Washington Worries Weigh On Texas Producers

WICHITA FALLS, TX.—Federal regulatory overkill constitutes the chief concern for oil and gas professionals participating in the Texas Alliance of Energy Producers’ 2023 Pulse of the Oil Patch Survey. The association notes that nearly 85% of the more than 130 respondents express disapproval of the Biden Administration’s approach to energy policy.

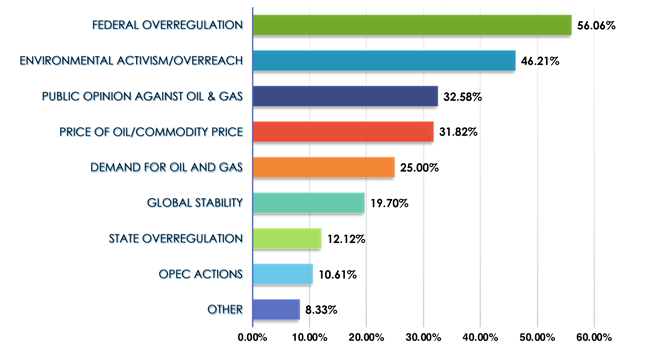

According to the Alliance, 2023 was the second consecutive year in which respondents chose “federal overregulation” as the industry’s top threat (56% versus 30% in 2022). Respondents also elevated “regulatory issues” and “regulatory uncertainty” to two of the three biggest challenges for 2023 (Figure 1).

Alliance President Jason Modglin acknowledges that the executive branch under Biden made a couple moves this spring that appear friendly to traditional energy, but the cumulative effect of all its actions nevertheless remains burdensome.

“The Biden Administration has signaled more support recently, but the oil and gas industry continues to fight onerous federal regulations and policy,” Modglin relates. “Led by Texas, the United States can produce enough oil and natural gas for our domestic needs while providing more energy security to our allies. But, as these results show, only if the federal government stays its heavy hand and rhetoric against fossil fuels.”

Beyond regulatory concerns, the survey shows that companies believe their biggest challenge for 2023 is “supply chain issues” for material such as steel and pipe. After that, participants’ steepest business challenges in 2023 are, in descending order:

- Regulatory and legislative issues;

- Regulatory uncertainty;

- Controlling expenditures;

- Growing the business;

- Staffing;

- Tax burden;

- Delays in project completion;

- Maintaining the business;

- Lack of budget; and

- Workplace and job site safety.

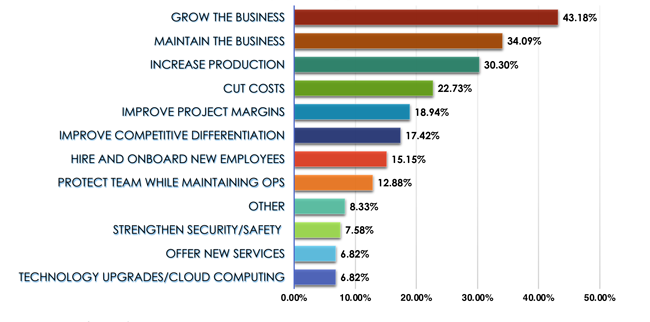

The Alliance also indicates that, like 2022, the most common top priority among respondents in 2023 is to “grow the business” (Figure 2), which the Alliance notes contrasts with the top priority in 2021. That year, participants cited a need to “maintain the business” as both their top challenge and highest priority, the Alliance recalls, which likely reflected challenges associated with the Covid-19 pandemic.

Although “maintaining the business” constitutes the industry’s second-highest priority in 2023, the association observes, it ranks 10th among the industry’s challenges. After growing and maintaining their companies, respondents’ biggest priorities are, in descending order:

- Increasing production;

- Cutting costs;

- Improving profit margins;

- Improving competitive differentiation;

- Hiring and onboarding new employees;

- Protecting their teams while maintaining operations;

- Strengthening security and safety;

- Offering new services; and

- Upgrading technology and/or incorporating cloud computing.

Reasons For Optimism

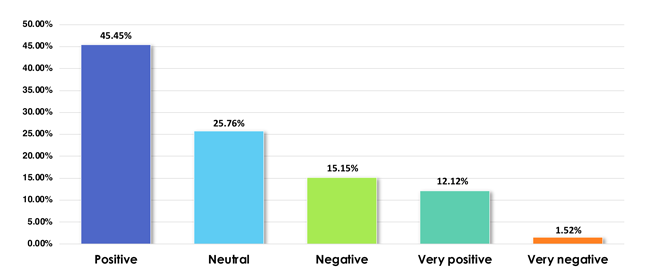

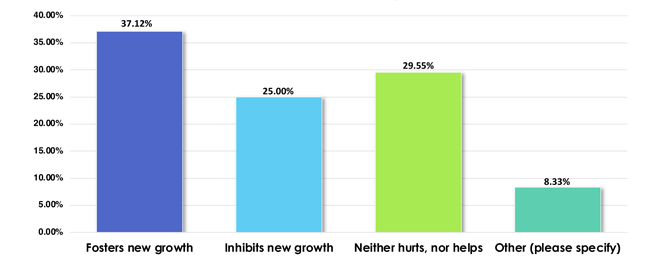

According to the Alliance, the Pulse of the Oil Patch Survey results also reveal year-over-year increases in positivity about the outlook for individual companies (Figure 3), as well as the Texas state regulatory environment (Figure 4). However, it says, oil and gas professionals are less optimistic that the industry will be in better shape in spring 2024. Survey results find that nearly half of participants predict conditions in the industry will remain about the same (versus only 27% in 2022), while one third believe it will be better or much better (versus 52% in 2022).

Meanwhile, even after a year in which geopolitical events dominated the headlines and spotlighted genuine threats—and actual disruptions—to reliable and affordable energy supplies, a plurality of survey participants indicates the public’s general attitude about American production has soured.

Despite the focus on global energy security, the Alliance details, 40% of survey respondents say public perception of American oil and natural gas has gotten worse or much worse during the past year. One quarter suggest it has gotten better or much better, while 34% judge it to be about the same. In fact, the Alliance notes, “public opinion against oil and gas” ranks third among the industry’s top listed macro concerns/threats in 2023.

Survey results were tabulated from more than 130 oil and gas professionals who responded to a Web-based survey between Jan. 18 and Feb. 13, the Alliance describes. Responses were solicited via social media and direct emails from Alliance and third-party databases.

- 75% of the respondents are based in Texas, with the rest representing 14 states.

- 40% of respondents work for independent producers.

- About half are owners or executives.

- The majority (57%) have between one and 10 employees, while 26% have between 11 and 250 employees.

To download the survey, see Federal Overregulation Concerns Rise for Oil and Gas Industry in 3rd Annual Texas Alliance of Energy Producers Survey.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.