Operators Show Resolve To Keep Focus On Returns

By Gregory D.L. Morris

The “merger of equals” between Cabot Oil & Gas and Cimarex Energy announced on May 24 is the latest development in the industry’s ongoing realignment shift as U.S. operators position for the future by making strategic moves to fortify their corporate strengths and reinforce any perceived weaknesses.

The all-stock transaction reflects an enterprise value of $17 billion for the combined companies, and integrates Cabot’s 173,000 net acres in the gas-rich Marcellus Shale with Cimarex’s 560,000 net acres in the liquids-rich Permian and Anadarko basins to create an inventory stocked with decades of high-return development locations in premier oil and natural gas basins.

“The combination of Cabot and Cimarex will create a free cash flow-focused, diversified energy company with the scale, inventory and financial strength to thrive across commodity price cycles,” says Dan Dinges, chairman, president and chief executive officer of Cabot. “With its premier assets, increased resource diversity and a strong financial foundation, the company will be well positioned to deliver long-term value creation for its shareholders and other stakeholders.”

Tom Jorden, chairman, president and CEO of Cimarex, adds, “We view commodity, geography and asset diversification as strategic advantages that will drive more resilient free cash flow and long-term value creation. We are aligned on our commitment to environment, social and governance (principles) and sustainability, and look forward to bringing our talented teams together to unlock the tremendous potential of this compelling combination.”

The oil and gas markets have rebounded in remarkable fashion over the past 12 months, but recent merger and acquisition activity among flagship independent oil and gas companies reinforces the industry’s commitment to fiscal discipline, responsiveness to cyclic shifts in commodity prices, and investor demands for sustainable operations. All three of those drivers are evident in the capital markets today, points out Kraig Grahmann, partner with the energy law firm Haynes & Boone.

“The focus for capital providers is on proven plays and players with a strong emphasis on reliable and consistent returns. The lesson for borrowers and management teams seeking backing is that lenders and investors are not going to pay you to experiment,” he says. “They want proven and repeatable results.”

The Biden administration’s decision to halt the issuance of new leases on federal lands also is a complicating factor for many operators, Grahmann notes. “We are hearing from producers who are active on federal land that they have lined up 10 years’ worth of permits so that they do not have to get further approval. But in general, capital providers are shying away from projects on federal lands, at least until there is clarity on how leasing will be handled,” he says.

Focused On Returns

Regardless of where a company operates, however, the U.S. market is “all about returns,” observes Wesley Adams, director of acquisitions and divestiture firm Energy Advisors Group. Returns have always been important, of course, but the overwhelming emphasis on returns is quite a turnabout from a few years ago when investors were rewarding growth and differentiation through operational performance.

“As a result, stock valuations do not make a lot of sense right now,” Adams goes on. “When large public companies have reported production growth, their stock has gone down. Investors want to see discipline above all else.”

The fact that the situation in the oil and gas financial markets is out of the ordinary is not altogether surprising considering the extraordinary volatility over the past few years. Capital continues to be constrained, which is one of the factors motivating corporate mergers, he suggests, adding that it is also not surprising that the Permian Basin has led the recovery in activity. “The Permian is generally in a better situation that other basins,” Adams relates. “There is some capital infusion, and even some research and development in effect.”

Also outside the historic norm is the customary trickle down of assets following a downturn and a period of corporate rationalizations and M&A deals. “What is supposed to happen after a downturn is that assets tend to get recycled to the market for smaller players to snap up and optimize,” Adams states. “We are not yet seeing the big companies shed assets, but I am expecting the third and fourth quarters to be good for acquisition and divestiture activity.”

So far, potential buyers and sellers have had a hard time aligning, but Adams says there have been good reasons for that. “Seasoned veterans have been telling me that they are being a lot pickier,” he goes on. “It is something of a reckoning given tighter capital access and the fact that so much private equity has withdrawn from the market. That will have a long-term effect from an A&D standpoint.”

That said, Adams stresses that the A&D spin cycle very likely will pick up speed in the back half of the year. “No matter how bleak it may feel sometimes, the wheel does not stop turning entirely, especially for private operators,” he comments. “Family-owned companies, in particular, are holding some cards because they can fund their own development.”

The biggest impediment to A&D activity has been low futures prices, Adams explains. “The gap between current strip and longer-term futures prices is where the value differential is,” he concludes. “The gap will start to close when strip prices rise. That is when people will get optimistic.”

Bullish Fundamentals

J. Marshall Adkins, managing director and head of energy investment banking at Raymond James & Associates Inc., projects that strip prices will indeed churn higher in the near future. In fact, Adkins says fundamentals in the global oil markets remain much more bullish than what is reflected by futures prices. “Our oil forecast is $18/bbl higher than 2022-23 futures price expectations,” he reports.

Backwardation continues to be the order of the day in the oil market, with West Texas Intermediate spot prices in late May trading 5% higher than the May 2022 WTI futures price and more than 10% higher than the May 2023 future price. Since the start of the year, WTI has rallied $15 a barrel, but consistent backwardation in the futures strip has had the effect of encouraging oil out of storage to take advantage of near-term pricing, Adkins notes.

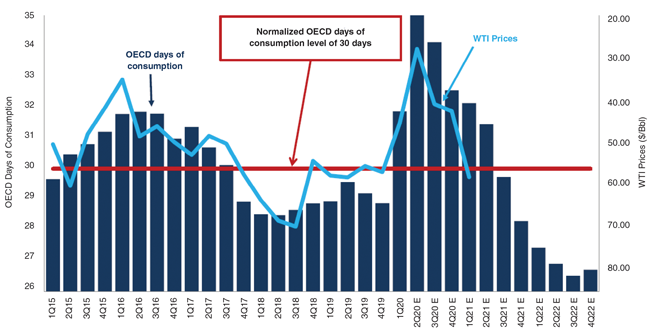

How much has storage been drawn down? Between May 2020 and January 2021, global oil inventories were down 2 million barrels a day, with U.S. inventories down 1 MMbbl/d, according to Adkins. That has oil inventories not only quickly normalizing with historic trends heading into summer, but puts inventories in position to fall well below normal beginning in the second half of the year (Figure 1).

FIGURE 1

Actual and Forecast Oil Inventories (OECD Days of Consumption versus Oil Price)

“With inventories nearing normal and demand poised to surge over the next six to 12 months, prices have meaningful upside,” he remarks. “Recovering demand and lower supply has already led to an undersupplied oil market, and fundamentals point to WTI reaching $75/bbl within the next six months. Even with OPEC+ producing at maximum capacity in 2022, there will be zero margin for error on supply disruptions.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.