M&A Activity

Upstream M&A Deal Activity Surged In Late 2018

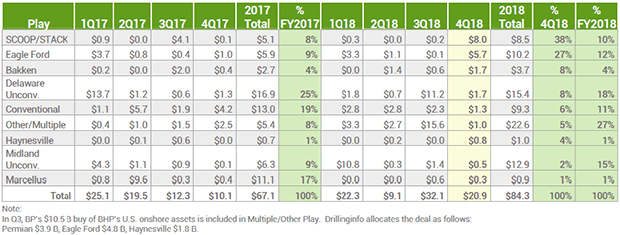

AUSTIN, TX.–U.S. upstream oil and gas merger and acquisition deal value clocked in at $84 billion in 2018, ranking as the highest total since 2014, according to a report from Drillinginfo. Large billion dollar-plus deals fueled the surge in the back half of the year with a record-setting $32 billion in the third quarter and $21 billion in the fourth quarter.

BP’s transformational $10.5 billion acquisition of most of BHP’s shale assets is the largest deal of the year (Figure 1), and the fourth largest since 2009. The deal underpins BP’s strategy to roll-out BPX as an independent and a leading U.S. onshore shale player, the report states.

The year also ran a close tie with 2014 for the most public company consolidations, with RSP Permian, Energen, Newfield Exploration, WildHorse Resources and Penn Virginia leading the exit list in 2018, says Andrew Dittmar, a Drillinginfo M&A analyst.

The pace of consolidation picked up late in 2018 with corporate-level deals accounting for more than 70 percent of the $21 billion total fourth-quarter deal value, he observes. That was the highest quarterly corporate deal total since the third quarter of 2014, before collapsing global oil prices spun the industry into a downturn.

“Investors continue to demand that companies deliver a clear line-of-sight to positive free cash flow,” Dittmar remarks. “Scale is one piece of the puzzle on how to get there given efficiencies in developing larger acreage blocks, optimizing supply chain logistics to lower costs and general and administrative savings. Wall Street no longer supports growth for growth's sake, and is ready to punish buyers who do deals without a clear profit strategy.”

Perhaps the most talked about week in the industry’s recent history occurred in late October and early November, when Dittmar says public company consolidation “went into a frenzy.” Within a span of only five days, beginning on Oct. 27, Denbury Resources acquired Penn Virginia for $1.7 billion, followed by Chesapeake Energy’s $3.9 million deal to purchase WildHorse Resource Development on Oct. 30 and Encana’s $7.7 billion buyout of Newfield Exploration on Nov. 1.

Immediately on the heels of those transactions, however, came a precipitous drop in oil prices that broke all support levels beginning in early November and ground the deal markets to a virtual stall, the report recalls (through mid-January, WTI had rebounded $10 over its closing price on Christmas Eve). Other public company consolidations in 2018 included Concho Resources’ $9.5 billion deal for RSP Permian in late March, Diamondback Energy’s $9.2 billion acquisition of Energen in August, and Cimarex Energy’s $1.6 billion deal for Resolute Energy, announced on Nov. 19.

Private Equity’s Share

The shift toward corporate-level M&A late in 2018 also cut into private equity’s share of deal activity. After hitting a high-water mark in the fourth quarter of 2017 by taking the buyer role in 46 percent of deals, private equity’s share of acquisitions fell to only 7 percent in the fourth quarter of last year. Private equity was not overly active as a seller in in the fourth quarter either, accounting for only 4 percent of sold deals by value versus 23 percent in fourth-quarter 2017.

That said, private and institutional capital is still highly active in the upstream business and playing an important role, the report stresses, with private equity-backed companies continuing to explore emerging areas such as the Louisiana Austin Chalk as well as more established resource plays.

“Private equity capital also is ready to move in when it feels public markets are undervaluing assets or companies, as seen by the letter put out by Elliott Management addressing QEP Resources Inc.’s stock performance, and including a firm offer to buy the company,” the report states. That comments was in reference to a letter the New York-based hedge fund sent to QEP Resources’ board in early January that cited the undervalued stock performance and offered to buy the company for a reported $2.55 billion (Elliott Management has a 5 percent stake in QEP, according to Refinitiv data).

Drillinginfo says another clear theme from 2018 was the institutionalization of the minerals market, with deal activity in this sector growing 100 percent over 2017 to reach nearly $3 billion. Buyers cross all capital sectors from public royalty companies such as Kimbell Royalty Partners to institutional players like Ontario Teachers’ Pension Plan and public operators like Continental Resources.

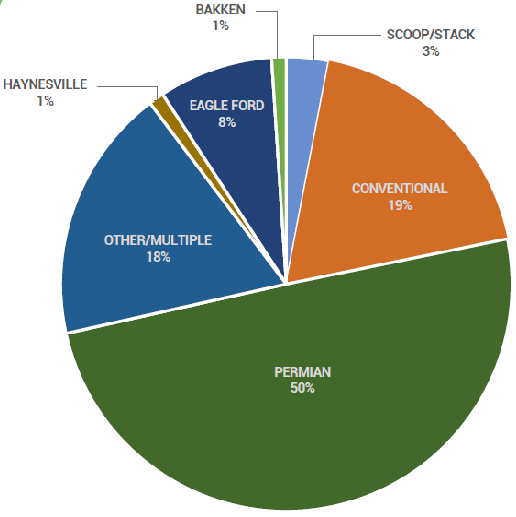

The Permian Basin was again the most active area for M&A deals, accounting for $28.3 billion (33 percent) of the $84.3 billion total (Figure 2). According to the report, other key takeaways from 2018 included:

- Funding asset acquisitions through an overnight equity raise became virtually non-existent.

- The special purpose acquisition company (SPAC) model to raise public market cash and then find an asset continued to work.

- The initial public offering stock market for upstream oil and gas firms remained largely closed.

- Royalty markets doubled and rapidly gained institutional attention.

2019 Outlook

For 2019, Drillinginfo says it expects the pace of oil and gas deal markets to remain impacted by oil price volatility, which ultimately provides numerous special situation opportunities, particularly for oil equities that have been oversold.

According to Brian Lidsky, the company’s senior director of market intelligence, “The straight-line drop in WTI spot oil prices from the start of October to just before Christmas coincided with the risk-off appetite that was pervasive across the capital markets. US exploration and production equities responded largely in lock-step with the rapid decline. Looking ahead, the reality is that albeit global oil demand may slow some, growth remains unabated and for all intents and purposes has surpassed the 100 million bbl/d level. All eyes are on the impact of the start of OPEC+ round two cuts, Iran sanctions, plus the trend of global oil demand.”

Drillinginfo quantified $39 billion of upstream deals in play in the United States at the start of 2019 based on known active marketing processes, 50 percent of which were located in the Permian (Figure 3). “There are certainly high-quality assets in the marketplace and buyers ready to acquire. The only barrier is bridging the bid/ask price. Historically, if the gap has widened, deals often come with contingent payments predicated on a price or asset performance benchmark,” the report reads.

For 2019, the report predicts:

- The launch of numerous noncore asset sales from public operating companies, with BP likely leading the charge;

- Private equity re-emerging as a key buyer on asset deals with a willingness to pay for proved, developed, producing reserves and take upside risk;

- Markets will reward scale and low-cost leaders, translating into richer equity currency for large players to make accretive buys of smaller players; and

- Leveraged oil and gas companies are likely to come under renewed pressure to take action to improve balance sheets.

For more information on 2018 M&A activity and the 2019 outlook, visit drillinginfo’s website.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.