LNG Shipping

U.S. LNG Benefits From Canal Expansion

By Victoria Zaretskaya

WASHINGTON–The newly expanded Panama Canal has significant implications for U.S. and global liquefied natural gas trade, reducing travel times and transportation costs for LNG shipments from the U.S. Gulf Coast to key demand centers in Asia and providing additional access to previously regionalized LNG markets.

The new locks are 180 feet wide, compared with 109 feet in the original locks, with the wider lanes providing access to larger LNG vessels. Prior to the expansion work, only 30 of the smallest LNG tankers (6 percent of the global fleet) with capacities up to 0.7 billion cubic feet could transit the canal. The expansions allow the Panama Canal to accommodate 90 percent of the world’s LNG tankers with carrying capacities up to 3.9 Bcf.

Transit through the Panama Canal will considerably reduce voyage time for LNG from the U.S. Gulf Coast to markets in northern Asia. Four countries in northern Asia–Japan, South Korea, China, and Taiwan–collectively account for almost two-thirds of global LNG imports.

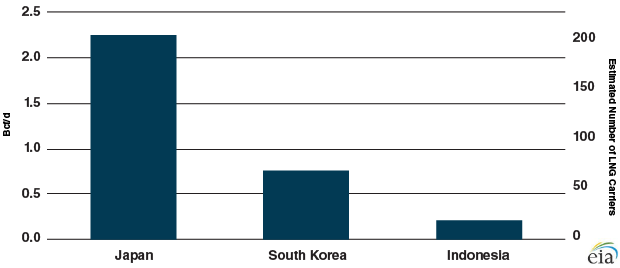

A transit from the U.S. Gulf Coast through the Panama Canal to Japan will reduce voyage time to 20 days, compared with 34 days for voyages around the southern tip of Africa or 31 days through the Suez Canal. Voyage time to South Korea, China and Taiwan also will be reduced by transiting through the Panama Canal. Figure 1 shows expected carriers likely to pass through the Canal carrying U.S. LNG to Japan, South Korea and Indonesia.

FIGURE 1

U.S. LNG Export Contracts Likely to Transit Panama Canal

Source: U.S. EIA calculations based on IHS and trade press.

Note: Calculations of the number of vessels assume the largest LNG vessel size (3.9 Bcf carrying capacity) allowed to transit the expanded Panama Canal.

The wider canal also considerably reduces travel time from the U.S. Gulf Coast to South America, declining from 20 days to only eight or nine days to Chilean regasification terminals, and from 25 days to five days to prospective terminals in Colombia and Ecuador.

In addition to shortening transit times, using the Panama Canal also will reduce transportation costs. The Panama Canal Authority has introduced new toll structures for LNG vessels designed to encourage additional LNG traffic through the Canal, especially for round trips. Transit costs through the Canal for a typical LNG vessel with a carrying capacity of 3.5 Bcf are estimated at $0.20 per MMBtu for a round-trip voyage, representing 9-12 percent of the round-trip voyage cost to countries in northern Asia.

Based on IHS data, the round-trip voyage cost for ships traveling from the U.S. Gulf Coast and transiting the Panama Canal to countries in northern Asia is estimated to be $0.30-$0.80/MMBtu lower than transiting through the Suez Canal and $0.20-$0.70/MMBtu lower than traveling around the southern tip of Africa. Transiting the Panama Canal offers reduced transportation costs to northern Asian countries such as Japan, South Korea, Taiwan, and China and may offer minimal cost reductions to countries in southeast Asia (Malaysia, Thailand, Indonesia and Singapore), depending on transit time.

U.S. LNG exports to India, Pakistan, and the Middle East are not expected to flow through the Panama Canal because alternative routes, either through the Suez Canal or around the southern tip of Africa, have lower transportation costs.

Some 9.2 billion cubic feet per day of natural gas liquefaction capacity is either in operation or under construction in the United States. By 2020, the United States is set to become the world’s third-largest LNG producer, after Australia and Qatar. More than 4.0 Bcf/d of U.S. liquefaction capacity has long-term (20-year) contracts with markets in Asia, of which 3.2 Bcf/d is contracted to Japan, South Korea and Indonesia.

An additional 2.9 Bcf/d of U.S. liquefaction capacity now under construction has been contracted long-term to various countries. Assuming all contracted volumes transit the Panama Canal, LNG traffic through the Canal could reach more than 550 vessels annually by 2021.

Victoria Zaretskaya is lead operations research analyst at the U.S. Energy Information Administration, and served as principal contributor to EIA’s analysis of the impact of the Panama Canal expansion on LNG trade. Prior to joining EIA in 2009, Zaretskaya worked in analytical and consulting roles at Exelon Power, Pace Global, Korimos Holdings, PFC Energy and ICF International. She holds a B.S. in economics from George Mason University and a master’s in international economics and finance from Johns Hopkins University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.