Hedging Strategies

‘Swaptions’ Give Producers Increased Hedging Flexibility

By Matt Smith

HOUSTON–Low seasonal natural gas prices are causing producing companies to get creative with their hedging strategies to lock in near-term cashflows above the levels the market is currently offering. When hedging with options, it is not uncommon for oil and gas producers to sell options and roll the premium value of the sold option into another hedging instrument.

An example of this is a costless collar. With a costless collar, a company buys a put option to establish a floor price that it will receive for the sale of its commodity. Rather than pay the premium for buying the put option, the company sells a call option with an equal premium to offset the purchased put premium. The result allows a company to participate in commodity prices above the floor price and below the ceiling price.

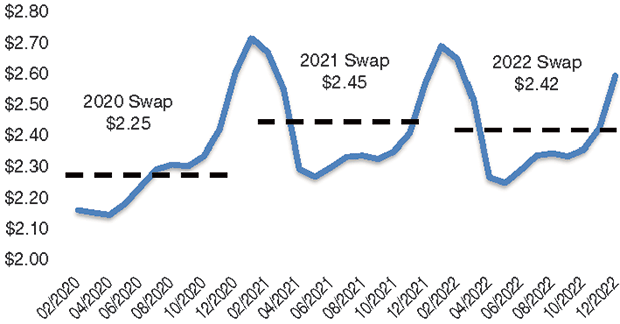

With calendar 2020 natural gas swap prices below $2.25 an MMBtu, traditional swaps and costless collars are not appealing to many companies. This, combined with the fact that New York Mercantile Exchange natural gas futures prices are in contango (meaning future prices are higher than spot prices), has led some companies to sell options in future periods and roll the premium into near-term swaps.

As an example of this strategy, assume that the current NYMEX swap prices are $2.25/MMBtu and $2.45/MMBtu for calendar years 2020 and 2021, respectively (Figure 1). Rather than hedging with swaps at these prices, a company may decide that it would rather sell an option giving the counterparty the right to enter into a swap for 2021 at $2.50/MMBtu (commonly referred to as a “swaption”). When this option expires in December 2020 (or whichever expiry date is negotiated), if the swap price is above $2.50/MMBtu, the bank will execute its right to swap at $2.50/MMBtu. If the price is below $2.50/MMBtu, the bank will not swap.

A company is able to take the premium from selling the swaption and roll this value into a swap to get an above-market 2020 swap price. If the premium was $0.25/MMBtu, in this example, the company would roll in the $0.25/MMBtu premium to get a swap price of $2.50/MMBtu. The downside is that the swaption does not provide any price protection in 2021 should natural gas prices slip and limits upside potential should natural gas prices increase. However, it has become a viable alternative for many operators given today’s challenging pricing environment.

It should be noted that swaptions can create financial reporting complexities when it comes to determining the appropriate fair value to record in financial statements. Option pricing theory uses the underlying commodity price, the contractual exercise price, volatility, interest rate, and time to expiration to value an option. For the volatility input, it is best to use implied volatility. Implied volatility is a calculated value that can be implied based on an option’s traded price on the futures exchange. For NYMEX natural gas monthly options, implied volatility inputs are readily available. However, implied volatilities for swaptions are not. Determining appropriate volatility is calculation-intensive and requires consideration of various inputs.

In addition, swaptions may require additional disclosures. Companies are required to disclose the fair-value hierarchy level in which each fair value measurement is categorized. The classification of a derivative in the fair value hierarchy is based on the lowest-level input that is significant to the fair value measurement in its entirety. ASC 820 establishes a fair-value hierarchy that prioritizes inputs used in valuation techniques into three levels.

Level 1 is quoted prices (unadjusted) in active markets for identical assets and liabilities that the reporting entity can access at the measurement date. Level 2 includes inputs other than quoted prices in active markets for identical assets and liabilities that are either directly or indirectly observable. Level 3 is unobservable inputs.

An example of a fair-value measurement classified as Level 1 is an exchange-traded derivative. An over-the-counter swap or option would be classified as a Level 2, as long as the inputs are observable for the entire term of the instrument. It is not always as cut-and-dry when determining whether a fair-value measurement is Level 2 or 3.

For example, consider a NYMEX natural gas option that expires in 24 months. Of course, NYMEX natural gas options are only observable for 18 months. In this situation, the inputs are often required to be extrapolated or other adjustments will need to be applied. ASC 820 indicates that if an adjustment to an observable input is required and that adjustment is based on an unobservable input and is significant to the overall fair value measurement, the measurement would be categorized in Level 3.

This hierarchy is intended to increase consistency and comparability among fair-value measurements. Classification within the hierarchy also plays a critical role in the amount of disclosures required to be made by a company. A fair-value measurement classified as Level 3 requires several additional disclosures. First, it requires a roll-forward of the beginning to ending balances, including:

- The balance of Level 3 assets or liabilities as of the beginning of the period;

- Total gains or losses;

- Purchases, sales, issues and settlements (presented separately);

- Transfers in and/or out of Level 3 (presented separately); and

- The balance of Level 3 assets or liabilities as of the end of the period.

Second, the valuation process used to determine the fair value must be disclosed. Moreover, the company must include a narrative description of the sensitivity of recurring Level 3 fair-value measurements to changes in the unobservable inputs used, if changing those inputs would significantly affect the fair-value measurement.

The uniqueness of these swaptions often leads to a significant amount of attention from auditors and the need for valuation specialists, and generally requires additional financial statement disclosures. It is crucial for producers to work with financial experts who understand the hedging and financial reporting processes in order to add value and meet fair-value reporting needs.

MATT SMITH is a director in Opportune’s financial instruments group. He assists companies with accounting for complex financial instruments under both U.S. GAAP and IFRS. With 15 years of client service experience at Opportune and Ernst & Young, Smith has gained extensive knowledge and expertise in derivative valuation and hedge accounting, stock-based compensation, debt and equity financing activities, embedded derivative assessments, Dodd-Frank compliance, and U.S. Securities Exchange reporting. He holds a degree in accounting from Oral Roberts University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.