Federal Leasing Lapse Poses Threats

WASHINGTON–Continuing to drag its feet on federal offshore oil and gas leases will cost Washington significant revenue, hurt employment and economic growth, and also sap U.S. energy output, warns a report jointly commissioned by the American Petroleum Institute and the National Ocean Industries Association.

“Any delay in leasing activity, such as a failure to enact a five-year leasing program, would likely have a negative impact on Gulf of Mexico project development, spending, supported employment and gross domestic product, and government revenues,” the analysis warns. “If this delay persists, the impacts will likely continue to grow, reducing long-term oil and natural gas development and production in the region and the economic activity and government revenues that activity supports.

The 68-page study, “The Economic Impacts of a Five-Year Leasing Program Delay for the Gulf of Mexico and Natural Gas Industry,” was prepared by Energy & Industrial Partners and released this spring.

Since 1980, the groups note, DOI has been required to prepare a five-year offshore leasing program, including a schedule of oil and gas lease sales and details on the size, timing and location of proposed leasing activity. Despite a statutory obligation under the Outer Continental Shelf Lands Act (OCSLA) to maintain an offshore leasing program, DOI is well-behind schedule in this multi-year regulatory process and has yet to initiate the third comment period required for completion, API and NOIA relate. The next five-year offshore leasing program must be in place by July 1, and no offshore lease sales can be held unless the department implements a new program.

The report calculates that delaying the program jeopardizes American energy security and will cost 14,000 jobs in Louisiana alone, as well as millions in contributions to the Louisiana economy.

“Now more than ever, U.S. oil and natural gas development is critical for Louisiana’s economy and our nation’s long-term energy security, and offshore production plays a key role,” affirms API Gulf Coast Regional Director Gifford Briggs. “Policymakers should be doing everything they can to encourage the development of Louisiana’s vast energy resources and acting on the five-year program is a commonsense step the administration could take right now to support global energy security now and in the future.”

“The Gulf of Mexico is a proven strategic energy asset that benefits every American. Workers across Louisiana and the Gulf Coast and throughout the nation need a new leasing plan so they can do their jobs and help fortify our national security, alleviate inflationary energy prices, and reduce our dependence on foreign sources of energy. The longer we go without being able to explore and develop new leases off shore, the longer we weaken the Gulf of Mexico,” adds NOIA President Erik Milito.

Moreover, points out Danos Owner and Chief Executive Officer Paul Danos, stymieing U.S. leasing is unlikely to curb oil and gas demand, but it will expand U.S. imports. “Danos has supported the energy industry in South Louisiana for more 75 years, where we employ nearly 2,500 people,” he details. “Ending or reducing lease sales in the Gulf of Mexico will increase carbon emissions, send jobs overseas, increase the cost of energy for Americans and take away the largest source of funding to restore and protect our Louisiana coast.”

A Looming Deadline

According to the analysis, an easily preventable void in the federal offshore leasing program now appears almost inevitable.

The report opens by observing that rising oil and gas prices, and their consequences for U.S. consumers, illustrate the importance of domestic oil and natural gas production. “In addition to the impact rising energy prices have on consumers, oil and natural gas production is a significant source of employment, GPD and government revenues,” it notes. “Under an efficient regulatory framework, the Gulf of Mexico oil and natural gas industry will likely continue to be a significant source of energy production, employment, GDP and government revenues for the United States for decades to come. Additionally, Gulf of Mexico oil and natural gas production has one of the lowest carbon footprints of oil and natural gas production globally.”

However, the report points out, Gulf production requires continual leasing. “Leases provide the opportunity to explore for hydrocarbons, but there is no guarantee that any will be discovered,” it notes. “Most leases do not contain hydrocarbons in economically recoverable quantities. Almost all offshore oil and natural gas projects produce from multiple leases, both from one reservoir which spans multiple blocks or from different reservoirs in different blocks.”

In most cases, the study says, additional leases are necessary to produce an existing field fully or to underpin the economics of processing and transportation infrastructure. Therefore, it argues, the industry needs ongoing opportunities to secure leases through a predictable leasing program, such as the typical Gulf of Mexico lease sales the Bureau of Ocean Energy Management holds at least biannually. However, the analysis notes that the last lease sales scheduled under the BOEM’s 2017–2022 program, lease sales 259 and 261, will not be held before the expiration of the current 5-year leasing program.

The Trump administration directed BOEM in April 2017 to initiate a process to develop the next national OCS program, the analysis recalls, with the first of three proposals appearing on Jan. 4, 2018 and a 60-day comment period that ended on March 9, 2018. However, it notes, the Trump administration did not finalize the program.

“With the current five-year leasing program expiring shortly, the current administration has not publicly initiated a draft proposed program, as required by OCSLA,” the study says. “Given the time needed to develop, draft, receive commentary and finalize a five-year leasing program, this delay all but ensures that Gulf of Mexico oil and natural gas lease sales will not be held for some time.” Unfortunately, the analysis cautions, pausing leasing activity will hurt Gulf of Mexico project development, spending, supported employment and GDP, and government revenues. “However, if this delay persists, the impacts will likely continue to grow, reducing long-term oil and natural gas development and production in the region and the economic activity and government revenues that activity supports,” it warns.

