Survey Says Cash Flow From Operations Is King

HOUSTON—Oil and gas companies have procured funds for new projects from a variety of sources in recent years, with the tides of debt and equity ebbing and flowing into greater and lesser use from one year to the next, a new Haynes Boone report observes. But ultimately, the firm’s research finds, companies’ first choice for drilling dollars is their own income.

That is one of the primary conclusions from the fall 2023 Haynes Boone Borrowing Base Redetermination Survey, which the firm released in early November.

“Although the mix of external capital sources has changed over the last several surveys, an internal capital source—cash flow from operations—remains the most popular source of funding,” Haynes Boone describes.

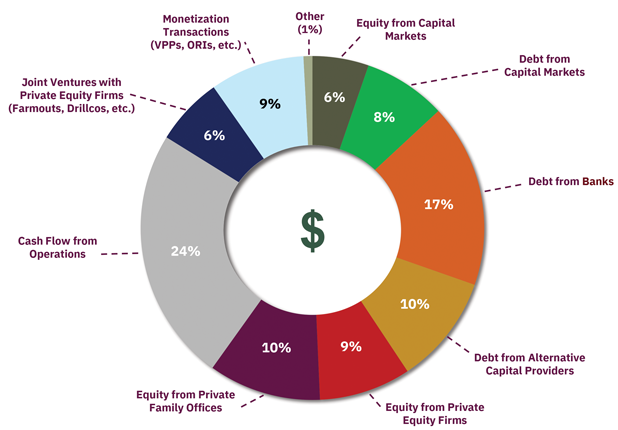

The report’s findings about where producers plan to source capital during the next 12 months, which reflect respondents’ ability to select more than one option, show that a plurality of answers (24%) cite cash flow from operations. Other responses mention:

- Debt from banks (17%);

- Equity from private family offices (10%);

- Debt from private equity firms (10%);

- Equity from private equity firms (9%);

- Monetization transactions (9%);

- Debt from capital markets (8%);

- Equity from capital markets (6%);

- Joint ventures with private equity firms (6%); and

- Other sources (1%) (Figure 1).

Haynes Boone notes a common expectation among producers that reserve-based lending will decline, even as other types of capital increase. “Respondents expect a meaningful drop in the use of commercial bank RBL capital as a financing source in the next year, but are increasingly optimistic regarding the utilization of equity and debt from capital markets in 2024,” the firm assesses. “Debt capital markets increased from 5% (spring 2023) to 8% (fall 2023) and equity capital markets increased from 2% (spring 2023) to 6% (fall 2023).”

Financing Future

Haynes Boone says it has conducted 18 borrowing base redetermination surveys since April 2015 to provide a clear, forward-looking view of lenders’ and producers’ borrowing base redetermination experiences amid commodity market price uncertainty.

The most recent survey was conducted in October and involved 102 respondents. The latest results’ topline takeaways also include what appears to be reserve-based lenders’ gradually increasing amenability toward new projects.

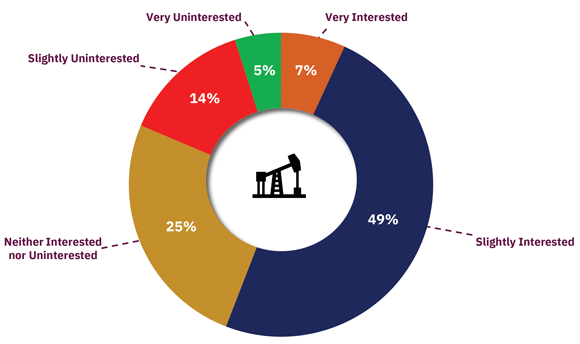

“As the supply of drilled but uncompleted wells in the major oil and gas plays rapidly declines, how interested are RBL lenders in funding additional new drilling activity?” the survey posed. According to Haynes Boone, 49% of respondents indicate lenders are slightly interested and 7% consider them very interested, while 25% deem them neither interested nor disinterested. The remaining responses describe RBLs as slightly uninterested (14%) or very uninterested (5%) (Figure 2).

