Carbon Sequestration Drives Surveys

By Colter Cookson

The 45Q tax credit for carbon capture and storage has increased substantially since its introduction in 2008. Now at $85 for every metric ton, it is helping drive a search for storage sites that are close to emission sources and have the right geology to contain carbon.

“Since 2020, we have seen an increase in seismic acquisitions related to identifying carbon storage sites,” says Erick Erwin, chief financial officer of Paragon Geophysical Services Inc., a seismic acquisition company based in Wichita, Ks. “In 2022, CCS accounted for about 40% of the square miles we surveyed.”

Erwin says the company has performed more than 30 CCS surveys. “These surveys are comparable in size and scope to the ones we do for oil and gas,” he comments. “The smallest project was about two square miles, but we have acquired one that was 250 square miles. As with oil and gas surveys, the parameters change based on the depth and situation the client is looking at.”

The smaller surveys may be for individual plants that want to capture the carbon dioxide they produce nearby, while the larger ones may be for a site that will connect to several sources by pipeline, Erwin says.

“Many of the surveys we have done are in North Dakota and Wyoming,” Erwin mentions. “These states, as well as Louisiana, have primacy over the permitting process for Class VI wells, the ones that are used to inject CO2 for storage rather than for enhanced oil recovery or some other purpose.”

In other states, the U.S. Environmental Protection Agency handles permitting for Class VI wells.

“Everybody is still trying to figure out the regulations and what companies will be required to do to monitor the injected CO2, but for now, the assumption is that they will need to take a baseline survey and periodically repeat it to see what has changed. Whether that needs to happen every 18 months or every five years is still up in the air,” he says.

The work for time lapse surveys resembles baselines, Erwin notes. “For the most part, we would be starting from scratch. We may know of some hazards from the previous survey, but we still need to do hazard mapping again in case new pipelines, houses, water wells, power lines or other infrastructure has been built.”

Even today, CCS has helped Paragon persevere through dips in demand for oil field seismic acquisition, Erwin says. He cautions that whether it continues to account for significant activity depends on the longevity of the underlying tax credits.

“We went through a cycle with geo- thermal where it became a sizable portion of our business but it lost popularity once the tax credits ran out,” Erwin recalls. “Geothermal is an extremely expensive process that requires several wells to produce hot water and equipment to inject that water back into the ground, which means that building a geothermal plant of any scale requires millions of dollars up front. On top of that, even developers who shoot seismic and do other due diligence run the risk of discovering the water is too cool.

“CCS also requires an upfront investment,” he notes. “If support for CCS fades and the tax credits go away, that investment may be hard to justify.”

Oil Field Surveys

Although seismic shoots focusing on hydrocarbon production still account for most of Paragon’s business, Erwin says the surveys have become more focused. “The bids we see are for smaller-scale projects that are designed to get more detailed information on specific areas,” he clarifies. “There is enough data already shot across the country that many people purchase existing data and put their spin on it rather than getting new data.”

Interest in carbon capture and storage is driving many seismic surveys, Paragon Geophysical Services Inc. reports. The CCS-oriented surveys the company has performed range in size from two square miles to 250 square miles.

When new data is acquired, it’s often because efficiency gains have enabled more thorough surveys, Erwin says. “In 2010, our crews had to set up lines of geophones connected by 50-pound cables. Cows, rodents and other animals loved chewing on the cables, so we had to replace them constantly during the shoot,” he recalls. “Today, our receivers are Bluetooth-enabled nodes that weigh only two pounds. They are much faster to deploy and easier to maintain.”

The node-based surveys have reduced impacts on landowners significantly, Erwin adds. “With cables, we had to run UTVs down each line to check for damage and perform repairs,” he says. “The nodes check themselves and send alerts to a tablet or recording trailer if there is an issue. Sometimes an animal kicks over a node, but that is less common than it used to be. In fact, we may only need to access the field twice: when we lay the nodes down and when we pick them up.”

Over time, it has become much easier to transport equipment, Erwin continues. “The system we had between the last cable-based one and the individual nodes we use today weighed about 7,000 pounds for every square mile the survey needed to cover. Our current system only needs 700 pounds for every square mile,” he says. “With 10 times less weight, we can go from three or four equipment trailers to one.”

The efficiency gains have enabled much closer spacing, Erwin relates. “Since I started working at Paragon 17 years ago, the number of points in a square mile has increased 30%-40%,” he calculates. “We can process data so much faster than before because of improvements to computing power. With artificial intelligence taking care of some of the mapping and interpretation work, I see parameters continuing to tighten.”

The Need For Seismic

Seismic surveys have come a long way, says Bruce Karr, technical adviser at Fairfield Geotechnologies. “In many areas, we are doing surveys that sample the Earth every 41 feet, with 1,000-plus samples from the near to far distances of that 41 square foot area. On a per square mile basis, we have more than 16.5 million data samples of the Earth,” he relates. “Ten years ago, we would have only gotten 200,000 points per square mile.”

