IMO 2020

Pending Regulation Has Broad Market Impacts

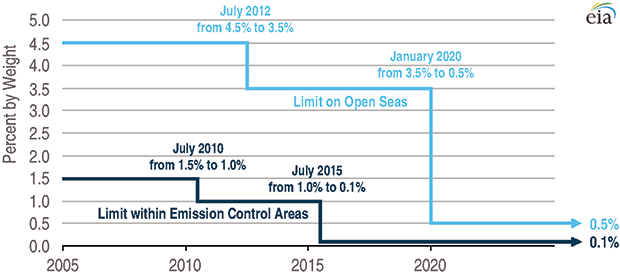

A new regulation from the International Maritime Organization requires marine shippers to reduce sulfur emissions by more than 80 percent in international waters beginning on Jan. 1, 2020. Specifically, IMO 2020 tightens the emissions standard to burning the equivalent of fuel oil with a sulfur content of less than 0.5 weight percent compared to the current maximum limit of 3.5 weight percent sulfur.

IMO 2020 applies across multiple countries’ jurisdictions to fuels used in the open ocean, representing the largest portion of the 3.9 million barrel-a-day global marine fuel market (marine vessels account for 4 percent of total world oil demand), according to the International Energy Agency.

Analysts generally agree that the pending regulation is likely to result in increased refinery utilization levels in 2020, and lead to changes in the relative values of crude oils, with sweet crudes such as West Texas Intermediate and Brent becoming more valuable than sour and heavy grades because their lower sulfur contents make them ideal for blending into diesel-like marine gasoil (MGO) or very low-sulfur fuel oil (VLSFO). By some accounts, 2.5 million barrels a day of additional low-sulfur, IMO 2020-complaint fuels will be needed by maritime shippers next year.

In its January Short-Term Energy Outlook, the U.S. Energy Information Administration says IMO 2020 will likely cause some price swings and fuel availability issues when the regulation takes effect, but predicts that its longer-term impact on oil prices will be moderate. “The change in fuel specification is expected to put upward pressure on diesel margins and modest upward pressure on crude oil prices in late 2019 and early 2020,” the report states. “The price effects that result from implementing this new standard will be most acute in 2020 and will diminish over time.”

In its World Oil Outlook, OPEC estimates that the global refining system will temporarily increase runs by 400,000 bbl/d in 2020 in order to produce sufficient volumes of middle distillates for low-sulfur fuels, increasing overall global oil demand growth to 1.7 million bbl/d next year.

FIGURE 1

Global Marine Fuel Sulfur Limits

Sources: U.S. Energy Information Administration, International Maritime Organization

Marine bunker fuel is comprised of residual oil, the long-chain hydrocarbons remaining after lighter and shorter hydrocarbons such as gasoline and diesel have been separated out. “Refineries have two options with regard to residual oils: invest in more downstream units to upgrade residuals into more valuable products, or process lighter and sweeter crude oils to minimize the production of residual oils and the sulfur content therein,” EIA says in the January STO.

With the new fuel specification widening discounts between light, sweet crude and heavy, sour grades, EIA projects that IMO 2020 will directly increase Brent prices by $2.50 a barrel on average next year. It will also lead to higher diesel fuel refining margins, prompting U.S. refinery runs to jump from an average of 17.2 million bbl/d in 2018 to a record level of 17.9 million bbl/d in 2020, the agency reports.

Major Repercussions

A report from IHS Markit warns that the repercussions of IMO 2020 will be “major, costly and far-reaching” for shippers and refineries, and to a lesser extent, consumers forced to pay higher costs for products shipped over the world’s oceans. The majority of vessel operators are expected to switch to VLSFO, but compliance remains the greatest uncertainty with the pending regulation, and there is concern whether sufficient supplies of compliant fuels will be available in the world’s ports, according to Spencer Welch, executive director of oil, midstream and downstream for Europe, CIS and Africa at IHS Markit.

“Shippers will face significant compliance costs to either upgrade equipment or switch to more expensive, cleaner fuels,” he says. “Refiners–and fuel buyers–will experience significant price impacts as they shift production to deliver greater volumes of very low-sulfur fuel oil (VLSFO) and find a market for their less valuable fuels.”

IMO’s rapid pace of implementation has “sent tidal waves through two industries that typically take many years to adapt to such significant change that requires tens of billions in investment,” points out Sandeep Sayal, IHS Markit's vice president of downstream research. “The global scope, the significant uncertainty in fuel formulations, and the volume of new lower-sulfur fuel demand, are causing a scramble.”

Once the regulation takes effect, it will be illegal for a vessel to have non-compliant fuel on board and any vessel found not in compliance could lose its charter to sail. Major insurance companies also have indicated that compliance assurance will be essential to vessel insurability, according to IHS Markit.

Shippers have three options for compliance: switch to VLSFO or liquefied natural gas, or install on-board scrubbers to ship exhaust stacks and continue to burn higher-sulfur fuels. “But until scrubbers can be installed–which for numerous ships will not happen before the January 2020 deadline–many ships will have to burn IMO-compliant VLSFO,” the report declares.

“We estimate that between 5,000 and 10,000 ships will undergo scrubber installation at a cost of between $2 million and $7 million each, plus increased operations costs,” comments Krispen Atkinson, IHS Markit’s senior consultant for maritime and trade research. “To date, the industry has spent or committed more than $6.6 billion to fit more than 2,000 ships with scrubbers.”

While other ships will be converted to compliant fuels with sulfur levels below 0.5 percent, fuel costs could escalate significantly because of the higher-quality fuel required and ship owners also may face fuel compatibility issues, the report contends. Each refinery complex could produce different, but compliant regional formulations to meet the new fuel standard based on available crude oils, product slates, costs and supply chain logistics, presenting operational and continuity challenges for shippers, it reads.

Refiners will produce more higher-value distillates from crude as new demand arises, with about half of the compliant low-sulfur fuel coming from non-distillate sources within the refinery, but the remaining 50 percent will need to be sourced from refinery distillates. However, IHS Markit notes that these same distillates also are needed for other growing diesel markets. “As a result, refiners will likely have to make significant operational changes, and ultimately, invest billions to shift their existing product slates, increasing costs and distillate prices,” the report concludes.

“Highly complex refineries (i.e., U.S. Gulf Coast refineries), which have the flexibility to convert various grades of crude oil into a wide range of refined products to meet market demand, will benefit most from the IMO specification change,” Welch explains. “Highly complex refiners produce the least amount of residual fuel oil and the highest amount of distillate and gasoline compared to lower-complexity refiners. Less integrated and less complex refiners will likely experience the greatest market risk.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.