep a small volume (estimated at 2,000 bbl/d out of the total 24,000 bbl/d it cut in May) offline beyond the end of the third quarter.

“No loss of production has been reported by any operator following the shut-ins and moderation of output, with most companies flagging a smooth return of operations, and in some cases posting a positive production impact from those reactivations,” says Akulinitseva.

Permian Gas Output

Natural gas output from the Permian Basin is expected to rebound relatively quickly in the second half of 2020 and remain robust for years to come, Rystad Energy projects. However, it adds that restricted investments related to COVID-19 are likely to postpone approvals for key pipeline projects to transport Permian gas to Gulf Coast and Mexican markets.

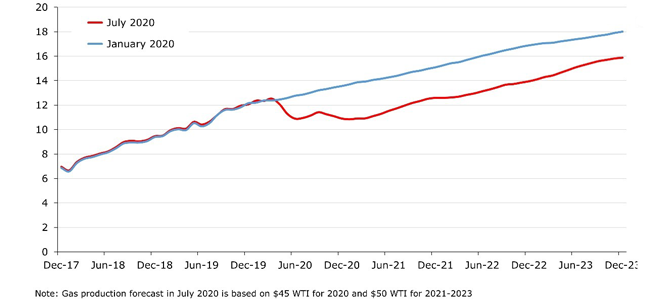

Rystad projects that Permian gas production will see a rapid boost even in a relatively low $45-$50 barrel WTI price environment. “In the short term, the reactivation of curtailments is expected to push basinwide gas output back to 11.4 billion cubic feet a day in September, although further growth may be delayed until mid-2021, when activity is expected to recover substantially,” says Artem Abramov, the company’s head of shale research.

Regardless, gas output in the Permian is anticipated returning to record levels by late-2021, reaching 16 Bcf/d by the end of 2023. While still significant growth, Abramov notes that this represents a downward revision of 2 Bcf/d compared to Rystad’s forecast prior to the COVID-19 pandemic (Figure 2).

“There has been limited news flow on the development of new gas pipelines in recent months, but we remain confident that both the Permian Highway Pipeline, which originally announced an in-service date of first-quarter 2021, and the Whistler project, which announced an in-service date of third-quarter 2021, are both moving ahead,” he states.

Both pipelines are designed to ship Permian gas to the Gulf Coast. The 430-mile, 42-inch Permian Highway has a transportation capacity of 2.1 Bcf/d. The 450-mile, 42-inch Whistler system has capacity of 2 Bcf/d.

For other pipelines, however, serious concerns about feasibility remain and many projects have been delayed or put on hold, Abramov reports. According to an April announcement, the Pecos Trail evaluation is now on hold, and the Permian to Katy pipeline also appears to be inactive, he says, adding, “Tellurian has continued to advertise its future global gas market hub around Driftwood LNG, the Permian Global Access pipeline, but the likelihood of any investment decisions in the short-term remains low from our perspective.”

On paper, the nameplate outbound capacity of all takeaway pipelines with local consumption (assuming the completion of the Permian Highway and Whistler) will reach 17.5 Bcf/d in 2022, enough to accommodate increased gas production in the basin through the mid-2020s. However, the future of utilization rates on Permian-to-Mexico pipelines (Roadrunner, Comanche Trail and Trans-Pecos) remains uncertain, Abramov remarks.

“While the Villa de Reyes-Aguascalientes-Guadalajara pipeline was finally completed and started service in June to northern Mexico and Guadalajara, it might take several quarters (if not years) to see a significant increase in West Texas-to-Mexico exports, relative to the total capacity of outbound pipelines,” he relates.

Regardless of the state of West Texas-to-Mexico exports, however, Rystad concludes there will be a need for new gas takeaway projects from the Permian as early as 2023-24. If these projects are not approved early enough, Abramov suggests the basin might again encounter a situation with insufficient takeaway infrastructure within three or four years.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.