Two Scenarios

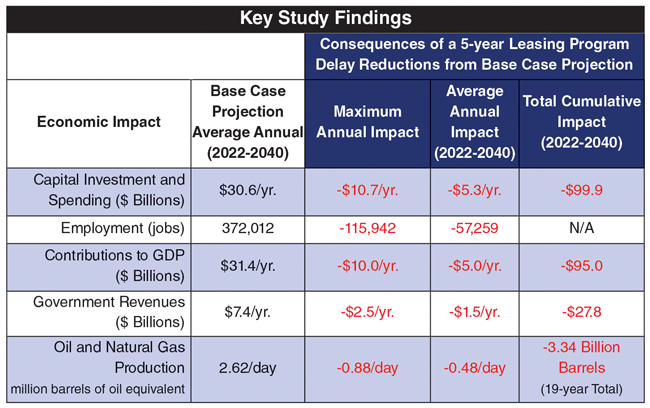

The report lays out a pair of scenarios, one of which is a base case that assumes a continuation of current policies with uninterrupted biannual lease sales, and a delayed five-year leasing program case, which examines the potential impacts of a delay in the sale of new offshore leases (Table 1).

According to the study, the scenarios rely solely on government and other publicly available data and EIAP’s expertise and analysis. It forecasts key activity indicators, including the number of wells drilled, projects executed, oil and gas production, and spending based on projected activity levels, all of which drive the report’s projected employment, GDP and government revenue forecasts.

The report’s findings mention key contributions the Gulf industry makes to national employment, GDP, and state and federal revenues:

- Combined Gulf of Mexico oil and natural gas production in 2022 is projected to be around 2.1 million barrels of oil equivalent a day. Oil and natural gas production from the Gulf of Mexico is on pace to average around 2.6 MMboe/d during the 2022-2040 forecast period.

- In 2022, offshore investment is predicted to total $30.3 billion for 2022. Across the forecast period, on average, Gulf industry spending projects at about $30.6 billion a year.

- The Gulf offshore oil and gas industry is projected to support an estimated 372,000 U.S. jobs, in line with average employment across the forecast period.

- The Gulf industry is forecast to support an estimated $30.8 billion of U.S. GDP in 2022. The industry is on pace to contribute an average of $31.4 billion of GDP a year during 2022-2040.

- In 2022, government revenues attributable to Gulf of Mexico oil and gas appear likely to reach nearly $6.8 billion. Government revenues derived from offshore oil and gas activities in the Gulf (excluding personal and corporate income taxes and property taxes) project to average more than $7.4 billion a year during the forecast period.

- The Gulf’s oil-producing states are on pace to receive around $375 million of revenues in 2022 because of revenue sharing under the Gulf of Mexico Energy Security Act (GOMESA), which is consistent across the forecast period. The Land and Water Conservation Fund (LWCF) is projected to receive nearly $1.2 billion of distributions. Contributions to the LWCF from GOMESA and non-GOMESA offshore sources are projected to average nearly $1.4 billion a year.

Missing Money

Delaying the next five-year leasing program will impair Gulf project development, investment, supported employment and GDP, and government revenues, the analysis warns. “If this delay persists, the impacts will likely continue to grow, reducing long-term oil and natural gas development and production in the region and the economic activity and government revenues that activity supports,” it cautions.

For the purposes of the report, the delayed five-year leasing program case assumes that after lease sale 261 is held in 2022, no further lease sales occur before 2028. “This year is an estimate of the earliest a lease sale could be held if the development of a new five-year leasing program started at the beginning of the next administration,” the analysis explains. “This study assumes existing leases would be unaffected and that no other major policy or regulatory changes impacting the Gulf of Mexico offshore oil and natural gas industry would be enacted.”

The report offers some stark contrasts between the two cases:

- In the delayed five-year leasing program case, average combined Gulf oil and gas production across the forecast period is projected to decline from around 2.6 MMboe/d to 2.1 MMboe/d (a decline of more than 18%). In 2036, when the most significant impacts are projected, combined oil and gas production projects to be around 885,000 bbl/d lower than the base case.

- The delayed leasing case foresees that the industry’s Gulf of Mexico investment will decline to an average of $25.3 billion a year, compared with $30.6 billion a year in the base case (a 17% difference). The report predicts this gap will be at its greatest in 2029, when spending projects to fall approximately $10.7 billion, a 31% reduction.

- Average employment supported under the delayed leasing case is predicted to drop 15% to 314,000 jobs nationally, compared with 372,000 jobs each year in the base case. At its maximum in 2029, supported employment is projected to total 116,000 fewer jobs, a 29% reduction.

- Average yearly GDP contributions in the delayed leasing case are predicted at slightly less than $26.4 billion, about a 16% reduction compared with $31.4 billion in the base case. At its maximum in 2029, GDP contributions are projected to be nearly $10 billion lower in the delayed leasing case, a 28% reduction.

- The delayed leasing case also forecasts government revenues will average around $6 billion a year, a 20% reduction from the $7.4 billion a year projected in the base case. When the impact is at its greatest in 2036, government revenues are predicted to be $2.5 billion lower, a 31% difference.

- State revenue sharing under GOMESA in the delayed leasing scenario is projected to remain relatively steady compared with the base case. Contributions to the LWCF are projected to average around $1.1 billion a year, compared with $1.4 billion a year in the base case during the forecast period. At its maximum in 2036, contributions are projected to be $420 million lower, 28% lower than the base case.

The study notes that volatility and uncertainty in both oil and gas markets and the global economy constitute limitations to its predictive power. Although its assumptions and forecasts are based on reasonable readings of conditions at the time of its development, those variables may significantly affect its projections. It adds that the analysis does not address the impacts of the potential policy environment, but acknowledges that also is an important factor.

“These and other policies could impose significantly greater engineering, operational, cost, and other burdens on the oil and natural gas industry and regulators,” it details. “The report’s projections of the effects of this potential scenario on engineering, operations and costs are an independent, good faith view derived from reasonable assumptions based on these potential scenarios and the authors’ expertise and experience.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.