Natural Gas Outlook

Rebounding Spot Prices, Demand Expected This Winter

WASHINGTON–The U.S. Energy Information Administration is forecasting higher expected consumption and significantly higher spot prices for natural gas this winter, along with modest increases in household expenditures for natural gas.

In its 2020 Winter Fuels Outlook, the agency says longer-range models from the National Oceanic & Atmospheric Administration indicate a colder winter than last year in much of the United States. Moreover, EIA notes that more people working and attending school from home as part of COVID-19 mitigation efforts is expected to increase demand for space heating at any given temperature relative to recent past winters.

With about half of all U.S. households heated primarily with natural gas, more residential consumption is forecast this winter because of both the colder forecast temperatures and higher demand for residential space heating. EIA projects that U.S. residential natural gas consumption will average 21.0 billion cubic feet a day. For households that use natural gas as their primary space heating fuel, EIA expects average household consumption for the winter to total almost 60 Mcf, up 8% from winter 2019-20.

The increase in expected winter residential consumption reflects a forecast for 5% higher U.S. population-weighted heating degree days (HDDs) than last winter. EIA also assumes 5% more natural gas use for residential space heating for each HDD as a result of virtual schooling and work-from-home policies.

The NOAA forecasts generally colder temperatures for most of the country this winter, with HDDs similar to the average of the previous 10 winters across the United States. The largest expected increases in HDDs are in the South and Northeast, where each region is expected to see 11% jumps in average natural gas consumption per household. Close behind is the Midwest at 8%. Residential gas consumption in the West is expected to rise by 2% given a milder winter forecast in that region.

Higher Spot Prices

Henry Hub spot prices are expected to average $3.00 per million Btu this winter, a 39% increase from last winter’s historically low prices. The forecast calls for declining natural gas production and rising liquefied natural gas exports to put upward pressure on natural gas spot prices, with Henry Hub prices rising from a monthly average of $2.08/MMBtu in October to $3.38/MMBtu in January.

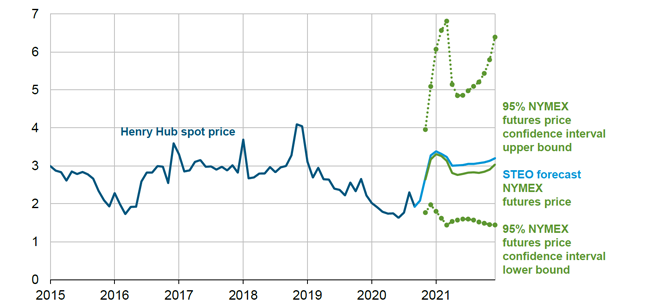

In the October Short-Term Energy Outlook, EIA says monthly average spot prices will remain higher than $3.00/MMBtu throughout all of 2021, averaging $3.13/MMBtu for the year, which would be up from an average of $2.07/MMBtu in 2020 (Figure 1).

FIGURE 1

Henry Hub Spot Price ($/MMBtu)

Note: Confidence interval and futures prices derived from market information for the five trading days ending October 1, 2020. Intervals not calculated for months with sparse trading in near-the-money options contracts.

Source: U.S. Energy Information Administration, Short-Term Energy Outlook, October 2020.

Although it expects storage to be at a record high of more than 4.0 trillion cubic feet at the official start of the winter heating season on Nov. 1, lower production, strengthening demand, and a major bounce-back in LNG exports are anticipated to lead to weekly withdrawals that outpace the five-year average. Under NOAA’s current forecast, inventories are projected to fall to 1.7 Tcf by the end of March, which would be 6% lower than the 2016-20 average.

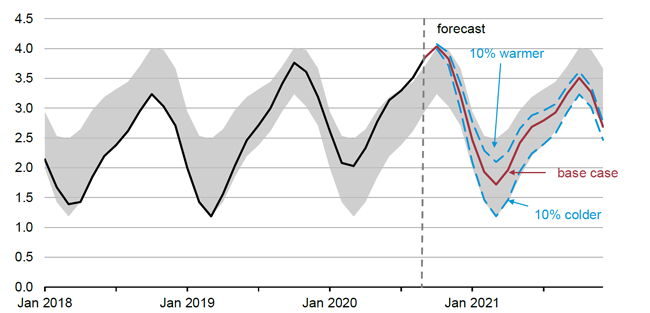

As always, however, EIA notes that weather is a major wildcard in wintertime demand and storage drawdown. Looking at various alternate weather scenarios, EIA would anticipate 17% more U.S. residential natural gas consumption than last winter if actual temperatures are 10% colder than NOAA’s current forecast, leaving end-of-March storage at 1.2 Tcf, or 35% below the five-year average. Under a 10% warmer-than-forecast scenario, end-of-winter inventories would be 2.1 Tcf, or 14% above the five-year average (Figure 2).

FIGURE 2

Working Natural Gas Inventories (Tcf)

Note: Gray band represents the range between the minimum and maixmum from 2015 to 2019. Source: U.S. Energy Information Adminstration, Short-Term Energy Outlook, October 2020.

U.S. dry natural gas production is on track to fall from a record 97.0 Bcf/d in December 2019 to 85.9 Bcf/d by spring 2021, before increasing slightly in the second half of the year. Output should average 87.7 Bcf/d this winter, representing a decrease of 7.8 Bcf/d (8%) from last winter’s average. Production is projected to decline the most in the Permian region, where reduced oil-directed activity will reduce associated natural gas output. EIA’s forecast of dry natural gas production in the United States averages 86.8 Bcf/d in 2021, with production to begin rising in the second quarter of next year in response to higher natural gas and crude oil prices.

For crude oil, the October STEO says U.S. production is projected to fall on an annual average basis from 12.2 million barrels a day in 2019 to 11.5 MMbbl/d in 2020 and 11.1 MMbbl/d in 2021, bottoming out in the second quarter of 2021 before growing slightly in late 2021 as recovering oil prices prompt increased drilling activity.

Rebounding LNG Exports

EIA estimates that U.S. LNG exports averaged 4.9 Bcf/d in September, which was an increase of 1.2 Bcf/d from August. Higher global forward prices indicate improving netbacks for buyers of U.S. LNG in European and Asian markets for the upcoming fall and winter seasons. The increased prices come amid expectations of natural gas demand recovery and potential LNG supply reductions because of maintenance at the Gorgon LNG plant in Australia. Consequently, EIA forecasts that U.S. LNG exports will return to pre-COVID levels by November 2020, averaging more than 9.0 Bcf/d from December through February.

Despite higher wellhead prices this winter, EIA projects the residential prices for homes that heat primarily with natural gas will average $9.55/Mcf, down from $9.73/Mcf last winter. That is a result of low commodity prices on gas volumes contracted through the first three quarters of 2020, according to the agency.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.