U.S. Resource Plays

Reports Bullish On Tight Oil, Shale Gas Basins

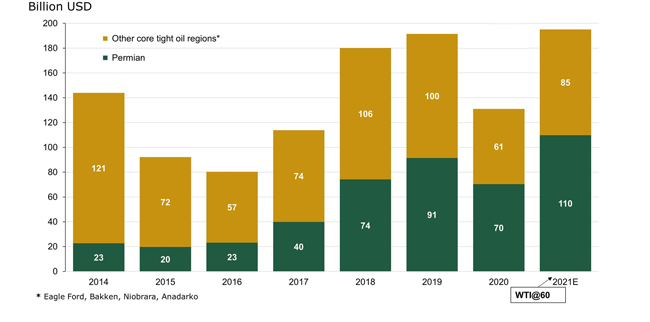

If West Texas Intermediate prices maintain their current trajectory and average $60 a barrel in 2021, U.S. tight oil producers will achieve a record $195 billion in hydrocarbon revenues before factoring in hedges, according to a Rystad Energy analysis. That would top the previous annual record of $191 billion set in 2019.

The estimate includes hydrocarbon sales from all tight oil horizontal wells in the Permian, Eagle Ford, Bakken, Niobrara and Anadarko basins (Figure 1). The Permian Basin alone is set to generate $110 billion in pre-hedge hydrocarbon sales from tight oil activity this year, compared to $91 billion in 2019.

However, corporate cashflows from operations may not reach a record before 2022 because more than $10 billion worth of revenue is going to be absorbed by significant hedging losses in 2021. As a group, shale producers aggressively hedged production volumes to offset heightened risk as prices began to recover from last year’s pandemic lockdowns, Rystad notes.

While hydrocarbon sales, cash from operations, and before-tax earnings for tight oil producers are all testing new highs in a $60-plus WTI environment, the report points out that capital expenditures are not growing exponentially as producers remain committed to maintaining operational discipline.

“From the upstream cashflow perspective, we see reinvestment rates falling to 57% in the Permian and to 46% in other oil regions this year. Corporate reinvestment rates are generally expected to be in the 60-70% range this year due to debt servicing and hedging losses,” says Artem Abramov, head of shale research.

To forecast medium-term tight oil production sensitivity, Rystad Energy used a “status quo” scenario where current policies and tax codes for oil producers remained unchanged. Reinvestment rates are assumed to decline gradually over the 2021-25 period as the industry matures, but not surprisingly, the average reinvestment rate clearly depends on oil prices.

“Updates from the latest earnings season show that even as oil prices rise, companies still prioritize accelerated balance sheet improvements and higher investor returns over increased CAPEX and production growth spending,” the reports states. “This indicates that the reinvestment rate itself will be a function of the oil price in future, with a stronger market resulting in lower reinvestment rates.”

Reinvestment Rate

According to Rystad’s company-by-company research, an average industrywide reinvestment rate of 50% is expected at $65/bbl WTI, 60% at $55/bbl, and 70% at a $45/bbl in 2021-25. These assumptions were then used to analyze the supply outlook for U.S. tight oil.

The $45/bbl WTI environment is viewed as the “new maintenance scenario,” with a conservative spending profile. The $55-$65/bbl range paves the way for significant output growth, with pre-COVID-19 production records being surpassed by late 2022 or early 2023. Rystad notes that the forecast is not for total U.S. oil volumes, which are also affected by conventional production declines.

“The Permian Basin alone can grow comfortably even in a $45/bbl world, likely plateauing at 1 million bb/d above its pre-COVID production peak by the middle of the current decade,” Rystad says. “If we assume $55 WTI as a long-term price deck, Permian tight oil volumes are set to deliver a compound annual growth rate of 11-12% over the next five years, or 2.6 million bbl/d of cumulative oil production growth.”

Production increases in the Permian are expected to be partially offset by a 500,000 bbl/d decline in other regions, which require a WTI price of $60/bbl barrel to demonstrate some production recovery in the forecast period. A continuous expansion in the Permian is consistent with the guidance shared by public tight oil producers, according to Rystad. Many of them forecast stable volumes through 2021 at a portfolio level, which for most diversified producers, implies some growth in the Permian offset by declines in more mature or less economic basins, it says.

In a $55 WTI environment, the U.S. shale industry would generate $43.8 billion of upstream free cashflow in 2022. With around $9.1 billion of estimated debt that needs to be serviced, the industry would still have a staggering $34.6 billion left at a corporate level. What happens if some recent initiatives by the Biden administration are implemented immediately?

“Any regulatory changes will weigh on U.S. tight oil’s market valuations, but we believe many producers would respond to increased taxes or carbon costs with only a marginal reduction in CAPEX. Then, instead of a 60% reinvestment rate on average in a $55/bbl WTI world, we might see a reinvestment rate of 70%. With such spending, the nation’s tight oil production will gradually climb to its pre-COVID record by 2025, but will not necessarily surpass it, falling 1.4 MMbbl/d short of the outlook under the status quo scenario in 2025,” Rystad says.

Challenging Task

Meantime, the proven oil and gas reserves of major companies are falling at an alarming rate, as produced volumes are not being fully replaced with new discoveries. In fact, the majors lost 15% of their reserves in the ground last year, with remaining reserves set to run out in less than 15 years unless the group makes more commercial discoveries, and fast, according to analysis from Rystad Energy.

