Project Management Solutions

Strategies Key For Success On Capital-Intensive Assets

Badar Alam and Greg Desnoyers

WILMINGTON, DE.–Major capital projects present unique challenges for owners/operators and investors. Growing size and complexity, combined with unforeseen environmental, cultural and economic factors, contribute to countless issues in project startup every year. More broadly, these issues can accumulate to reduce the anticipated value of capital-intensive assets. While project managers are so often dedicated to the mantra of “on time and on budget delivery,” it is asset operability over the long term that serves as the missing link in measuring true, sustainable capital project performance.

According to Ed Merrow, founder and president of Independent Project Analysis Inc., 65 percent of all global megaprojects (over $1 billion) can be classified as failures. Even more sobering, this figure rises again for sectors such as oil and gas, where 70 percent of large-scale projects tend to fail. Tremendous time, effort and resources are expended every day in planning and delivering complex capital projects. Yet a key factor influencing their successful execution continues to be overlooked or undervalued, namely asset operability.

Asset operability is an asset’s ability to perform a desired function to the capacity for which it was intended over its entire usable life. Any deviation from the expected output performance immediately reduces the net present value of the asset. Only 11 percent of the companies surveyed by the Economist Intelligence Unit for a research report issued in January 2011 reported delivering the expected return on investment on major capital projects 90-100 percent of the time.

The common basis for these failures was often poor, uninformed decision making, combined with what Catherine Tinsley, Robin Dillon and Peter Madsen characterized as “ignoring the near misses” in an article in the April 2011 Harvard Business Review. One can point to numerous cases of unheeded near misses, which eventually led to major project failures. From the Columbia Space Shuttle explosion in 2003, to the antenna troubles that emerged following the much-anticipated launch of the iPhone 4 in 2010. The results were very different, but root causes aligned. Most significant failures stem from the lack of an appropriate response to observable signals.

As Tinsley, Dillon and Madsen explained, “These seemingly innocuous events are often harbingers; if conditions shift slightly, or if luck does not intervene, a crisis erupts.”

Underlying Danger

Crucially, it is the “human element” that influences our interpretation of near misses, and therefore, represents an underlying danger. Standard operating procedures dictate how to handle conventional preparations or take remedial action in the event of an incident. Near misses, however, do not have easily measureable impacts, and therefore, frequently only register as potentially significant or catastrophic issues that were luckily avoided.

Problems relating to the responsibility of acting on near misses often begin when the mandate handed down from senior management contains vague or contradictory language. That forces project leaders to independently determine major priorities and drivers. Given the nature of their positions, they will inevitably focus on cost and schedule, while the objectives of business leaders will encompass the startup, production and long-term operability of major assets.

The strategic disconnect that emerges is often one of the first in a series of near misses and incremental failures that compound to drive project risk to unmanageable levels. Project monitoring and evaluation tools and systems frequently ignore the effects of near misses, instead placing a strict focus on cost and schedule metrics. However, global data collected across all industries suggests the operability metrics of a given asset trump cost and schedule from a value perspective. According to Independent Project Analysis, schedule (which is often prioritized as the most important driver in project execution) actually ranks third on the list of business impact behind both operability and cost.

Referring to large capital investments, Jim Porter, former vice president of DuPont Engineering, once said, “It’s not about projects, it’s about business!” His point was that while a project must be implemented carefully according to an established set of processes and guidelines, the true value of the asset in question will never be realized without excellence in operability. Ultimately, the only asset of value is one that operates as planned.

Decision-Making Gap

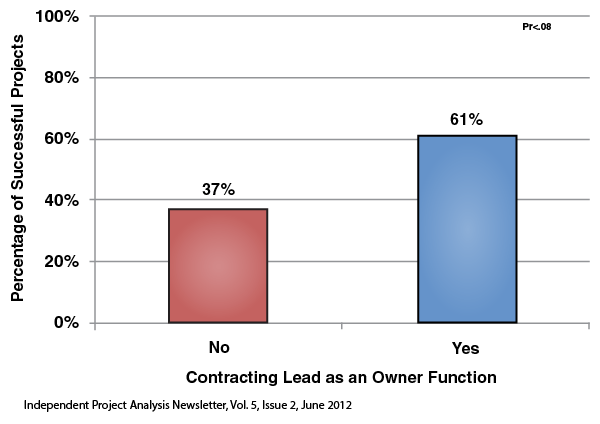

It is rare in today’s market for any capital project of scale to be completed without the significant use of contractors. Yet this reliance on an external workforce to complete large and complex tasks is not getting the attention it needs. Contractor management is one of the highest–and least understood–risk areas for any project. Figure 1 illustrates the impact on project success in the absence of an owner playing a lead contracting role. The marked difference in outcomes is a direct result of the inherent decision-making gap between owners and engineering procurement companies or project management companies.

