Banks’ Tumult Can’t Crack Foundation

Although a couple years have passed since the onset of the Covid-19 pandemic, the market is still reeling from economic and political uncertainty, and the recent failures of Silicon Valley Bank, Signature Bank and Silvergate Bank have spurred signficant concern about the overall health of the financial services industry.

Viewing these events through the perspective of the oil and gas sector may magnify concerns even more for an industry in which capital often has been elusive in recent years. However, focusing on fundamentals more than headlines reveals that the outlook remains strong and indicates our resilient industry will push ahead through any near-term financial services sector challenges.

For years, we have witnessed a slow exodus of financial institutions from oil and gas, but it seems that the void always is filled either by the committed long-term players (banks) or new entrants. Many larger banks remain committed to the industry, and at the same time, smaller regional banks also have stepped up to provide debt financing in the sub-$25 million market. Having spoken with many of these regional partner banks during the last several weeks, none suggest they may pivot away from oil and gas lending; in fact, almost all have been asking about new opportunities to lend.

Of course, this will not be the case for everyone. As we approach the spring borrowing base redetermination season, it seems inevitable that some participant banks will bow out. This likely will be limited to a few institutions, most of whose plans to depart the sector predate the bank failures during the first quarter of 2023. Nevertheless, we expect longstanding and new lenders to replace these departing participants.

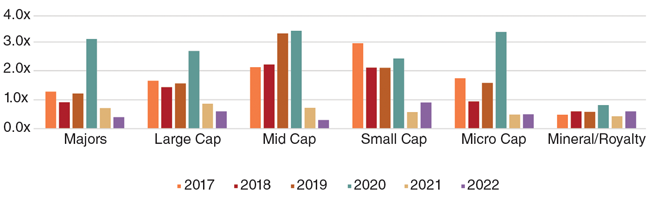

Perhaps one of the most significant near-term impacts of recent bank failures will see the oil and gas sector continue to endure tightening credit terms. In 2022, the industry confronted both rising interest rates and heightened leverage constraints, as most loans required a debt-to-EBITDA ratio no greater than 2.0x.

This posed a challenge for some borrowers, especially those attempting to secure acquisition financing. However, the more conservative terms for credit, combined with commodity prices that exceeded those of recent years, helped strengthen many operators’ balance sheets, and ultimately fostered a level of financial health the sector has not enjoyed in more than a decade.

Accordingly, a stronger financial profile helps companies withstand the tighter credit market and positions them well to capture opportunities going forward (Figure 1).

Shifting Sources

Banks will not be the sector’s new entrants. Last year, we started to see more alternative capital providers submit term sheets and options to the industry. These alternatives included names completely new to the space, as well as known industry partners offering new credit products.

Of the new entrants, most were private credit funds interested in backfilling the void left behind by departing commercial lenders. The standard proposal from these groups often has been in the form of a term loan, but more creative structures have been presented by funds that traditionally have provided equity and now have allocated part of their funds to capture the opportunity to lend at higher market rates.

For private equity funds, this certainly departs from previous strategy, but with interest rates rising to the high single digits, funds have an opportunity to deploy capital by taking senior secured risks while locking in rates that exceed their preferred returns.

Another market participant who is not new to the sector, but who definitely has been scarce in recent years, is the direct investor. Despite all the noise in the market, the oil and gas sector continues to perform, and capital has a way of finding a return. Since last year, we have seen an increasing appetite from family offices seeking exposure to the asset class. The market’s perceived challenges are precisely what attract direct investors, who often consider them to be opportunities. Therefore, we anticipate increasingly more participation from direct investors.

A Favorable Outlook

Even amid the ongoing challenges of volatile commodity prices, political risk and perceptions of banking market uncertainty, the fundamental outlook for the oil and gas industry appears favorable, despite fearful chatter about a looming recession and anemic global economic growth.

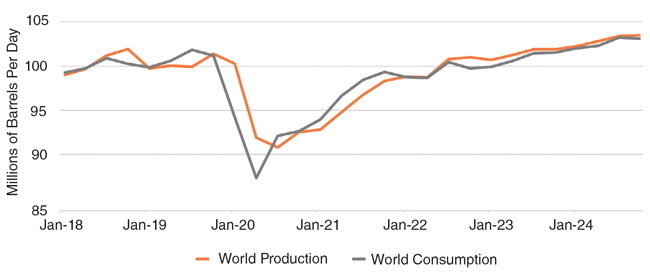

In its March 2023 Short-Term Energy Outlook, the U.S. Energy Information Administration predicts global liquid fuels consumption will increase 1.5 million barrels in 2023 and another 1.8 MMbbl in 2024, boosting consumption beyond pre-pandemic levels. With global liquids production expected to remain in rough equivalence with consumption, the near-term outlook is constructive and bodes well for the industry.

FIGURE 2

World Liquid Fuels Production and Consumption Balance

Source: U.S. Energy Information Administration

So why cite the supply and demand chart in Figure 2 for an article about the state of the banking sector and financing options for oil and gas projects? It is often beneficial to maintain a broad perspective without losing sight of the most basic fundamentals. It took a 100-year pandemic and global economic shutdown to markedly destroy demand, and in fewer than six months (while most of the world was still under Covid-19 restrictions), demand began to outstrip production.

All the fears contributing to market uncertainty cannot diminish our need for the product. Simply put, hydrocarbons are still a viable and important component of global economic growth—we need them, and as long as we do, there will be an industry to produce this necessary energy and a segment of the financial sector ready to partner with it.

JASON REIMBOLD is managing director of energy investment banking for BOK Financial Securities, where he is responsible for leading the energy investment banking group while originating and executing client mandates including acquisitions, divestments, raising capital and facilitating joint ventures. He has worked in energy finance since 2005 and currently offices in Dallas. He earned a BSBA in finance from the University of Tulsa and served in the U.S. Army and U.S. Army Cavalry.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.