According to Karr, the extra detail modern surveys provide will be essential to carbon storage. For an area to be an effective storage site, it needs a formation with enough pore space to contain a meaningful amount of CO2 and seals that can keep the CO2 in place, he describes.

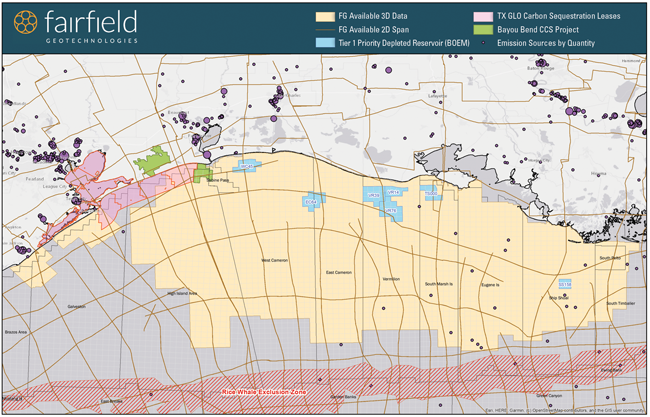

Existing seismic data will be key to assessing potential carbon storage sites, Fairfield Geotechnologies suggests. The Gulf of Mexico offers a case in point. This map shows some of Fairfield Geotechnologies’ Gulf seismic to highlight coverage of Texas General Land Office lease sites and depleted reservoirs that the Bureau of Ocean Energy Management identified as strong candidates for CCS.

“We have poked enough holes in the ground and understand most basins’ geology well enough to guess where these locations should be,” he says. “However, seismic is still the only tool we have to sample the earth between wells. We can take two wells and interpolate between them, but if we rely solely on those inferences, we can miss faulting or localized structures that could compromise containment.”

Existing data can help companies identify where the geology calls for closer scrutiny, Karr says, noting that this is especially true at deeper depths. “At 5,000 feet, a survey from 20 years ago may have only three or four samples every 110 feet. At 10,000 feet, the same survey could have 30-60 samples,” he illustrates.

In addition to suitable geology, carbon storage sites need proximity to emission sources, Karr suggests. “Once we have a solid starting point, the economics go back to location,” he elaborates. “Where does it make sense to put CO2 in the ground given the size of the reservoirs and the distance from emission sources?”

Those emission sources can range from gas processing facilities and refineries to ethanol plants, cement factories and coal-fired power generators, Karr notes.

Thanks largely to increases in the 45Q tax credit and lessons learned from university-backed pilot programs, Karr says CCS projects are becoming more ambitious. “A couple years ago, many of the projects may be only a few square miles,” he relates. “Today, we are seeing major operators inquire about licensing seismic to get a baseline for figuring out where to put large-scale storage projects.”

Long-Term Considerations

Once sites are operating, they will need to be monitored for any possible leakage through the cap rocks. “CO2 shows up well on time-lapse seismic,” Karr assures. “If a company takes a snapshot of the earth, pumps a bunch of CO2 in the ground and takes a second snapshot six months later, it can deduce where the CO2 has moved.

“As a gas or liquid, CO2 contrasts well with the solid rock matrix,” he explains. “A liquid is harder to see than a gas, and most CCS projects aim to keep the CO2 in a liquid state. However, even liquid CO2 causes changes in the local pressure signature that are quite clear in seismic.”

Using seismic to monitor CO2 is a proven technique, Karr says. “We have injected CO2 underground as part of EOR projects for decades,” he notes. “We may be changing where we put CO2 in CCS applications, but we have a long history of transporting and managing it. If CCS is something people will pay for, we have the tools to do it.”

The greatest challenge is political, Karr assesses. “CO2 is a nasty substance. It’s highly corrosive, so many people will not want a pipeline near their neighborhoods,” he acknowledges.

The regulatory framework will need to support surveys, Karr continues. “As a general rule, getting a detailed look at the subsurface requires at least twice as much space on the surface,” he says. “Some of the CCS surveys will involve investigating 20-50 square miles of the subsurface.”

An area that is accessible initially may become difficult to survey as cities and their accompanying infrastructure expand, Karr muses. “Right now, we are asking companies to monitor CO2 for at least 50 years. A lot of companies do not even exist that long,” he adds.

And what happens if the CO2 moves in unexpected ways? “If we build a storage site in an area that looks fantastic only to discover that it leaks, it could create an opportunity for lawyers to go after companies that were involved in the project,” Karr speculates. “That could be the operator who put the CO2 in the ground, the plant that created the CO2 or a service company that helped design, build or monitor the site.”

EOR projects suggest that although such situations should be extremely rare, they are possible. “We have seen cases where CO2 injected into the ground has leaked to the surface,” Karr allows. “Usually, this occurs because of inadequate analysis at the start of the project. But if there is one truth about the subsurface, it is that every time we learn something, we open a whole new set of questions. As CCS matures, we may discover that a few sites we once considered promising are poor storage candidates.”

Fortunately, he suggests, there are legions of experts at companies and universities that are doing everything they can to ensure CCS is safe and profitable. “At the end of the day, if you give people a bunch of money to do something, they will figure it out,” Karr says.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.