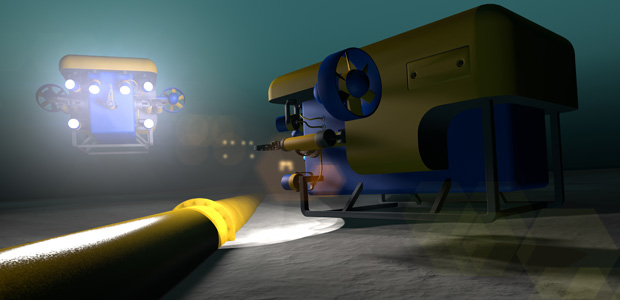

Subsea Activity

SURF Equipment, Services Demand On The Rise

The global offshore market has “tremendous room for growth,” according to Rystad Energy’s analysis of historic investments and oil field service purchases for the world’s offshore oil and gas fields.

“(The) offshore continues to thrive and has much to offer the future,” summarizes Audun Martinsen, head of oil field services research at Rystad Energy.

Historically, sanctioned greenfield projects have racked up total investments of $3.7 trillion in real dollars worldwide up to the present day, he says. In total, Rystad estimates that greenfield sanctioning likely has only achieved 40% of its potential $9.3 trillion in investments in reference to total global reserves.

“Likewise, the brownfield market has only begun, with total historical expenditures accounting for only about 20% of the estimated brownfield spend over the project’s lifetime, leaving 80% of brownfield spending to the future,” Martinsen remarks, noting that extensions and enhancements to existing producing fields represent a $25 trillion market.

Rystad projects that by using advanced technology, 50% of the 3,000 existing offshore fields still could be producing in 2030. In addition, upcoming projects already under development or expected to be sanctioned represent an additional 2,500 fields. “We expect to spend five to six times as much on brownfield services as what has been spent as of today,” Martinsen states.

The most immature upstream market is decommissioning, he says, where Rystad estimates that only 3% of all necessary decommissioning expenditures have been spent already. In terms of size, however, decommissioning is a relatively small market, at $1.8 trillion, Martinsen points out.

Looking at specific segments of offshore services, Rystad’s analysis found that 58% of total maintenance and operations expenditures are yet to be spent, representing $20.5 trillion. “Well services and commodities; drilling contracting; engineering, procurement, construction and installation (EPCI); and subsea are equally large markets, which we expect will make significant contributions to the service sector over the next 50 years,” Martinsen comments.

Rising SURF Tide

Indeed, activity already is picking up for the subsea, umbilical, riser and flowline (SURF) sector, according to research by Wood Mackenzie’s marine construction service. The company tracked 30 major SURF contracts awarded in 2018, which was up from 19 contracts in 2017.

“The tide is rising for SURF contracts in 2019,” observes Krystal Alvarez, senior research analyst, who adds that Wood Mackenzie is tracking 19 SURF contracts already awarded in the first quarter of this year alone.

(Editor’s Note: Fittingly, as the global offshore industry gathered in Houston in the first week of May for the 2019 Offshore Technology Conference, BP announced the sanctioning of the Thunder Horse South Expansion 2 Project in the Gulf of Mexico. Thunder Horse is one of the largest fields in the Gulf. BP awarded an integrated EPCI contract to TechnipFMC for the subsea equipment, including tree systems, manifolds, flowline, umbilicals and jumpers, pipeline end terminations, subsea distribution and topside control equipment.)

Alvarez reports that more than half of the SURF contracts awarded in 2018 are scheduled for installation in 2019 with a lead time of one year or less, reflecting the fact that many of last year’s contracts were for subsea tiebacks and smaller, less complex projects as operators moved to a phased approach to project development.

According to Alvarez, the major and minor contracts awarded in 2018 by contractor include:

- Subsea 7 with 15 awards (Equinor’s Johan Castberg offshore Norway; Wintershall Norge’s Nova offshore Norway; the BP-operated Azeri-Chirag-Gunashli complex and Shah Deniz Field in the Caspian Sea; BP’s Alligin in the U.K. sector of the North Sea; ExxonMobil’s production uplift pipeline projects offshore Nigeria; Shell and ExxonMobil’s Penguins Field redevelopment in the U.K. North Sea; the Shell-Egyptian General Petroleum Corp.’s West Delta Deep Marine Phase 9B offshore Egypt; Shell’s Vito in the Gulf of Mexico; Total’s Zinia Phase 2 offshore Angola; Nexen’s Buzzard Phase 2 in the U.K. North Sea; Fieldwood Energy’s Katmai in the Gulf of Mexico; Tullow’s Jubilee offshore Ghana; Shell’s Shearwater Fulmar gas line replumb project in the U.K. North Sea, and BP’s Manuel in the Gulf of Mexico);

- TechnipFMC with four awards (Energean’s Karish offshore Israel; LLOG Exploration’s Who Dat in the Gulf of Mexico; Shell’s Gumusut Kakap Phase 2 offshore Malaysia; and Chevron’s Gorgon Stage 2 offshore Australia);

- McDermott with six awards (ONGC’s KG DWN-98/2 offshore India; POSCO Daewoo’s Shwe Phase 2 offshore Myanmar, PEMEX’s Ayatsil offshore Mexico; Shell’s Silvertip, Great White and Frio fields in the Gulf of Mexico; and Petrobras’ Franco Rota Marica pipeline project offshore Brazil);

- Saipem with three awards (ExxonMobil’s Liza Phase 2 offshore Guyana, Premier Oil’s Tolmount Main in the North Sea; and Eni-Egyptian General Petroleum Corp.’s Zohr offshore Egypt); and

- Ocean Installer with two awards covering multiple Statoil-operated fields offshore Norway (Snorre, Troll, Njord, Åsgard, Bauge, Fenja and Dvalin).