The task is becoming more and more challenging as investments in exploration shrink and success rates slump. The declining proven reserves could create serious challenges for ExxonMobil, BP, Shell, Chevron, Total and Eni to maintain stable production levels in coming years.

“This would, in turn, cause revenues to dwindle and pose a major threat to the financing of the group’s energy transition plans,” Rystad states. “Even for European majors, which are increasingly focusing on the energy transition, business models will continue to be dominated by the sale of oil and gas.”

Big Oil saw its proven reserves drop by 13 billion barrels of oil equivalent in 2020 as the companies took large impairment charges, and exploration this year has not gotten off to a great start either. According to Rystad, global first-quarter discovered volumes industrywide totaled 1.2 billion boe, the lowest in seven years, as high-ranked prospects failed to deliver and successful wildcats only yielded modest-sized finds.

ExxonMobil’s proven reserves shrank by 7 billion boe (30%) in 2020 from 2019 levels, mainly as result of reductions in Canadian oil sands and U.S. shale gas. Shell saw its proven reserves fall by 20%. Chevron also suffered reserve losses due to impairments, despite the addition of some 2 billion boe of proven reserves to its inventory through the acquisition of Noble Energy. Similarly, total proven reserves drop from 19 billion to 18 billion boe in 2020. Only Total and Eni were able to avoid reductions in proven reserves over the past decade.

“New discovered volumes, a measurement of a company’s exploration performance, illustrate the daunting challenge faced by oil majors to maintain their reserves bases. Over the past five years, the six majors have replaced only 45% of their production through reserves from new discoveries,” according to Rystad.

Rising Gas Production

U.S. natural gas production is poised to grow to a new record of 93.3 billion cubic feet a day in 2022 and should continue to rise further, exceeding 100 Bcf/d in 2024, a separate Rystad Energy study shows. As a result, the performance of the country’s key gas basins is going to attract increased interest from investors and markets, with carbon dioxide emissions intensity, capital efficiency, and potential bottlenecks drawing close scrutiny.

U.S. gas output reached an all-time peak of 92.1 Bcfd in 2019 before declining to an estimated 89.7 Bcf/d in 2021. However, Rystad says the downward trend is expected to quickly change as the effects of the pandemic subside and activity builds across the country’s major gas basins.

“The Appalachian Basin was best-in-class in 2020 when it comes to CO2 emissions intensity, and the region is set to report a record-high capital efficiency in 2021 as reinvestment to maintain output will drop to its lowest ever,” the report reads. “Meanwhile, the Haynesville Shale will offer the largest gas output growth going forward, risking bottlenecks unless more pipelines are approved.”

To maintain production at current levels, Appalachian producers will need an upstream reinvestment rate of only 67% in 2021. While the biggest public independents in the region have historically managed to lock in relatively favorable derivatives positions, 2016 was the only year when the basin was able to deliver an upstream reinvestment rate of under 100%, excluding the impact of hedging, financing activities and midstream-related cash flows, according to our estimates.

The pre-hedging upstream reinvestment rate increased to 147% in 2019 with low prices in the second half of that year, and stayed above 100% in 2020. “Reinvestment rates look set to stay well below 100% in the future across the basin, based on the new business models adopted by some of the biggest and the most well-established producers,” the report says. “In our base case, we generally expect an average long-term upstream reinvestment rate of 75% for the Appalachian.”

Appalachian gas production has yet to reach its peak, according to the analysis. “We still anticipate (long-term) growth of 16% in Appalachian gas production, with the Marcellus and Utica forecast to add 5 Bcf/d over the next two decades,” Rystad relates, adding that region’s overall contribution to the nation’s total will, however, remain flat at 36% with the Permian and Haynesville driving most of the incremental growth. “Nevertheless, Appalachia will continue to remain the dominant supplier given its significant inventory of remaining drilling locations.”

The Haynesville is projected to become the largest source of U.S. output growth, adding 10 Bcf/d between 2020 and 2035 (86% growth). The region is forecast to account for 21% of the country’s gas production in 2035, compared to 13% in 2020.

The Haynesville remains poised to see a production growth of 5 Bcf/d or more over the next five years based on a conservative level of drilling, Rystad Energy estimates. “A key factor in the Haynesville’s ability to sustain an advantage will be to maintain the relative ease with which operators can transport gas from wellheads to Gulf Coast markets,” Rystad offers.

Significant growth also is forecast in gas volumes from tight oil plays. Rystad says associated gas from the Permian will account for more than 5 Bcf/d of growth from 2021 to 2035, driven primarily by the Delaware Basin.

Global LNG Tightness

The global liquefied natural gas market will get tighter over the next decade and could even see annual supply deficits as a result of likely delays in the development of LNG projects in Mozambique due to the country’s worsening security situation, according to Rystad.

Mozambique was once poised to catapult into the upper ranks of global LNG producers by the middle of this decade, but Total’s recent force majeure declaration signals indefinite delays on its LNG complex onshore Mozambique. The violent insurgencies also threaten ExxonMobil’s yet-to-be sanctioned Rovuma LNG. Together, the two projects represent 28 million tons per annum (MMtpa) of LNG capacity.

The market could see up to 9 MMtpa of supply removed between 2026 and 2030, disrupting global balances. Rystad says it forecasts a tightening LNG market through 2024 as demand continues to grow. “With a strong pipeline of liquefaction projects under construction, we previously expected that a new wave of supplies coming into the market around 2025 would create a downward cycle in prices,” the analysis states. “However, the potential delay of the Mozambican projects means that now there is an increasing risk of a prolonged period of tightness midway through this decade.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.