It is impossible for a contractor to possess the understanding and perspective necessary to make decisions consistently factoring in an owner’s long-term best interests. This is compounded by the contractor’s natural focus on short-term project execution, rather than the asset’s long-term operability. That difference in emphasis increases the risk of near misses, of which the owner may not even be aware.

Owners, therefore, face substantially greater risks and are likely to fail to spot the near miss signals if they do not play an active role in the early phases of a project. They assume risks and responsibilities are transferred to contractors. This is only partially true. Even if a contractor is responsible for a specific failure, it is ultimately the owner who has to deal with the loss of asset value caused by schedule slippages, unforeseen costs, litigation and subsequent corrective action. It is far better to limit such damage by ensuring clarity of scope with contractors, and with the owner maintaining an informed decision-making role throughout a project’s lifecycle.

But the roots of project failure lie deeper still. If decision making is the most influential factor for success or failure, then individuals are at the center of project outcomes. All decisions stem from someone, somewhere. This reality leaves major capital projects susceptible to common management missteps.

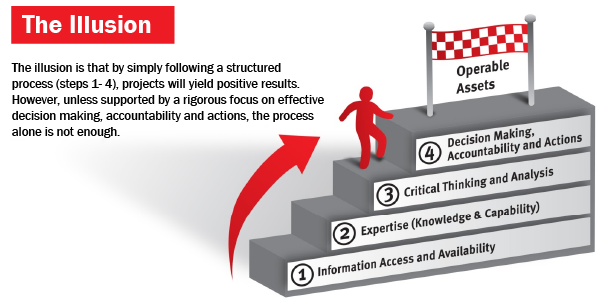

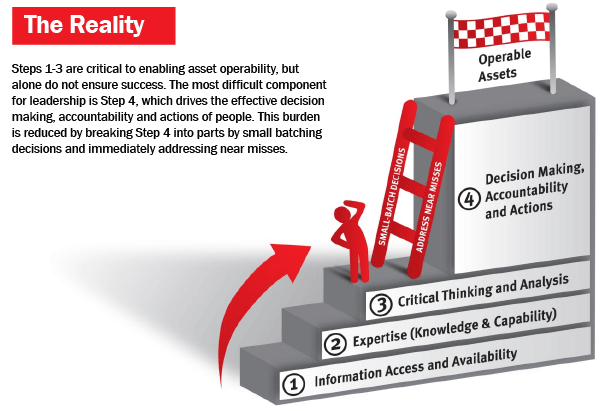

Figures 2A and 2B are graphical representations of the “illusion” versus the “reality” of decision making. The model in Figure 2A reflects the (perceived) steps that lead to effective decision making. That is, capable and knowledgeable people enjoying access to necessary information, and engaging in critical thinking to evaluate options and make timely decisions that lead to positive action. The theory starts to break down, however, when one thinks about the enduring near misses and small failures of the real world. Indeed, the model usually looks a lot more like Figure 2B.

Too often, decision making, accountability and action powers are exercised by (or transferred to) inappropriate parties. Or more problematically, no clear ownership exists at all. There are many reasons for this, including lack of access to information, unqualified personnel, poor basic data, and transparency and trust issues.

Critical Success Factors

Given what is known about capital projects, how can operators avoid getting caught in a situation where an asset is produced with a high likelihood of failure? The key is to address seven critical success factors:

- Front-end loading versus the business goal;

- Proactive management of environmental, health and safety (HS&E);

- Contracting strategy and contractor management;

- Staffing and managing teams for success;

- Technology confirmation;

- Integrated execution with “no changes;” and

- Minimizing nonvalue-adding investment.