FIGURE 2

As the supply of Drilled but Uncompleted (DUC) wells in the major oil and gas plays rapidly declines, how interested are RBL lenders in funding additional new drilling activity?

“For many years, RBL lenders scrutinized and frowned upon developmental capex spending,” the report relates. “However, respondents now expect RBL lenders to be neutral on or even slightly interested in their loan proceeds being used for drilling and completion programs.”

Haynes Boone points out that its survey follows a third-quarter commodity price ascent largely prompted by strong global oil and gas demand, as well as conflict in the Middle East. Nevertheless, the report acknowledges, such factors do not appear to boost participants’ expectations about their borrowing power.

“Despite these underlying fundamentals,” it says, “respondents do not expect meaningful borrowing base increases this redetermination season.”

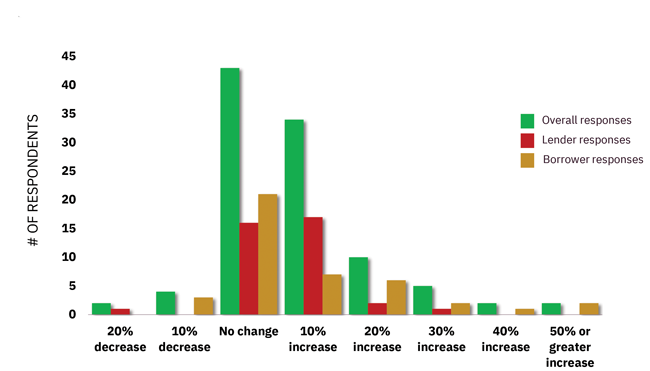

Indeed, more than 40 survey participants predict no changes in borrowing bases in autumn 2023 compared with spring 2023, with slightly more borrowers than lenders offering that forecast. A larger contrast emerges on predictions of a 10% increase, which lenders predict at a rate more than double that of borrowers; as well as forecasts for a 20% increase, which borrowers appear to expect at a rate about three times that of lenders. That trio of responses constitutes the overwhelming majority of forecasts, with none of the other predictions of either decline or steeper increases amounting to more than the outer edges of the bell curve (Figure 3).

FIGURE 3

What percentage do you expect borrowing bases to change in fall 2023 as compared to spring 2023?

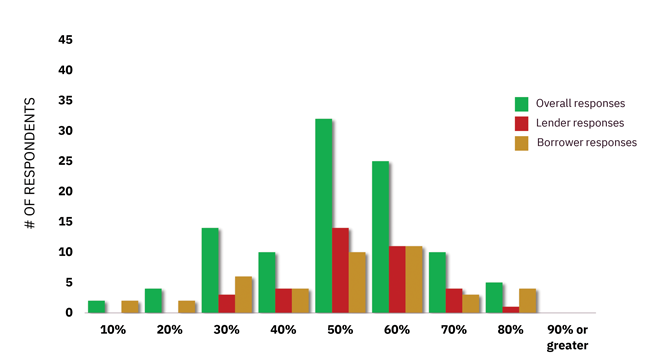

Meanwhile, the firm indicates, companies’ approach to risk mitigation instruments appears stable. “Hedging percentages continue at the increased levels we first saw in spring 2023, demonstrating that recent market fluctuations have not pushed producers to deviate from their existing hedging strategies,” the survey states.

FIGURE 4

On average, what percentage of anticipated future production have reserve-based credit facility borrowers hedged for the next 12 months?

Survey data shows the greatest number of participants say reserve-based credit facility borrowers have hedged about 50% of their anticipated future production for the next 12 months. The second-ranked answer—60% hedged—accounts for about a quarter of respondents, and has support from an identical number of lenders and borrowers (Figure 4).

According to Haynes Boone, survey participants include executives at:

- Oil and gas producers (41%);

- Financial institutions (36%);

- Professional services firms (15%);

- Private equity firms (5%); and

- Oil field service companies (3%).

For the complete results, see Haynes Boone Borrowing Base Redeterminations Survey: Fall 2023.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.