First-Quarter Contract Awards

The 19 SURF contract awards Wood Mackenzie tracked in the first quarter of 2019 include:

- Subsea 7 with seven awards (Saudi Aramco’s Berri and Zuluf; ExxonMobil’s West Barracouta offshore Australia; Woodside’s SNE Field Development Phase 1 offshore Senegal; Woodside’s Scarborough and Julimar Development Phase 2 offshore Australia;, and Shell’s Arran in the U.K. North Sea);

- McDermott with six awards (LLOG’s Stonefly in the Gulf of Mexico; Sarawak Shell-Sapura Exploration & Production’s Gorek, Larak and Bakong fields offshore Malaysia; BP’s Greater Tortue Ahmeyim floating liquefied natural gas project offshore Mauritania; and Senegal; and Saudi Aramco’s Marjan in the Arabian Gulf);

- TechnipFMC with five awards (BP’s Atlantis Phase 3 in the Gulf of Mexico; Petrobras’ Mero 1 offshore Brazil; Lundin Norway’s Solveig and Rolvsnes offshore Norway; Eni’s Merakes offshore Indonesia; and ConocoPhillips’ Tor Phase 2 in the Norwegian North Sea); and

- Saipem with one award (Saudi Aramco’s Berri and Marjan).

“Ten of the contracts awarded in first-quarter 2019 are scheduled for installation in 2020, which could mean a tightening in utilization of key enabling vessels such as Subsea 7’s Seven Oceans and Seven Pacific, McDermott’s Amazon and North Ocean 102, Saipem’s FDS 2 and Castorone, and TechnipFMC’s Deep Blue,” Alvarez says, noting that the vessel utilization rate in 2018 for McDermott, Subsea 7 and TechnipFMC averaged 65%.

While SURF contract awards are on an uptick, Alvarez says contractor margins still are tight, and reflect the challenge of delivering projects signed at lower prices during the downturn. “Contractors remain focused on selecting and bidding for projects with optimal risk and profitability profiles,” she says. “Although tendering activity significantly increased in the first quarter of 2019, pricing remains competitive as there is still an oversupply of assets, and backlogs remain at lower levels.”

That said, the SURF market is making a gradual recovery from the multiple-year down cycle, Alvarez goes on. “Global marine contractors are focusing on technology, strategic alliances and early engagement to maximize growth potential. These key drivers enable cost-effective solutions while enhancing margins and market position. These strategies are essential for critical management of costs as SURF activities increase,” she says, adding that the industry will have to remain focused on controlling costs as asset utilization rises and the pricing of installation assets improves.

Referencing Wood Mackenzie’s global forecast for SURF installation through 2024, Alvarez says the market likely will see “major SURF installation opportunities” over the next two years. “SURF tendering activity is increasing, particularly in Brazil, Australia, Angola and Nigeria. We could see an increased number of large greenfield projects awarded, depending on if they are sanctioned,” she remarks, adding that the majority of these projects have a breakeven price below the medium- and long-term oil-price expectations.

“These larger projects will require longer offshore campaigns for the highly sought-after installation vessels. As these awards come to market, industry utilization will increase and project pricing will improve,” Alvarez predicts.

Pipelines And Umbilicals

Looking at the global pipeline and umbilical forecast, Alvarez says Wood Mackenzie sees a dip in installation activity in 2019 before modest growth resumes next year. The Middle East, Russia and Caspian Sea will be the largest contributors to volumes in 2019 for Gazprom’s Turk Stream pipeline and Noble Energy’s Tamar Phase 1 and Leviathan projects.

According to Wood Mackenzie’s analysis, 52% of the global forecast demand for 2019-24 will be driven by SURF installation activity. The remaining activity will come from trunk line and export installation activity (26%) and conventional activity (22%).

“Pricing improvements are expected to begin in 2020-21,” Alvarez concludes. “At that time, we expect installation demand to rise to higher levels, with Europe, Asia and Africa contributing the highest volume of pipe to be installed.”

The increasing number of subsea projects is a key factor fueling market growth for subsea thermal insulation materials. According to a new report from Stratistics MRC, the thermal insulation market for subsea equipment and pipelines accounted for $73.23 million in 2017 and is expected to reach $120.85 million by 2026, growing at a compound annual growth rate of 5.7%.

Based on insulation type, Stratistics MRC says polyurethane is forecast to achieve significant growth during the forecast period. “It is widely preferred owing to low flexibility and thermal conductivity properties,” the report states. “The primary advantage of polyurethane is that it can sustain volatile temperatures even at the bottom of the ocean, as it can cover unlimited depth, and therefore is used on wet insulation systems.”

By geography, Stratistics MRC anticipates that Europe will dominate the global subsea thermal insulation market given the increasing numbers of subsea projects planned over the next several years.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.