The value is not in the “what to do,” but in the “how” and “why” to do it.

Daniel Grollo, chief executive officer of Australian construction giant Grocon, has stated, “Safety for us is not just an indicator of how we are performing from the perspective of not hurting people, but also of how the business is running. Our safest sites are safe because they are run efficiently.” The Grocon experience suggests a symbiotic relationship between success factors. Indeed, the safest projects often turn out to be the most successful.

The interdependence of project factors cannot be overstated. Having robust processes, procedures and systems in place is not enough. For an asset to be a success, the what, how and why need to be translated to fit the reality. The seven success factors make this possible and highlight the areas requiring leadership attention to achieve sustainable asset operability. Focusing on project management in this way takes into account the innumerable factors that influence real-time decision making throughout major projects (for instance, labor, supply chains and government relations).

Such an approach also includes methods to identify and act on near misses and small failures, and helps to drive home the message that catastrophic failures can be prevented by careful tracking and remedial action.

Small-Batch Decisions

But how can senior management adopt and instill these principles organization wide? The answer is through the “small batching” of decisions and actions. “Doing things in smaller batches may require more labor, but it gives project teams tremendous flexibility,” says John Sun, managing director of the Shanghai-based operations of Albemarle, a global chemical company. Originally conceived as part of Toyota’s production system, the approach has significant merits when applied to capital projects, often providing the necessary counterbalance to a common cause of project failure: speed.

Independent Project Analysis President Merrow has eloquently captured the dangers of tempo in execution, stating “Because we’re trying to make these projects at breakneck speed, we end up breaking our necks!” By dividing timelines and deliverables into more manageable, self-contained modules, small batching offers project teams the flexibility to deal with unexpected changes without ramping up cost and losing control of the ultimate goal of asset operability.

Using the small-batch approach in a “readiness-to-operate” (RTO) preparation of an asset for initial operations is crucial to long-term operability. From our experience, we know this method ensures project decisions remain consistent with the end business goal.

In 2012, a company with both upstream and midstream oil and gas assets was constructing a multiyear, multibillion-dollar hydrocarbon extraction and upgrading facility. The facility, remotely located in a region known for its harsh climate, was experiencing significant schedule delays, safety concerns and cost overruns (mainly from contractor activities).

An assessment of the owner’s and prime contractor’s project systems and processes was conducted to provide recommendations that could get the project back on track. The location dynamics, combined with a suboptimal decision making and near miss process, were determined to have been a root cause of much of the organization’s troubles. The assessment helped the owner immediately identify and implement more rigorous permitting, incident investigation and leadership governance procedures to help stop inefficient decision making processes at all levels.

These modifications led to project execution processes that better fit the day-to-day realities faced by both the owner and the contractors. As a result of the recommendations and hands-on implementation support with all parties, the project experienced measurable improvements in overall schedule, efficiency and safety performance, while keeping budgets under control.

The generally high failure rate of large capital projects can be better managed by addressing near misses and by small batching decisions. These key principles form part of a well-vetted, integrated capital projects management system based on unique owner/operator perspectives gained from running manufacturing facilities for products as diverse as industrial petrochemicals, protective materials, fibers and plastics. This transparent and inclusive mode of execution allows decision makers to tackle concerns immediately, often in response to near misses, and empowers project teams to address issues in an effective and timely manner.

A capital projects management system not only provides the real-world basis for capital project consulting methodology, but looks beyond simple measures of on time and on budget delivery to focus on the critical issue of creating an asset that will sustainably meet or exceed operability objectives throughout its full asset lifecycle. With proven methodologies and best practices, third-party capital projects management can help companies mitigate risks and improve performance with a practical, hands-on approach to implementation across the asset lifecycle to reduce large project failure rates.

Badar Alam is global practice leader of capital effectiveness and contractor management for DuPont Sustainable Solutions, specializing in improving project planning and execution with organizations. He is a graduate of the University of Alberta.

Greg Desnoyers is a solution strategist/business process consultant for DuPont Sustainable Solutions, with expertise in the areas of capital effectiveness, contractor management and safety. He previously served as a chemical process engineer/product manager for DuPont Performance Coatings. Desnoyers holds a B.S. in chemical engineering from Northeastern University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.